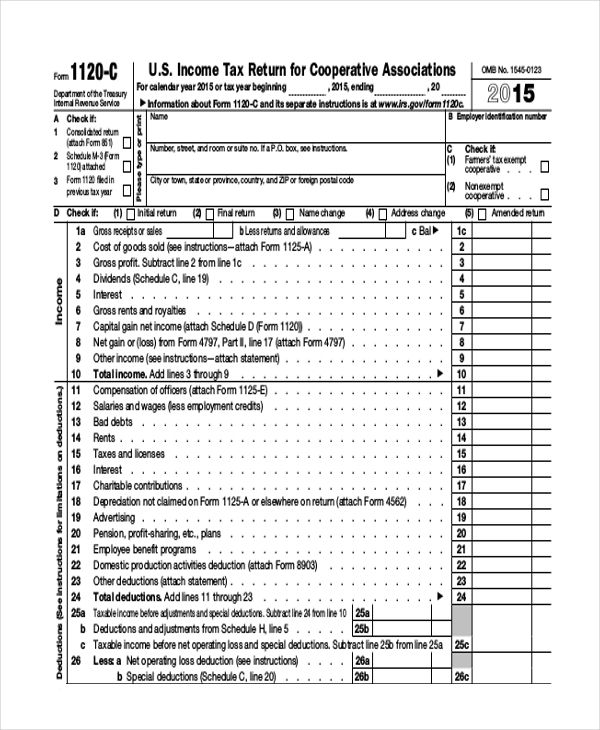

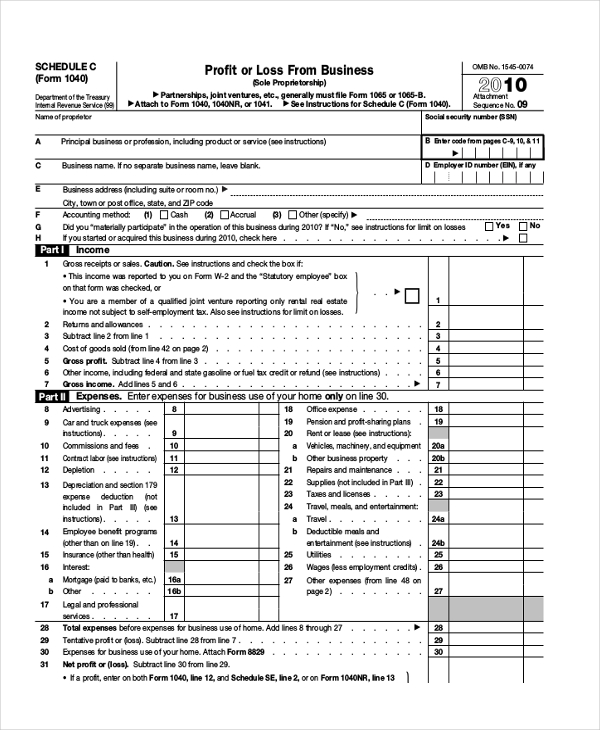

2023 Printable Schedule C Form Information about Schedule C Form 1040 Profit or Loss from Business used to report income or loss from a business operated or profession practiced as a sole proprietor includes recent updates related forms and instructions on how to file

Page 1 of 20 13 32 25 Jan 2023 The type and rule above prints on all proofs including departmental reproduction proofs MUST be removed before printing Department of the Treasury Internal Revenue Service 2022 Instructions for Schedule CProfit or Loss From Business Use Schedule C Form 1040 to report income or loss from a business you operated Most US resident taxpayers will file Form 1040 for tax year 2023 Seniors age 65 and older have the option to file Form 1040 SR this year which is basically the same as Form 1040 Nonresident taxpayers will file Form 1040 NR Commonwealth residents will file either Form 1040 SS or Form 1040 PR If you need to amend a federal income tax return

2023 Printable Schedule C Form

2023 Printable Schedule C Form

https://schedule-printable.com/wp-content/uploads/2021/09/printable-schedule-c-form-2-630x380.png

A Friendly Guide To Schedule C Tax Forms U S FreshBooks Blog

https://www.freshbooks.com/blog/wp-content/uploads/2015/03/Schedule_C.png

Fillable Form 1040 Schedule C 2019 In 2023 Irs Tax forms Credit

https://i.pinimg.com/originals/74/e5/28/74e528da939cd203b1c1b07905b48754.png

2021 Schedule C Instructions The Schedule C form is generally published in October of each year by the IRS Schedule C instructions follow later usually by the end of November If published the 2023 tax year PDF file will display the prior tax year 2022 if not The 2023 Schedule C tax form is used to report your business net profit to the IRS Our step by step guide helps you fill it out and maximize your deductions

Profit or Loss From Business Use Schedule C to report income or loss from a business or profession in which you were the sole proprietor Small businesses and statutory employees with business expenses of 5 000 or less may be able to file Schedule C EZ instead of Schedule C 11 0001 Schedule C Instructions Schedule C EZ is used instead of Schedule C by qualifying small businesses and statutory employees with expenses of 5 000 or less About Schedule D Form 1040 Capital Gains and Losses Information about Schedule D Form 1040 or 1040 SR Capital Gains and Losses including recent updates related forms and instructions on how to file

More picture related to 2023 Printable Schedule C Form

Free Printable Schedule C Tax Form

https://images.sampleforms.com/wp-content/uploads/2016/11/Form-1120-Schedule-C.jpg

Sample Schedule C Form Fill Online Printable Fillable Blank Pdffiller

https://images.sampleforms.com/wp-content/uploads/2016/11/Schedule-C-Form.jpg

Business Income schedule c Organizer Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/40/37/40037376/large.png

TRAVERSE CITY MI US December 18 2023 EINPresswire Washington D C The Internal Revenue Service IRS has just released the updated Tax Form 1040 Schedule C instructions and The last Schedule C guide you ll ever need with step by step instructions and examples Take a look at how The Hulk would fill out his form Features Expense tracking on autopilot Takes 30 sec after linking bank or credit card Tax bill prediction 2023 February 17 2022 Reviewed by The Last Schedule C Guide You ll Ever Need by

SCHEDULE A Form 1040 Department of the Treasury Internal Revenue Service Itemized Deductions Attach to Form 1040 or 1040 SR Go to irs gov ScheduleA for instructions and the latest information Caution OMB No 1545 0074 2023 Attachment If you are claiming a net qualified disaster loss on Form 4684 see the instructions for line 16 Last quarterly payment for 2023 is due on Jan 16 2024 Taxpayers may need to consider estimated or additional tax payments due to non wage income from unemployment self employment annuity income or even digital assets The Tax Withholding Estimator on IRS gov can help wage earners determine if there s a need to consider an additional tax

FREE 9 Sample Schedule C Forms In PDF MS Word

https://images.sampletemplates.com/wp-content/uploads/2016/11/21170428/Schedule-C-Form-1040.jpg

FREE 9 Sample Schedule C Forms In PDF MS Word

https://images.sampletemplates.com/wp-content/uploads/2016/11/21170649/Schedule-C-Form-Profit-or-Loss-From-Business.jpg

2023 Printable Schedule C Form - 2021 Schedule C Instructions The Schedule C form is generally published in October of each year by the IRS Schedule C instructions follow later usually by the end of November If published the 2023 tax year PDF file will display the prior tax year 2022 if not