Alabama Income Tax Form 40 Printable Legal Legal Division Public Records Request To report a criminal tax violation please call 251 344 4737 To report non filers please email taxpolicy revenue alabama gov

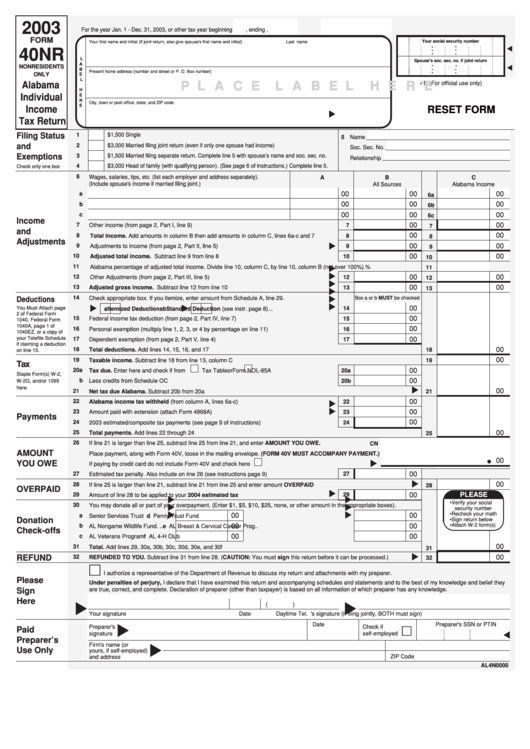

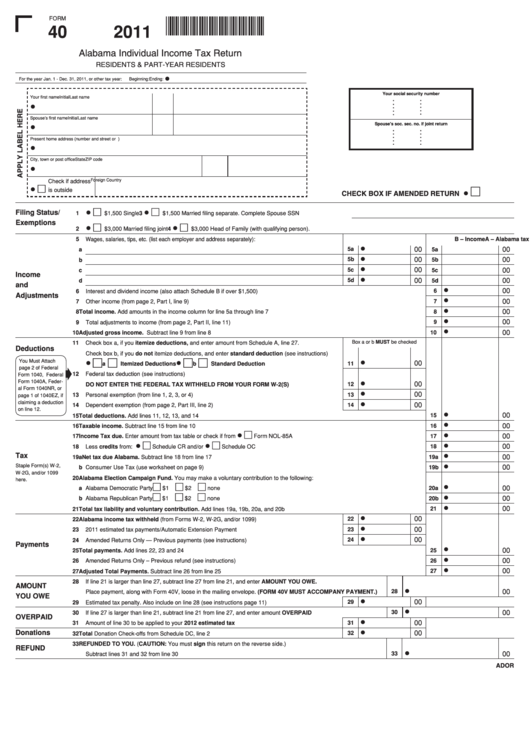

To report a criminal tax violation please call 251 344 4737 To report non filers please email taxpolicy revenue alabama gov Form 40 is the Alabama income tax return form for all full time and part time state residents non residents must file a Form 40NR This tax return package includes Form 4952A Schedules A B CR D E and OC Form 40 requires you to list multiple forms of income such as wages interest or alimony

Alabama Income Tax Form 40 Printable

Alabama Income Tax Form 40 Printable

https://www.incometaxpro.net/images/forms/state/2018-alabama-tax-forms.jpg

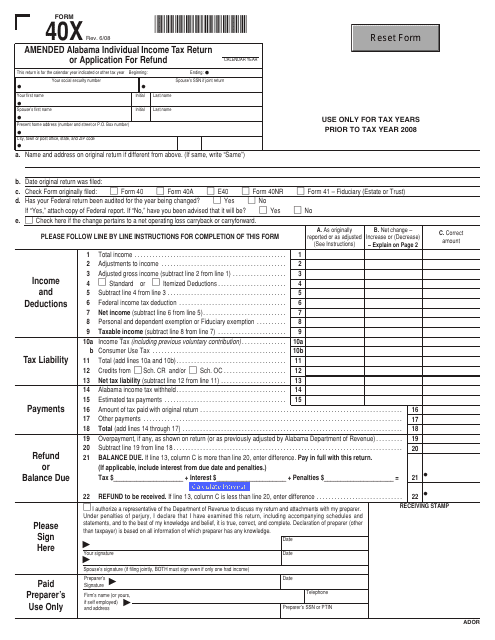

Form 40X Fill Out Sign Online And Download Fillable PDF Alabama

https://data.templateroller.com/pdf_docs_html/226/2269/226987/form-40x-amended-alabama-individual-income-tax-return-or-application-for-refund-alabama_big.png

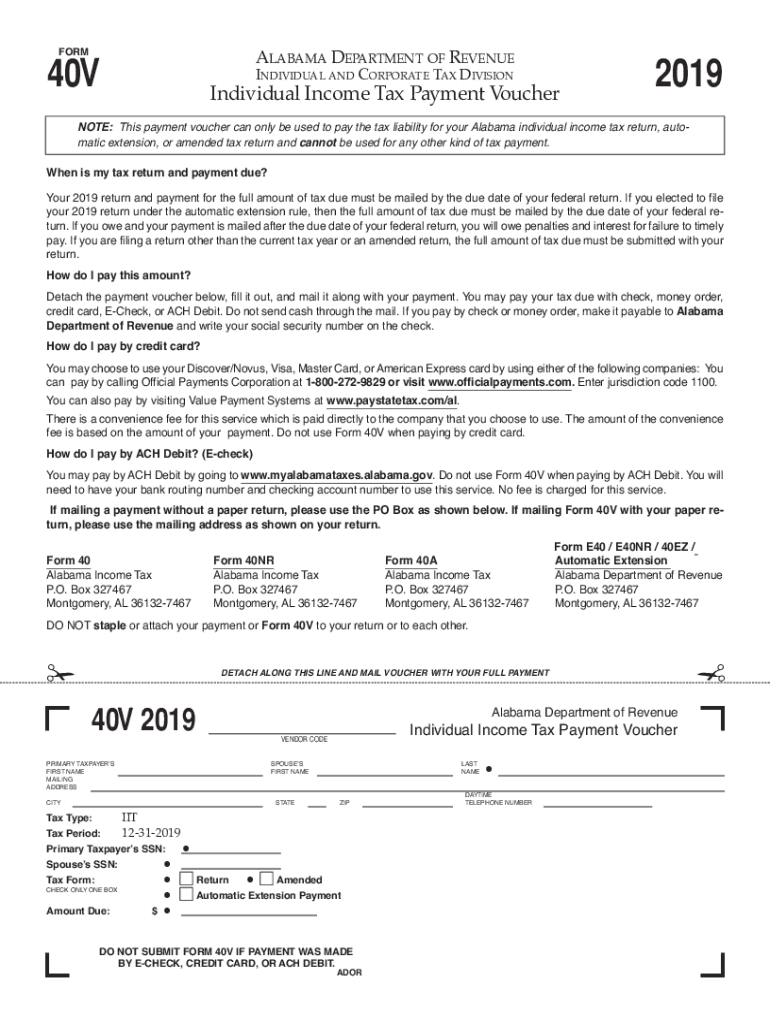

Alabama Income Tax Form 40V 2018 Form Fill Out And Sign Printable PDF

https://www.signnow.com/preview/513/601/513601728/large.png

Income Tax Legal Motor Vehicle Property Tax Tax Incentives Tax Policy To get started open the tax forms eg Alabama Form 40 or your saved tax forms the HTML file using this button or drag it to the area below Only use the print form button if the form you are printing does not have a green print button To obtain the best print Estimated Income Tax Worksheet Form 40ES is an estimated tax worksheet that will allow you to calculate your estimated quarterly income tax payments Alabama expects you to pay income tax quarterly if you owed 500 or more on your previous year s tax return 11 0001 Taxpayer Refund Request

Most taxpayers are required to file a yearly income tax return in April to both the Internal Revenue Service and their state s revenue department which will result in either a tax refund of excess withheld income or a tax payment if the withholding does not cover the taxpayer s entire liability Form 40 TY 2022 22000140 1 1 500 Single 3 1 500 Married filing separate Complete Spouse SSN NRA 2 3 000 Married filing joint 4 3 000 Head of Family with qualifying person Complete Schedule HOF

More picture related to Alabama Income Tax Form 40 Printable

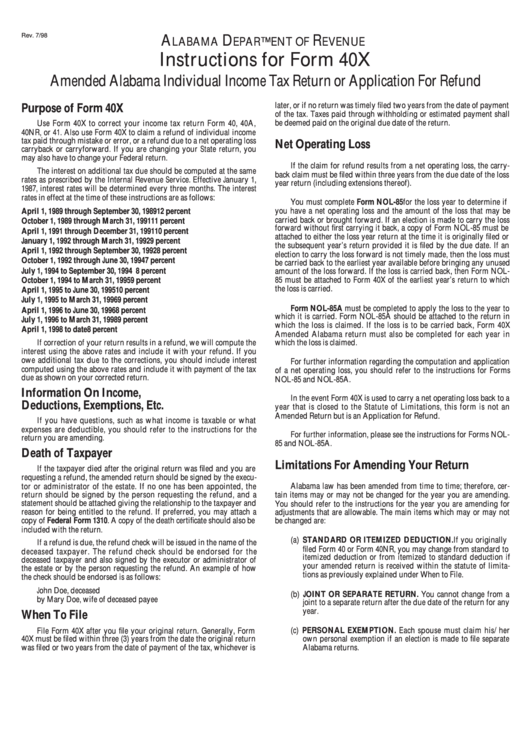

Instructions For Form 40x Amended Alabama Individual Income Tax

https://data.formsbank.com/pdf_docs_html/280/2807/280789/page_1_thumb_big.png

Fillable Form 40nr Alabama Individual Income Tax Return 2003

https://data.formsbank.com/pdf_docs_html/268/2682/268244/page_1_thumb_big.png

Alabama 40a tax form Instruction Booklet 2012 Fill Out Sign Online

https://www.pdffiller.com/preview/100/98/100098264/large.png

Alabama state income tax Form 40 must be postmarked by April 18 2023 in order to avoid penalties and late fees Printable Alabama state tax forms for the 2022 tax year will be based on income earned between January 1 2022 through December 31 2022 The Alabama income tax rate for tax year 2022 is progressive from a low of 2 to a high of 5 5a B IncomeAlabama Income Tax Withheld from Schedule W 2 line 18 column G If you are making a payment Form 40 line 30 mail your return to Alabama Department of Revenue P O Box 2401 Montgomery AL 36140 0001

ALL A 3 Annual Reconciliation of Alabama Income Tax Withheld ALL BF 1 Application to Become a Bulk Filer ALL Form 6014 A Authorization for Access to Third Party Records by Alabama Department of Revenue Employees It appears you don t have a PDF plugin for this browser Please use the link below to download 2022 alabama form 40 pdf and you can print it directly from your computer More about the Alabama Form 40 Tax Return eFile your Alabama tax return now eFiling is easier faster and safer than filling out paper tax forms

Fillable Form 40 Alabama Individual Income Tax Return 2011

https://data.formsbank.com/pdf_docs_html/54/543/54362/page_1_thumb_big.png

Alabama Tax Forms And Instructions For 2020 Form 40

https://www.incometaxpro.net/images/forms/2020/alabama-tax-forms.png

Alabama Income Tax Form 40 Printable - Form 40 TY 2022 22000140 1 1 500 Single 3 1 500 Married filing separate Complete Spouse SSN NRA 2 3 000 Married filing joint 4 3 000 Head of Family with qualifying person Complete Schedule HOF