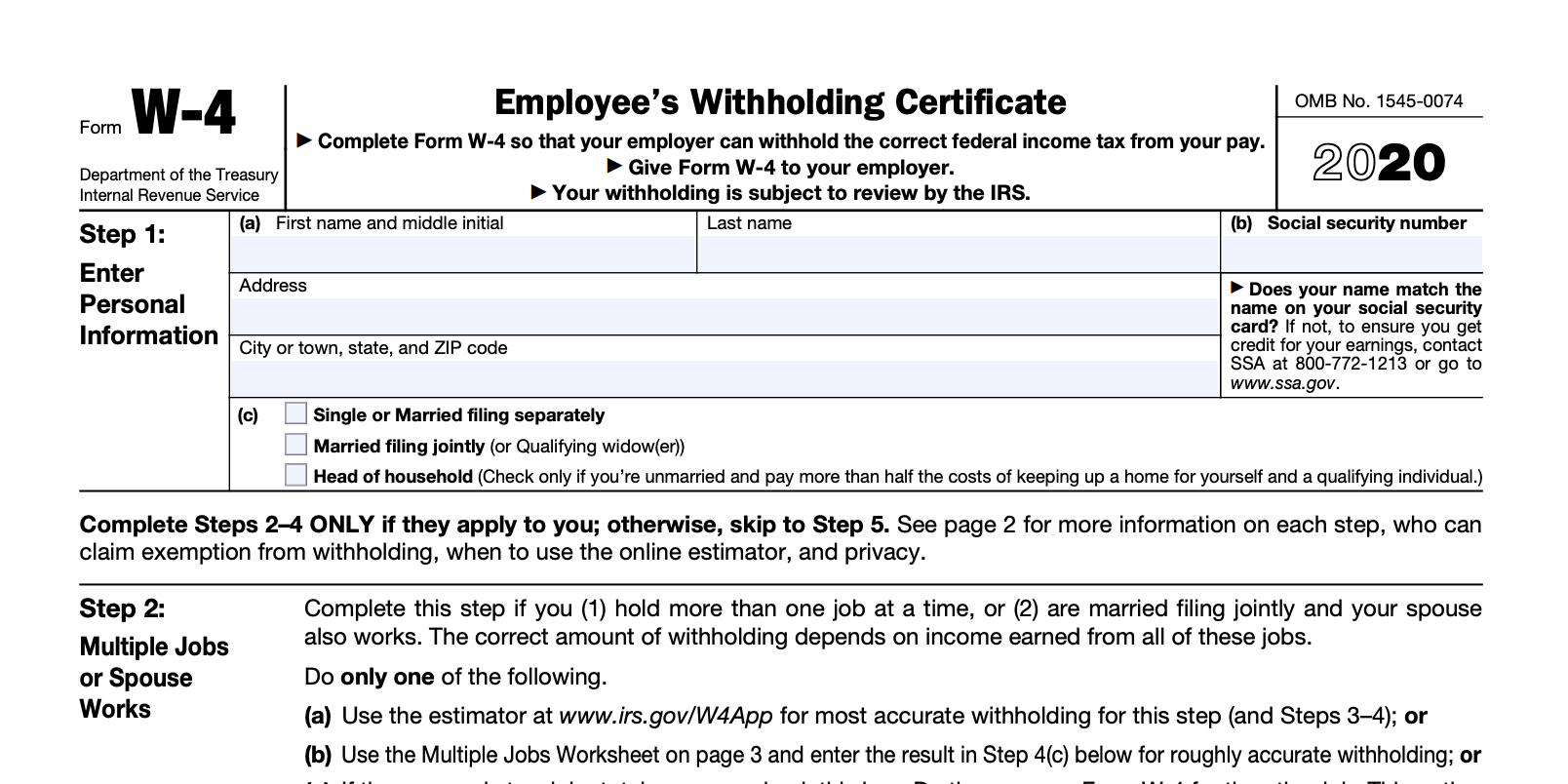

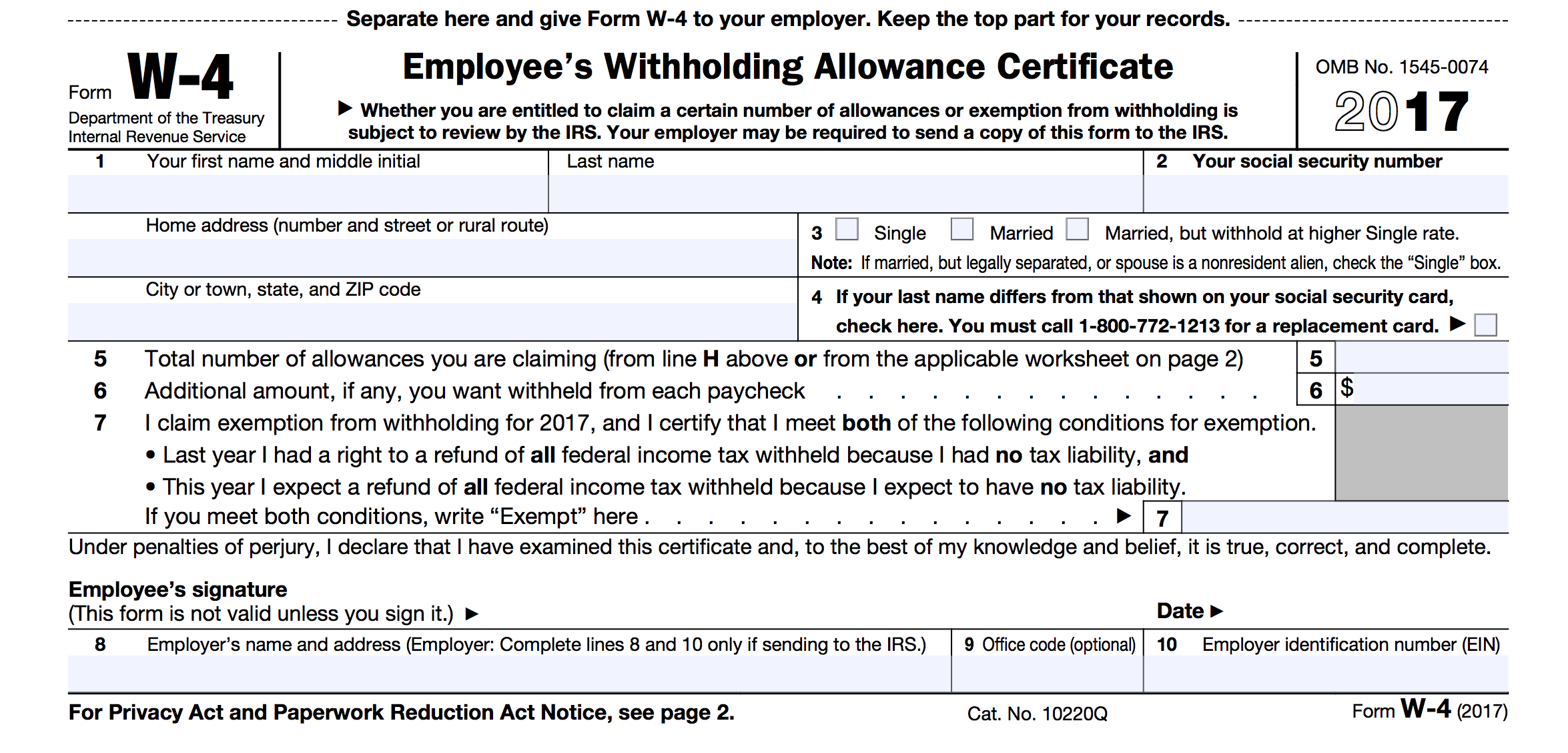

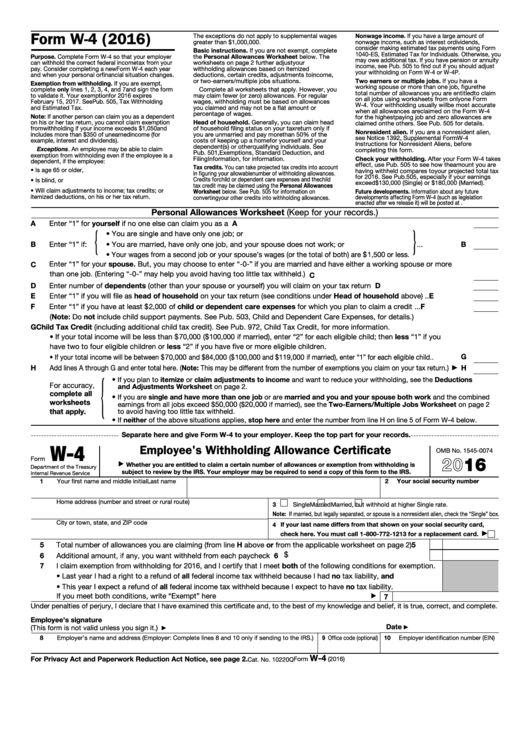

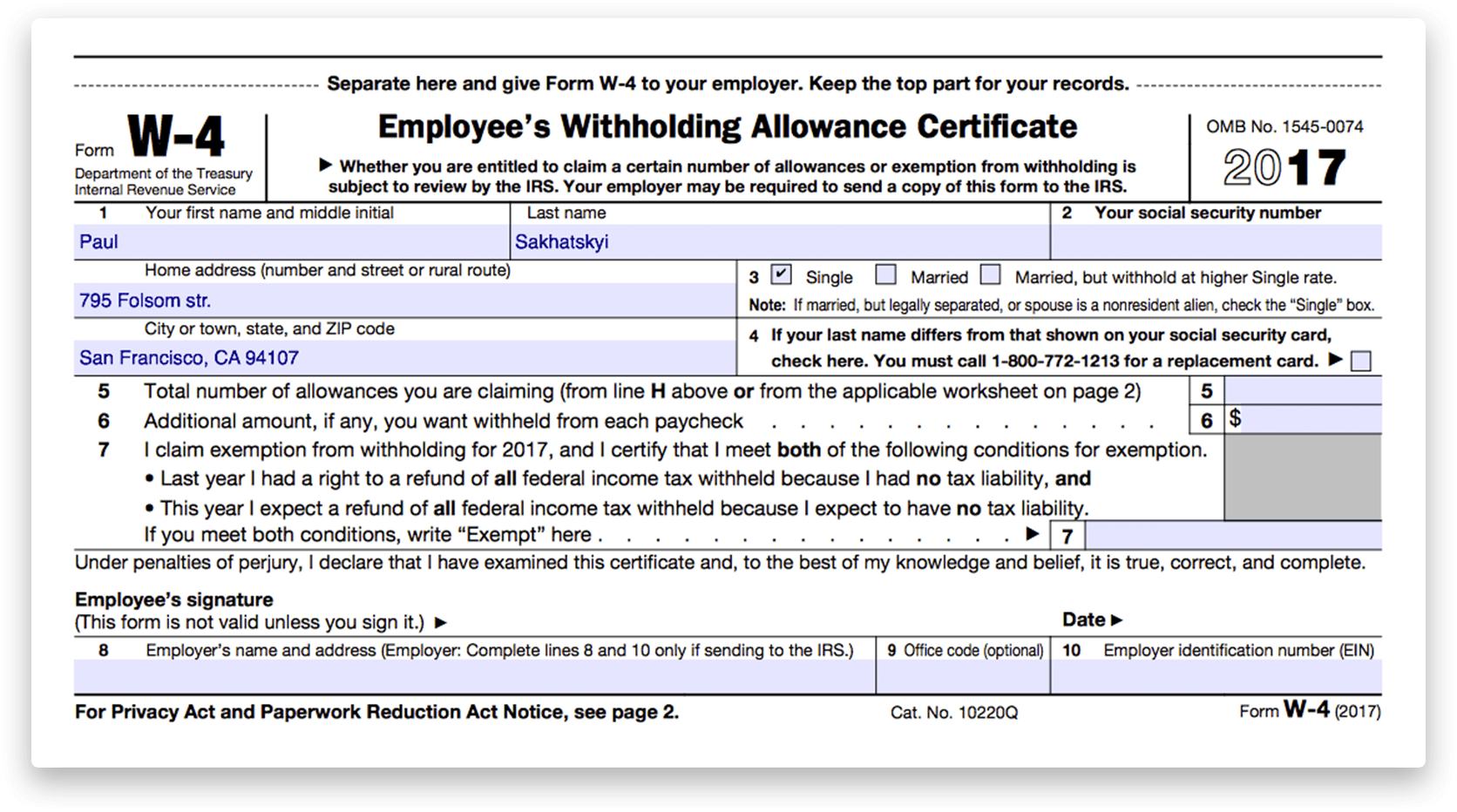

Free Printable 20017 Tax Form W 4 Form W 4 is completed by employees and given to their employer so their employer can withhold the correct federal income tax from the employee s pay

When all allowances are claimed on the Form W 4 for the highest paying job and zero allowances are claimed on the others See Pub 505 for details Nonresident alien If you are a nonresident alien see Notice 1392 Supplemental Form W 4 Instructions for Nonresident Aliens before completing this form Check your withholding After your Form W Purpose of Form Complete Form W 4 so that your employer can withhold the correct federal income tax from your pay If too little is withheld you will generally owe tax when you file your tax return and may owe a penalty If too much is withheld you will generally be due a refund

Free Printable 20017 Tax Form W 4

Free Printable 20017 Tax Form W 4

http://www.form-w-4.com/wp-content/uploads/2018/03/irs-w-4-2018.png

Federal W 4 Form Printable Printable Forms Free Online

https://www.pdffiller.com/preview/521/567/521567036/big.png

Free Printable W 4 Form For Employees Printable Templates

https://w4formsprintable.com/wp-content/uploads/2021/07/w-4-form-printable-for-2020-get-irs-w4-form-sample-to-4.jpg

Print or make a second copy for your records and give the original to your payroll department Do not file the W 4 with your tax return Related Information How do I apply my refund to next year s 2024 taxes How do I print estimated tax vouchers for my 2024 taxes How do I print my federal tax forms without my state forms Was this helpful What is a W 4 A W 4 form formally titled Employee s Withholding Certificate is an IRS tax document that employees fill out and submit to their employers Employers use the

Check the status of your income tax refund for the three most recent tax years IRS2Go App Check your refund status make a payment find free tax preparation assistance sign up for helpful tax tips and more Your online account Access your individual account information to view your balance make and view payments and view or create payment As far as IRS forms go the new W 4 form is pretty straightforward It has only five steps If you are single have one job have no children have no other income and plan on claiming the standard deduction on your tax return you only need to fill out Step 1 your name address Social Security number and filing status and Step 5 your signature

More picture related to Free Printable 20017 Tax Form W 4

Free Printable W 4 Form For Employees Printable Templates

https://w4formsprintable.com/wp-content/uploads/2020/09/understand-your-w-4-mrmillennialmoney-8.png

Fillable Form W4 2022 W4 Form

https://w4formsprintable.com/wp-content/uploads/2020/09/fillable-form-w-4-employee-s-withholding-allowance-3.png

Understanding Taxes Simulation Completing Form W 4

https://apps.irs.gov/app/understandingTaxes/hows/mod01/media/sm1_w4.gif

Download or print the 2022 Federal Form W 4 Employee s Withholding Allowance Certificate Blank for FREE from the Federal Internal Revenue Service have suggestions for making this form simpler we would be happy to hear from you See the instructions for your income tax return Page 4 Form W 4 2023 Married Filing Jointly or Qualifying As you may know Form W 4 is used to determine your withholding allowances based on your unique situation so that your employer can withhold the correct federal income tax from your pay To complete the W 4 properly you ll need to go through the personal allowance worksheet to ensure you re not paying too much or too little taxes come tax time

IRS Form W 4 or Employee s Withholding Certificate is a form given to an employer by an employee that calculates the amount of federal income tax that should be withheld from the employee s pay A W 4 is not required to be submitted annually unless the employee is exempt from withholding The IRS issued a new Form W 4 in 2020 The new design is simple accurate and gives employees privacy while minimizing the burden on employers and the payroll process And although employees don t have to give employers an updated Form W 4 they should be encouraged to update their Form W 4 Each employee is responsible for their own withholding

How To Fill Out 2018 IRS Form W 4 PDF Expert

https://pdfexpert.com/img/howto/fill-w4-form/filledform_2x.png

Il W 4 2020 2022 W4 Form

https://w4formsprintable.com/wp-content/uploads/2020/09/how-to-fill-out-a-w-4-form-the-only-guide-you-need.png

Free Printable 20017 Tax Form W 4 - As far as IRS forms go the new W 4 form is pretty straightforward It has only five steps If you are single have one job have no children have no other income and plan on claiming the standard deduction on your tax return you only need to fill out Step 1 your name address Social Security number and filing status and Step 5 your signature