Independent Contractor Printable 1099 Form Form 1099 NEC Independent Contractors Question What s the difference between a Form W 2 and a Form 1099 MISC or Form 1099 NEC Answer Although these forms are called information returns they serve different functions Employers use Form W 2 Wage and Tax Statement to Report wages tips or other compensation paid to an employee

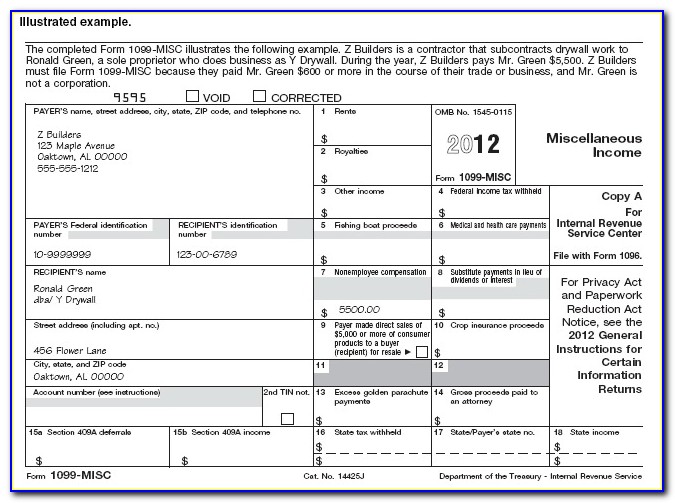

If you pay independent contractors you may have to file Form 1099 NEC Nonemployee Compensation to report payments for services performed for your trade or business File Form 1099 NEC for each person in the course of your business to whom you have paid the following during the year at least 600 in Form 1099 NEC Nonemployee Compensation is a tax form specifically designed to report payments made to those who aren t considered employees Freelancers independent contractors or those who are otherwise self employed may receive one or more 1099 NEC forms from clients detailing how much they were paid during the tax year

Independent Contractor Printable 1099 Form

Independent Contractor Printable 1099 Form

https://uploads-ssl.webflow.com/58868bcd2ef4daaf0f072902/5ab4028e9825160f3b4e4824_Screen Shot 2018-03-22 at 3.22.21 PM.png

Printable Independent Contractor 1099 Form Printable Forms Free Online

https://www.thesecularparent.com/wp-content/uploads/2018/11/irs-1099-form-independent-contractor-700x469.jpg

Printable 1099 Form Independent Contractor TUTORE ORG Master Of

https://www.viralcovert.com/wp-content/uploads/2018/12/irs-form-1099-misc-2012-download-free.jpg

This form report the amount shown in box 1 on the line for Wages salaries tips etc of Form 1040 1040 SR or 1040 NR You must also complete Form 8919 and attach it to your return For more information see Pub 1779 Independent Contractor or Employee Independent contractor or employee Generally you must report payments to independent contractors on Form 1099 NEC in box 1 See the instructions for box 1 Section 530 of the Revenue Act of 1978 as extended by section 269 c of P L 97 248 deals with the employment tax status of independent contractors and employees

Instructions for Recipient Recipient s taxpayer identification number TIN For your protection this form may show only the last four digits of your social security number SSN individual taxpayer identification number ITIN adoption taxpayer identification number ATIN or employer identification number EIN Form 1099 NEC is specifically designed to report nonemployee compensation which includes payments made to independent contractors freelancers and other service providers who are not considered employees This form is used to report payments of 600 or more for services provided during the tax year 2023

More picture related to Independent Contractor Printable 1099 Form

Free Independent Contractor Agreement Template 1099 Word PDF EForms

https://i2.wp.com/eforms.com/download/2018/06/1-Page-Independent-Contractor-Agreement.png?ssl=1

New 1099 NEC Form For Independent Contractors The Dancing Accountant

https://i0.wp.com/www.thedancingaccountant.com/wp-content/uploads/2020/12/image.png?w=892&ssl=1

1099 Form Independent Contractor Pdf Irs Form 1099 Misc Fill Out

https://jumbotron-production-f.squarecdn.com/assets/11075493e5b6812373621.png

A 1099 NEC form non employee compensation is an IRS tax document that reports payments made by businesses or individuals to independent contractors or non employees during a calendar year The paying party must issue a 1099 NEC if payments during the year exceed 600 and the recipient must use the form to report their income when filing taxes Form 1099 NEC Nonemployee Compensation applies to all payments made for work performed by independent contractors including freelancers and self employed individuals Some businesses mistakenly refer to independent contractors as 1099 employees but actual employees receive a W 2 not a 1099 NEC Determining whether a person performing work

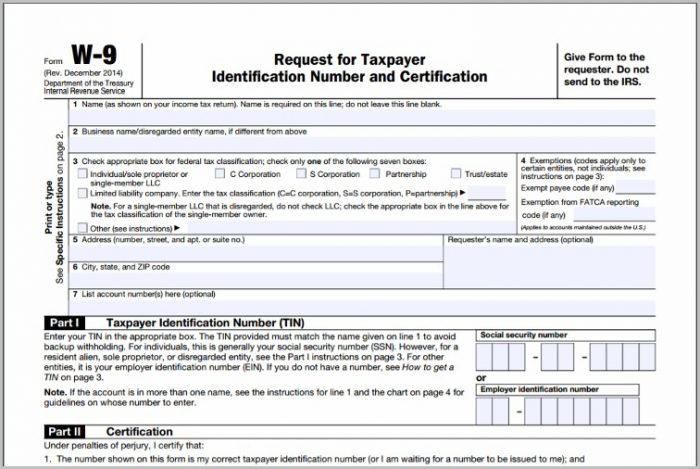

Form W 9 If you ve made the determination that the person you re paying is an independent contractor the first step is to have the contractor complete Form W 9 Request for Taxpayer Identification Number and Certification This form can be used to request the correct name and Taxpayer Identification Number or TIN of the payee Penalties under IRC Section 6721 may apply for non electronic filing of information returns e g Forms W 2 1099 series etc when electronic filing is required Such penalties may also apply for non filing late filing or incorrect information The potential penalty in 2023 is up to 310 per return up to an annual maximum of 3 783 000

Printable Independent Contractor 1099 Form Printable Forms Free Online

https://images.ctfassets.net/ifu905unnj2g/7AaGwx9GYM2YM9YyWJLFqv/b9806db0e4623117df61caf7b38e80e4/2022_1099_Form_Copy_B.png

Free Independent Contractor Agreement Template 1099 Word PDF EForms

https://i1.wp.com/eforms.com/images/2018/05/Independent-Contractor-Agreement.png?fit=1600%2C2070&ssl=1

Independent Contractor Printable 1099 Form - This form report the amount shown in box 1 on the line for Wages salaries tips etc of Form 1040 1040 SR or 1040 NR You must also complete Form 8919 and attach it to your return For more information see Pub 1779 Independent Contractor or Employee