Free Printable W 4 Form For Employees IRS Form W 4 or Employee s Withholding Certificate is a form given to an employer by an employee that calculates the amount of federal income tax that should be withheld from the employee s pay A W 4 is not required to be submitted annually unless the employee is exempt from withholding

Complete Form W 4 so that your employer can withhold the correct federal income tax from your pay Consider completing a new Form W 4 each year and when your personal or financial situation changes Current Revision Form W 4 PDF Recent Developments Additional Guidance for Substitute Submissions of Form W 4 29 NOV 2022 Purpose of Form Complete Form W 4 so that your employer can withhold the correct federal income tax from your pay If too little is withheld you will generally owe tax when you file your tax return and may owe a penalty If too much is withheld you will generally be due a refund

Free Printable W 4 Form For Employees

Free Printable W 4 Form For Employees

https://w4formsprintable.com/wp-content/uploads/2021/07/form-w-4-download-printable-pdf-or-fill-online-employee-s-1.png

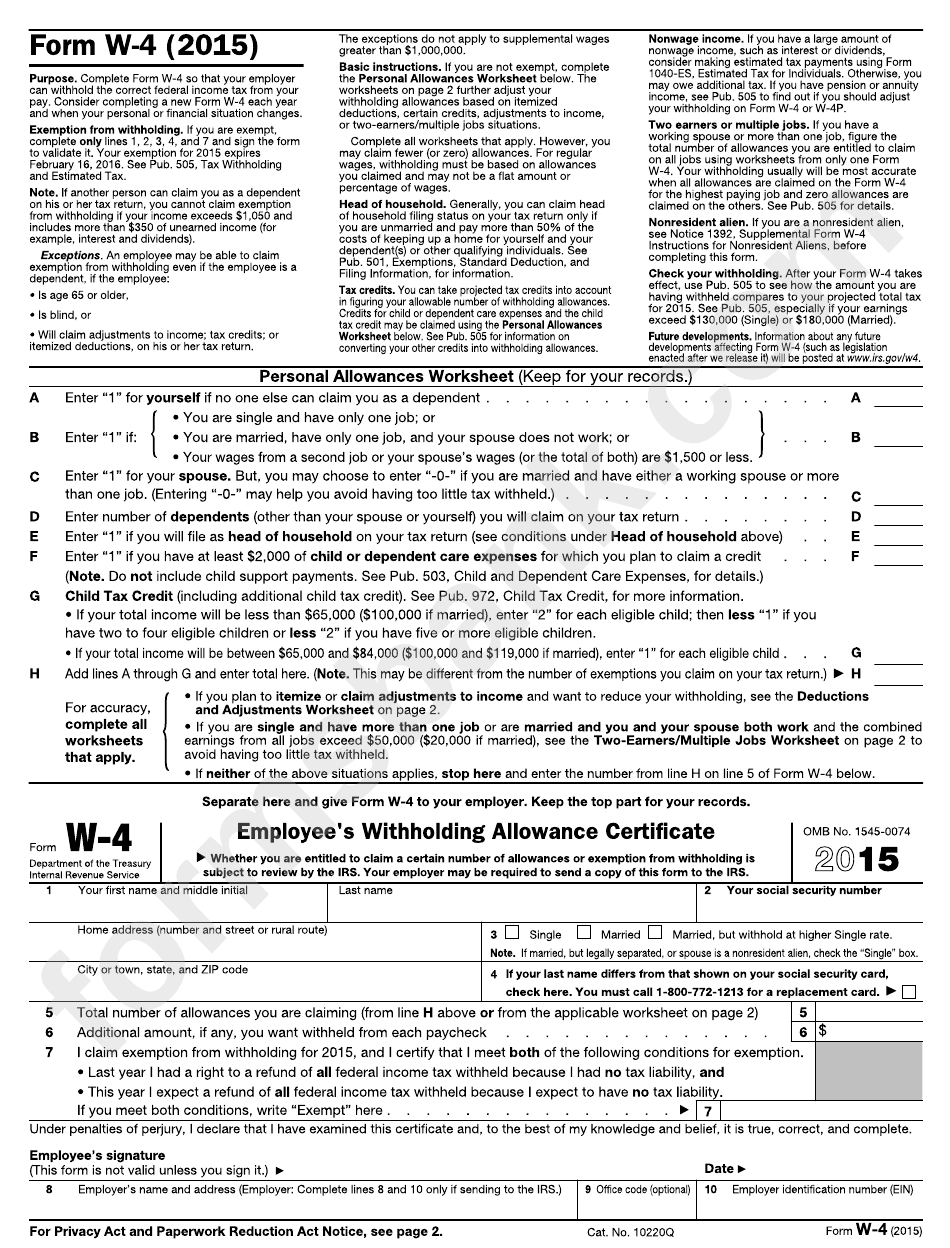

Form W 4 Employee S Withholding Allowance Certificate 2015

https://data.formsbank.com/pdf_docs_html/142/1427/142784/page_1_bg.png

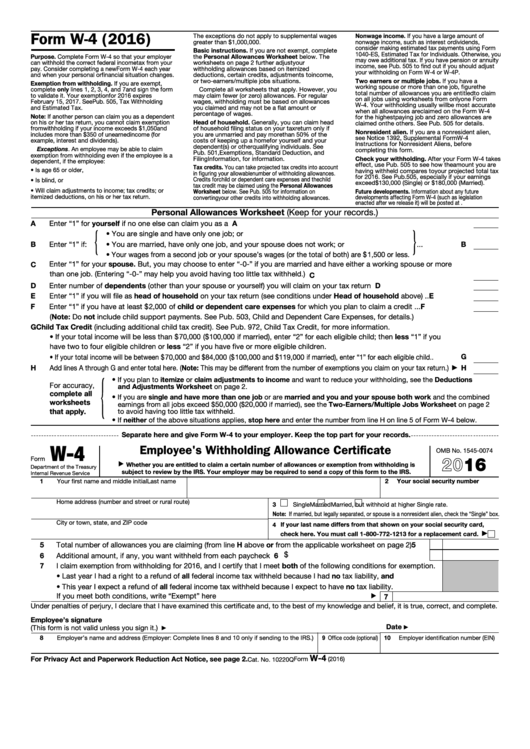

Fillable W 4 Form 2022 W4 Form

https://w4formsprintable.com/wp-content/uploads/2020/09/fillable-form-w-4-employee-s-withholding-allowance-1.png

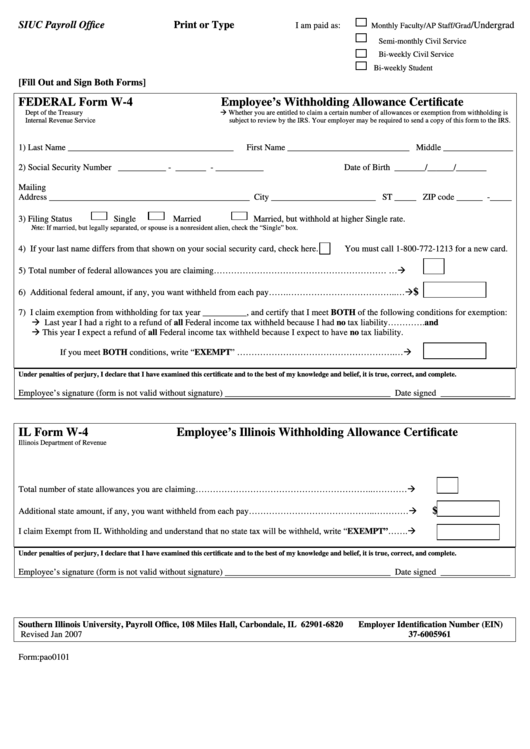

A W 4 form formally titled Employee s Withholding Certificate is an IRS tax document that employees fill out and submit to their employers Employers use the information provided on a Form W 4 should be filled out by every new employee preferably on their first day of employment but no later than their first week You do not need to file your employees W 4 forms with the IRS but they should be kept on file with other personnel records for a minimum of four years Payroll software providers often offer options for the

Form W 4 2019 Future developments For the latest information about any future developments related to Form W 4 such as legislation enacted after it was published go to irs gov FormW4 Purpose Complete Form W 4 so that your employer can withhold the correct federal income tax from your pay If your total income will be 200 000 or less 400 000 or less if married filing jointly Multiply the number of qualifying children under age 17 by 2 000 Multiply the number of other dependents by 500 Add the amounts above for qualifying children and other dependents You may add to this the amount of any other credits

More picture related to Free Printable W 4 Form For Employees

What You Should Know About The New Form W 4 Atlantic Payroll Partners

https://atlanticpayroll.us/wp-content/uploads/2021/01/Form-W-4-2021-web-imagev2.png

IRS Form W 4 Download Fillable PDF Or Fill Online Employee s

https://data.templateroller.com/pdf_docs_html/2554/25541/2554171/irs-form-w-4-employee-s-withholding-certificate_print_big.png

Free Printable W 4 Form For Employees Printable Templates

https://storage.store2phone.com/industriesData/307/ScreenShots/LiveApp/f8b733a0-1a21-4927-9429-4ddb781b6ab0.PNG

This W4 Form Tool lets you complete sign and create your W 4 which will be emailed as an attachment to you eFile does not store or share any of your W 4 information You can then submit or email the W 4 PDF Form via this tool to your employer not the IRS Watch the W 4 video for more details Since tax refunds are generally the result How To Complete a W 4 Form Step 1 Complete your personal information List your name address social security number and tax filing status Tax filing options include the following Single or Married filing separately Married filing jointly or Qualifying widow er

What Is A W 4 Get Started Free A W 4 form tells an employer the correct amount of federal income tax to withhold from an employee s paycheck It is a form that an employee must fill out anytime they start a new job The IRS recommends filling out a new W 4 each calendar year and when your personal or financial situation changes What s Included Cloned 4 735 A W 4 form is an IRS tax form filled out by an employee to tell their employer the correct amount of federal income tax to withhold from their paycheck No matter your industry collect W 4s online from your employees with our free W 4 Form Template Employees can fill out the form from any device with their tax information

Il W 4 2020 2022 W4 Form

https://w4formsprintable.com/wp-content/uploads/2020/09/how-to-fill-out-a-w-4-form-the-only-guide-you-need.png

Free Printable W 4 Form For Employees Printable Templates

https://data.formsbank.com/pdf_docs_html/180/1803/180351/page_1_thumb_big.png

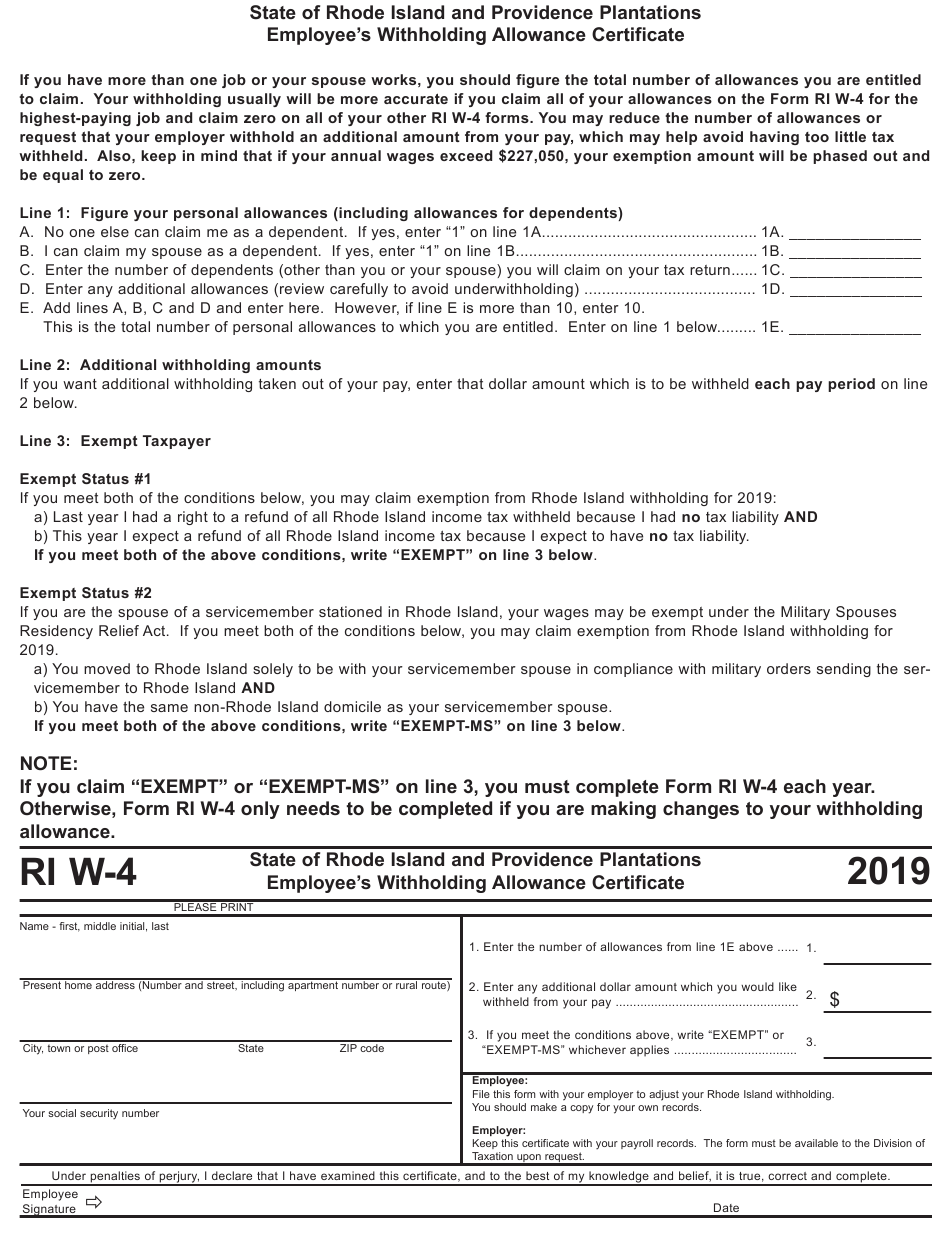

Free Printable W 4 Form For Employees - Form W 4 2019 Future developments For the latest information about any future developments related to Form W 4 such as legislation enacted after it was published go to irs gov FormW4 Purpose Complete Form W 4 so that your employer can withhold the correct federal income tax from your pay