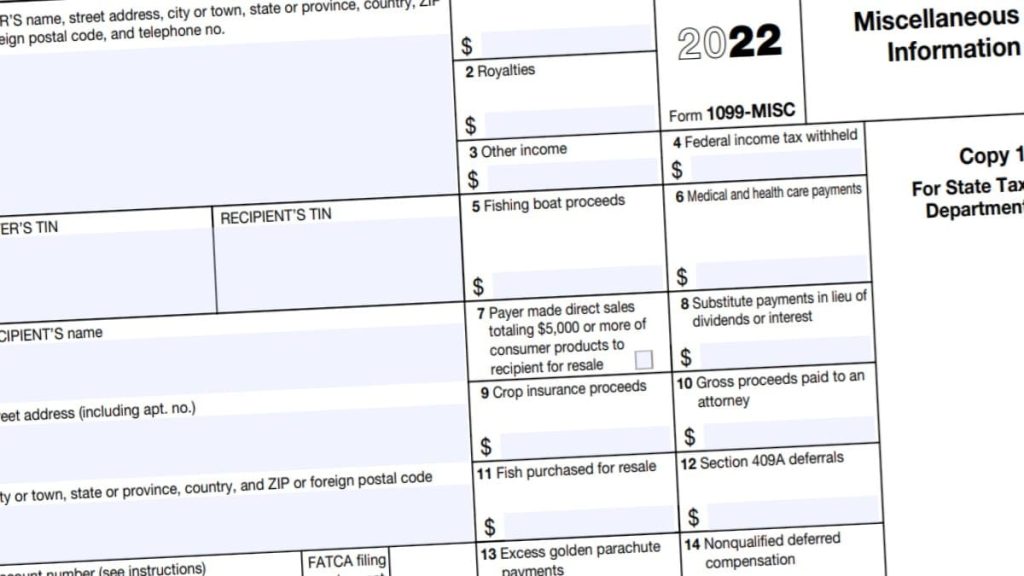

2023 1099 Misc Printable Form Home About Form 1099 MISC Miscellaneous Information File Form 1099 MISC for each person to whom you have paid during the year At least 10 in royalties or broker payments in lieu of dividends or tax exempt interest At least 600 in Rents Prizes and awards Other income payments Medical and health care payments Crop insurance proceeds

Instructions for Recipient Recipient s taxpayer identification number TIN For your protection this form may show only the last four digits of your social security number SSN individual taxpayer identification number ITIN adoption taxpayer identification number ATIN or employer identification number EIN IRS Form 1099 MISC Updated November 27 2023 A 1099 MISC is a tax form used to report certain payments made by a business or organization Payments above a specified dollar threshold for rents royalties prizes awards medical and legal exchanges and several other specific transactions must be reported to the IRS using this form

2023 1099 Misc Printable Form

2023 1099 Misc Printable Form

https://fillableforms.net/wp-content/uploads/2022/10/1099-misc-instructions-2023-1099-forms-taxuni-3-1024x576.jpg

1099 MISC Form Printable And Fillable PDF Template

https://www.pdffiller.com/preview/456/108/456108087/big.png

Tax Form 1099 MISC Instructions How To Fill It Out Tipalti

https://lh4.googleusercontent.com/k2lr2QLf9OvFdt0aPeTtU_t9ryklux-DLzsAEo7vztZzgeWxWNS_bp3Jfmd7RXXBkfSp08oMB_5HICrBpvPTBvPnx0jNx1omGKS0qhbKog9ZnHRxa-ojwuj7dEv81zXye_n3IJKW

IR 2023 14 January 25 2023 The Internal Revenue Service announced today that businesses can now file Form 1099 series information returns using a new online portal available free from the IRS Following feedback from taxpayers tax professionals and payment processors and to reduce taxpayer confusion the IRS delayed the new 600 Form 1099 K reporting threshold for third party settlement organizations for calendar year 2023 As the IRS continues to work to implement the new law the agency will treat 2023 as an additional transition

Starting with the tax year of 2020 a 1099 MISC Form is meant to be filed for every person i e non employee you have paid over 600 for an assorted list of miscellaneous business payments The list of payments that require a business to file a 1099 MISC form is featured below The IRS filing season 2024 deadlines for tax year 2023 are as follows Form 1099 MISC Guide Filing Season 2024 Form 1099 Deadlines TY2023 Please note that these are just the federal deadlines Please verify with your state for any state requirements and the proper submission methods

More picture related to 2023 1099 Misc Printable Form

Printable Form 1099 MISC Sunnyvale California Fill Exactly For Your City

https://www.pdffiller.com/preview/608/781/608781885/big.png

Irs Printable 1099 Form Printable Form 2023

https://www.printableform.net/wp-content/uploads/2021/06/what-is-irs-form-1099-q-turbotax-tax-tips-videos.jpg

1099 2023

https://img.zpbusiness.com/img/accounting-business-taxes-hiring/irs-form-1099-reporting-for-small-business-owners.png

2023 Form 1099 R Attention Copy A of this form is provided for informational purposes only Copy A appears in red similar to the official IRS form The official printed version of Copy A of this IRS form is scannable but the online version of it printed from this website is not For tax year 2023 here are the due dates for each form Form 1099 NEC Form 1099 MISC You are required to furnish Form 1099 NEC to the payee and file with the IRS by January 31 2024 for payments made to contractors in the 2023 tax year For 2023 you are required to send Form 1099 MISC to the payee the contractor by January 31 2024 and

Updated November 06 2023 IRS 1099 Forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages such as freelance earnings interest dividends and more There are 20 active types of 1099 forms used for various income types 1099s fall into a group of tax documents called information returns because they notify 1099 MISC Use Form 1099 MISC miscellaneous income to report payments made in the course of your business for each person to whom you paid at least 10 in royalties or at least 600 in rents prizes and awards medical and health care payments or other income payments Additionally you must also file Form 1099 MISC for each person for whom

Form 1099 MISC For Independent Consultants 6 Step Guide

https://global-uploads.webflow.com/58868bcd2ef4daaf0f072902/5ab4028e9825160f3b4e4824_Screen Shot 2018-03-22 at 3.22.21 PM.png

Printable 1099 Misc Tax Form Template Printable Templates

https://www.pandadoc.com/app/uploads/form-1099-misc.png

2023 1099 Misc Printable Form - Form 1099 2023 IRS 1099 MISC Tax Form Printable Free Fillable PDF Fill Online or Print 1099 Tax Form for 2023 IRS Form 1099 2023 Developer IRS Genre Miscellaneous Information Version 2023 IRS 1099 MISC Fillable Form for Online Filling