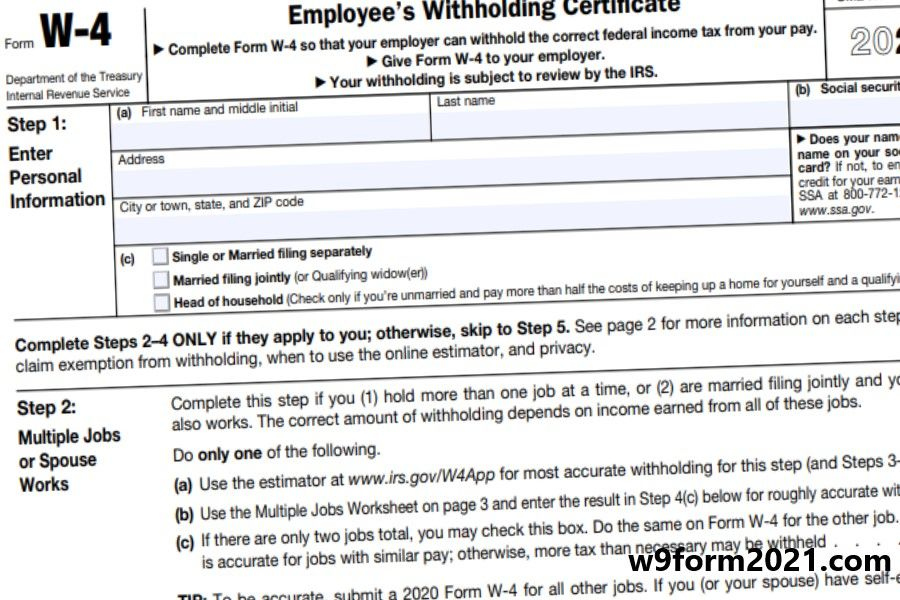

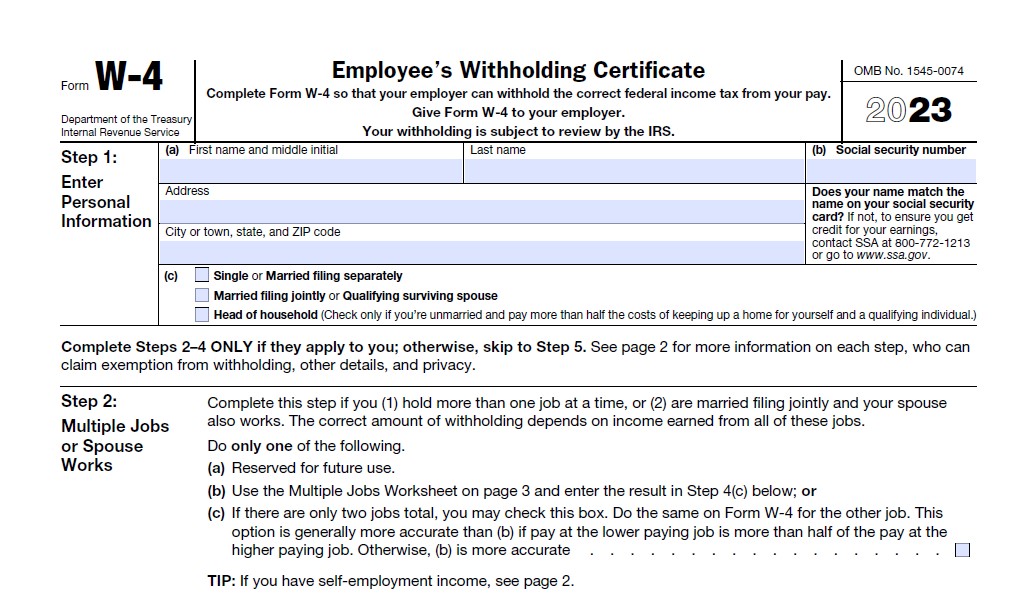

Colorado W 4 Printable 2023 Irs 2024 Form W 4 Complete Steps 2 4 ONLY if they apply to you otherwise skip to Step 5 See page 2 for more information on each step who can claim exemption from withholding and when to use the estimator at irs gov W4App Step 2 Multiple Jobs or Spouse Works

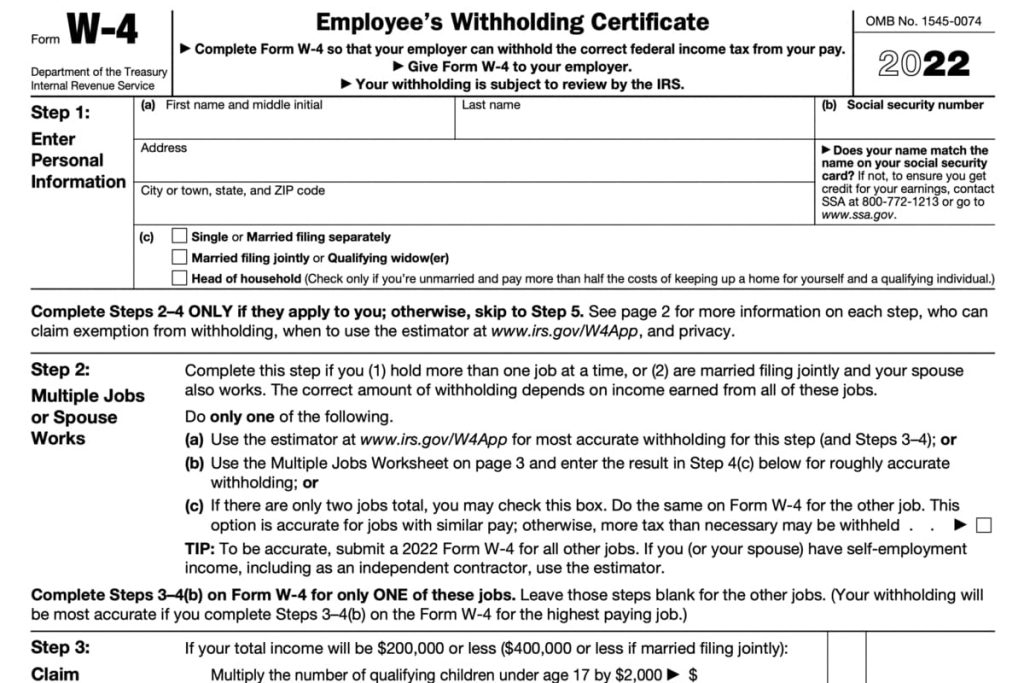

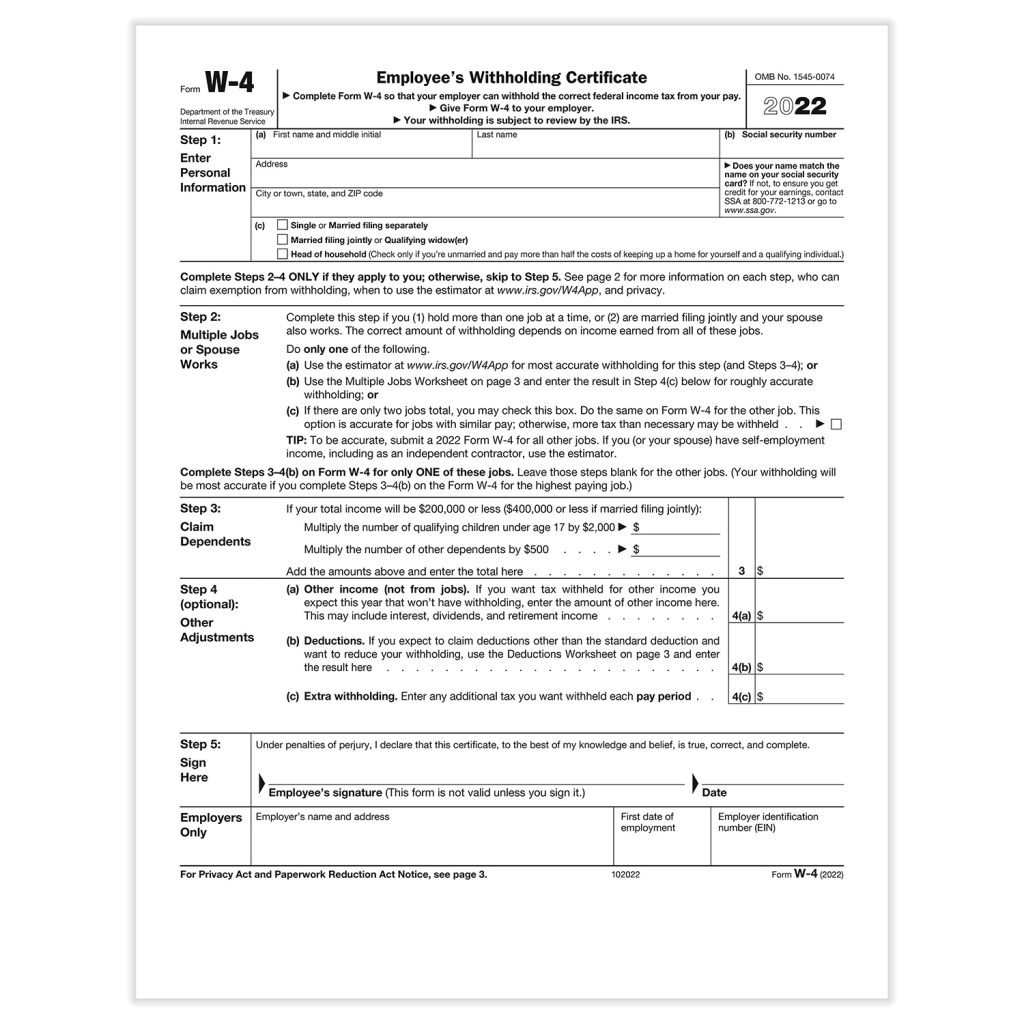

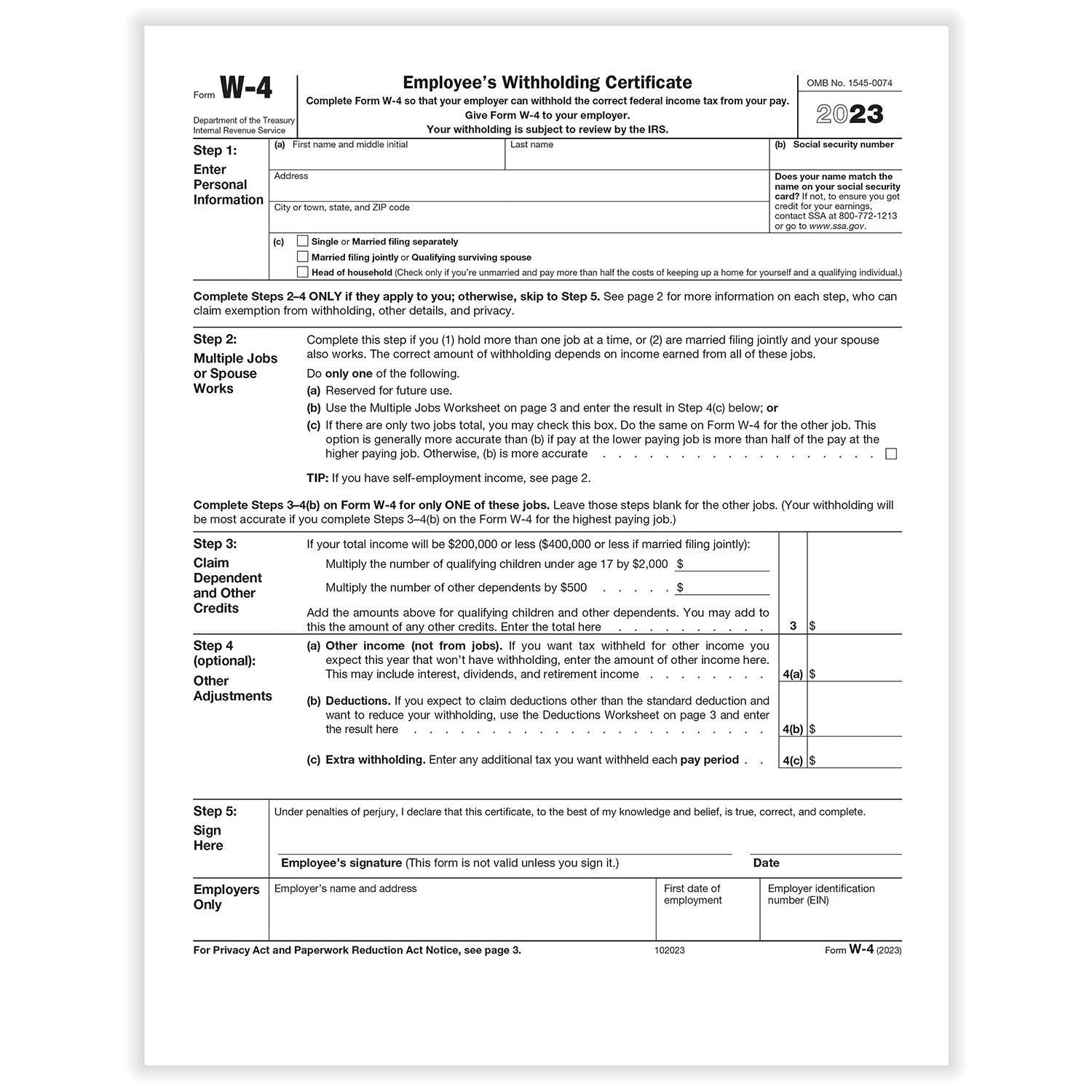

Complete Form W 4 so that your employer can withhold the correct federal income tax from your pay Give Form W 4 to your employer Your withholding is subject to review by the IRS OMB No 1545 0074 2023 Step 1 Enter Personal Information W 4 2023 Title 2023 Form W 4 Author SE W CAR MP Subject Employee s Withholding Certificate Krey l ayisyen Complete Form W 4 so that your employer can withhold the correct federal income tax from your pay Consider completing a new Form W 4 each year and when your personal or financial situation changes Current Revision Form W 4 PDF Recent Developments Additional Guidance for Substitute Submissions of Form W 4 29 NOV 2022

Colorado W 4 Printable 2023 Irs

Colorado W 4 Printable 2023 Irs

https://free-online-forms.com/wp-content/uploads/2023/01/W-4-Form-2023-768x860.jpg

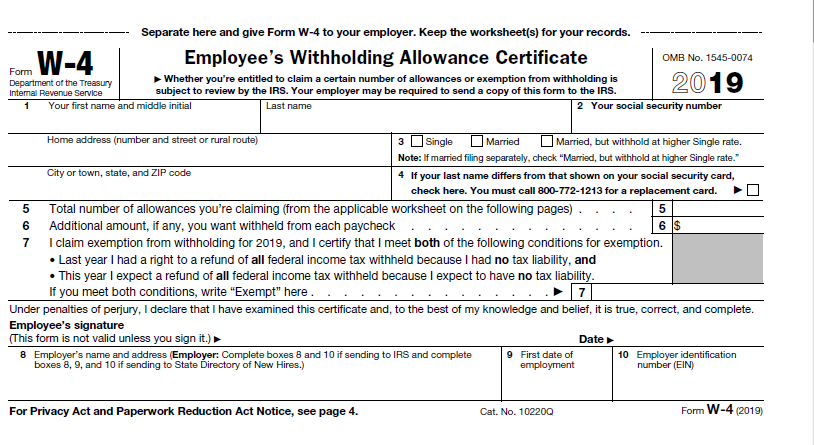

Colorado W4 Form 2021 2022 W4 Form

https://w4formsprintable.com/wp-content/uploads/2021/07/w4-form-2021-printable-7.jpg

W4 Form 2023 Withholding Adjustment W 4 Forms TaxUni Fillable Form 2023

https://fillableforms.net/wp-content/uploads/2022/10/w4-form-2023-withholding-adjustment-w-4-forms-taxuni-1024x683.jpg

Employers use the W 4 to calculate certain payroll taxes and remit the taxes to the IRS and state and local authorities if applicable on behalf of employees How you fill out a W 4 can Earlier Forms W 4 as if they were 2020 or later Forms W 4 for purposes of figuring federal income tax withholding See How To Treat 2019 and Earlier Forms W 4 as if They Were 2020 or Later Forms W 4 later for more informa tion Electronic submission of Forms W 4 and W 4P You may set up a system to electronically receive Form W 4 or

Purpose This page contains the 2023 Form W 4 and instructions for viewing and changing your W 4 in the employee portal For IRS guidance on what to file on your W 4 please refer to the IRS tax calculator Please note International employees are subject to special rules and should meet with an international tax specialist to complete the W 4 form To schedule an appointment with an Use this chart to learn which state W 4 form you need to distribute to and collect from new hires State State W 4 Form Alabama Form A 4 Employee s Withholding Tax Exemption Certificate Alaska N A no state income tax Arizona Arizona Form A 4 Employee s Arizona Withholding Election

More picture related to Colorado W 4 Printable 2023 Irs

2023 IRS W 4 Form HRdirect Fillable Form 2023

https://fillableforms.net/wp-content/uploads/2022/10/2023-irs-w-4-form-hrdirect-2-1024x1024.jpg

Colorado Withholding Form 2022 W4 Form

https://w4formsprintable.com/wp-content/uploads/2021/07/form-cr0100ap-download-fillable-pdf-or-fill-online.png

IRS W 4 Form 2023 Printable IRS Tax Forms 2022

https://irstax-forms.com/wp-content/uploads/2022/12/W-4-Form-2023-Printable.jpg

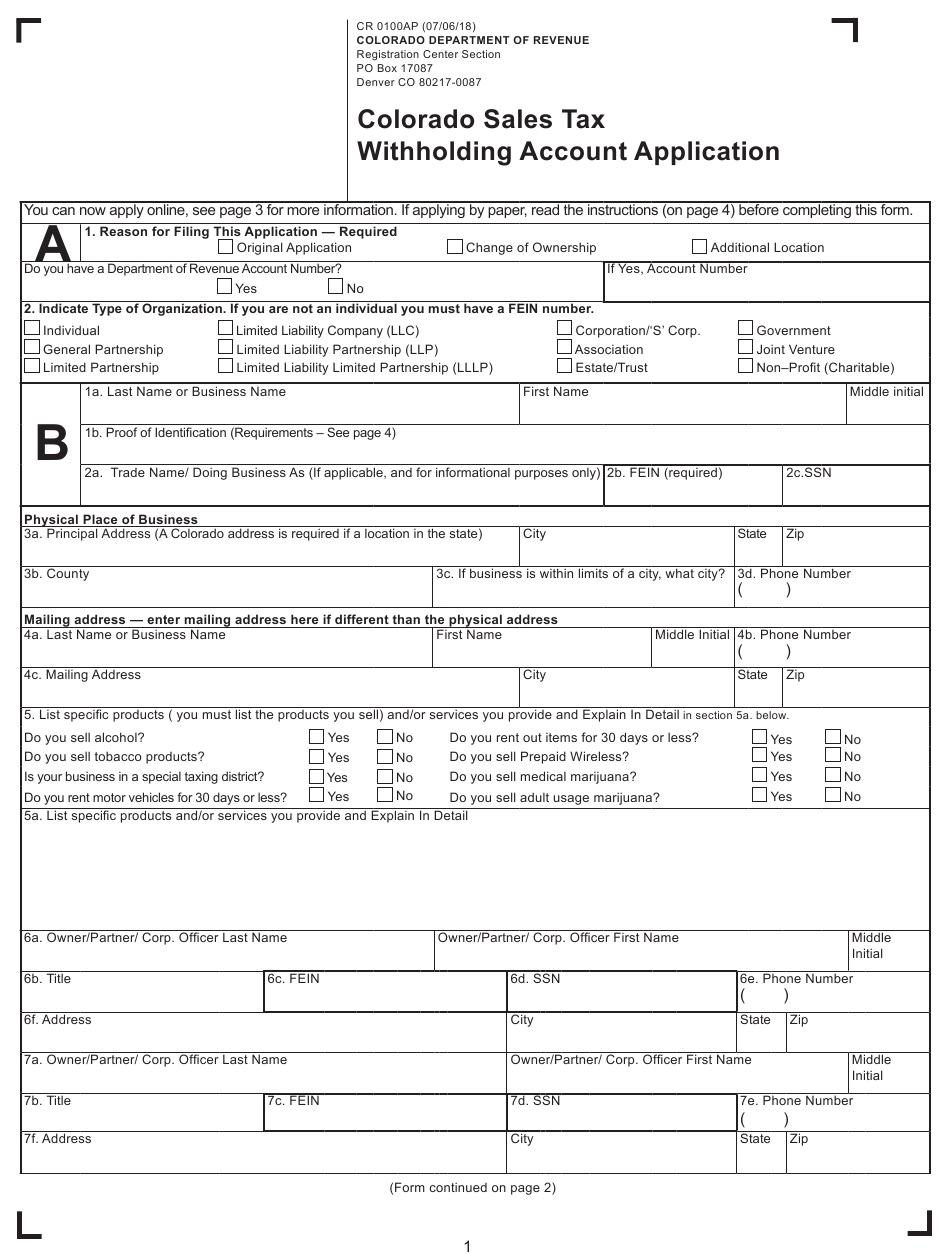

Form DR 0004 is the new Colorado Employee Withholding Certificate that is available for 2022 It is not meant to completely replace IRS form W 4 for Colorado withholding but to help employees in a few specific situations fine tune their Colorado withholding Colorado Withholding Worksheet for Employers This worksheet prescribes the method for employers to calculate Colorado wage withholding based on the employee s Colorado form DR 0004 or federal form W 4 Employers must begin using the updated calculation for pay periods beginning on or after January 1 2023 For a general overview of

IR 2023 235 Dec 11 2023 WASHINGTON The Internal Revenue Service today urged taxpayers to take important actions now to help them file their 2023 federal income tax return next year This is the second in a series of reminders to help taxpayers get ready for the upcoming filing season All out of state employees must fill out a W 4 for the state in which they work and mail or fax it to Employee Services Email is not a secure method to deliver the personal information contained on the W 4 Please note Pennsylvania residents There are two forms to fill out for your state Alaska Florida New Hampshire Nevada South

Comprovante De Rendimentos 2023 W4 Irs Form IMAGESEE

https://www.digisigner.com/wp-content/uploads/2019/05/W4_2019.png

New W 4 Form 2023 Printable Forms Free Online

https://cdn.hrdirect.com/Images/Products/A1393-2023-w4-form_xl.jpg

Colorado W 4 Printable 2023 Irs - Earlier Forms W 4 as if they were 2020 or later Forms W 4 for purposes of figuring federal income tax withholding See How To Treat 2019 and Earlier Forms W 4 as if They Were 2020 or Later Forms W 4 later for more informa tion Electronic submission of Forms W 4 and W 4P You may set up a system to electronically receive Form W 4 or