Printable 2023 Form 8949 Forms and Instructions About Form 8949 Sales and other Dispositions of Capital Assets Use Form 8949 to reconcile amounts that were reported to you and the IRS on Form 1099 B or 1099 S or substitute statement with the amounts you report on your return

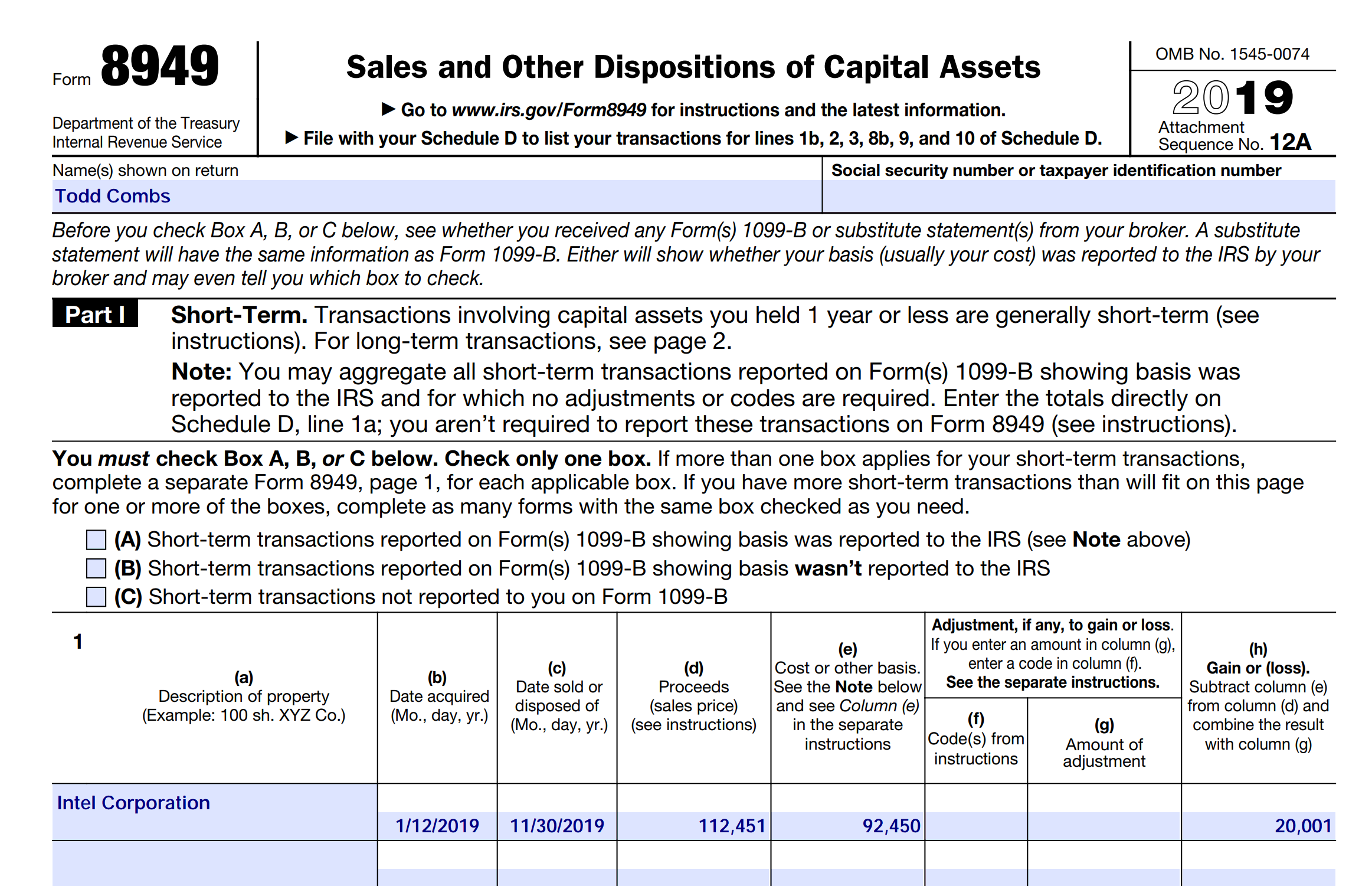

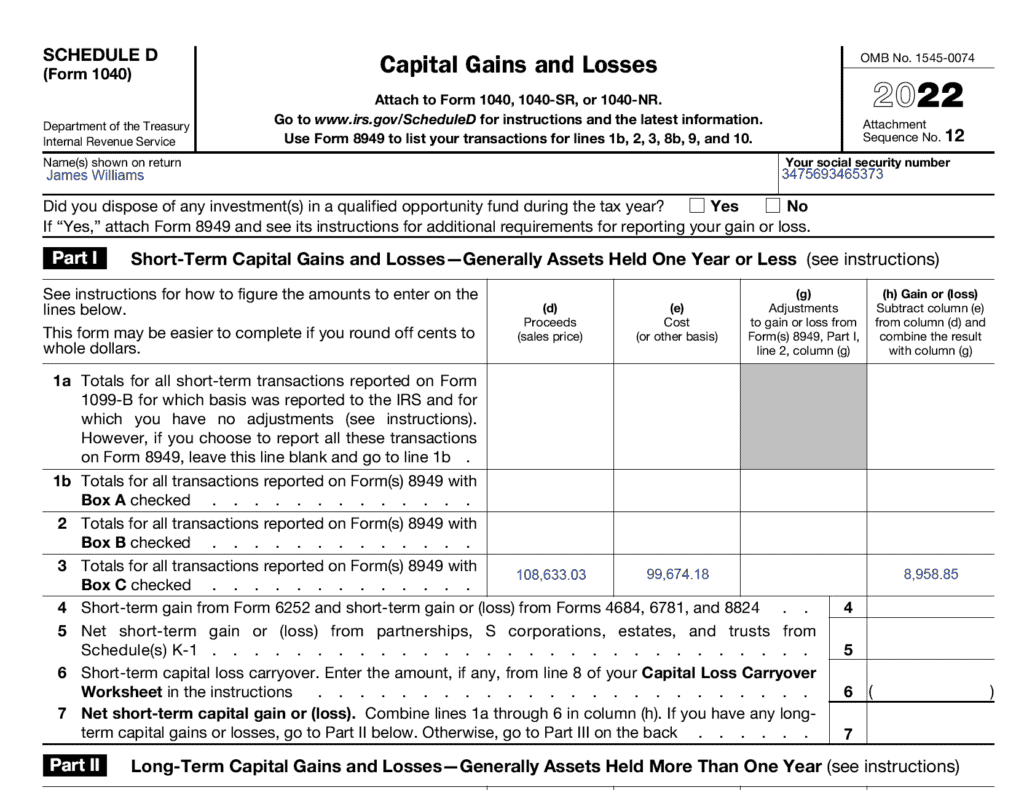

Cat No 37768Z Form 8949 2022 Form 8949 2022 Name s shown on return Name and SSN or taxpayer identification no not required if shown on other side Attachment Sequence No 12A Page 2 Social security number or taxpayer identification number Use Form 8949 to report sales and exchanges of capital assets Form 8949 allows you and the IRS to reconcile amounts that were reported to you and the IRS on Forms 1099 B or 1099 S or substitute statements with the amounts you report on your return

Printable 2023 Form 8949

Printable 2023 Form 8949

https://www.signnow.com/preview/489/187/489187832/large.png

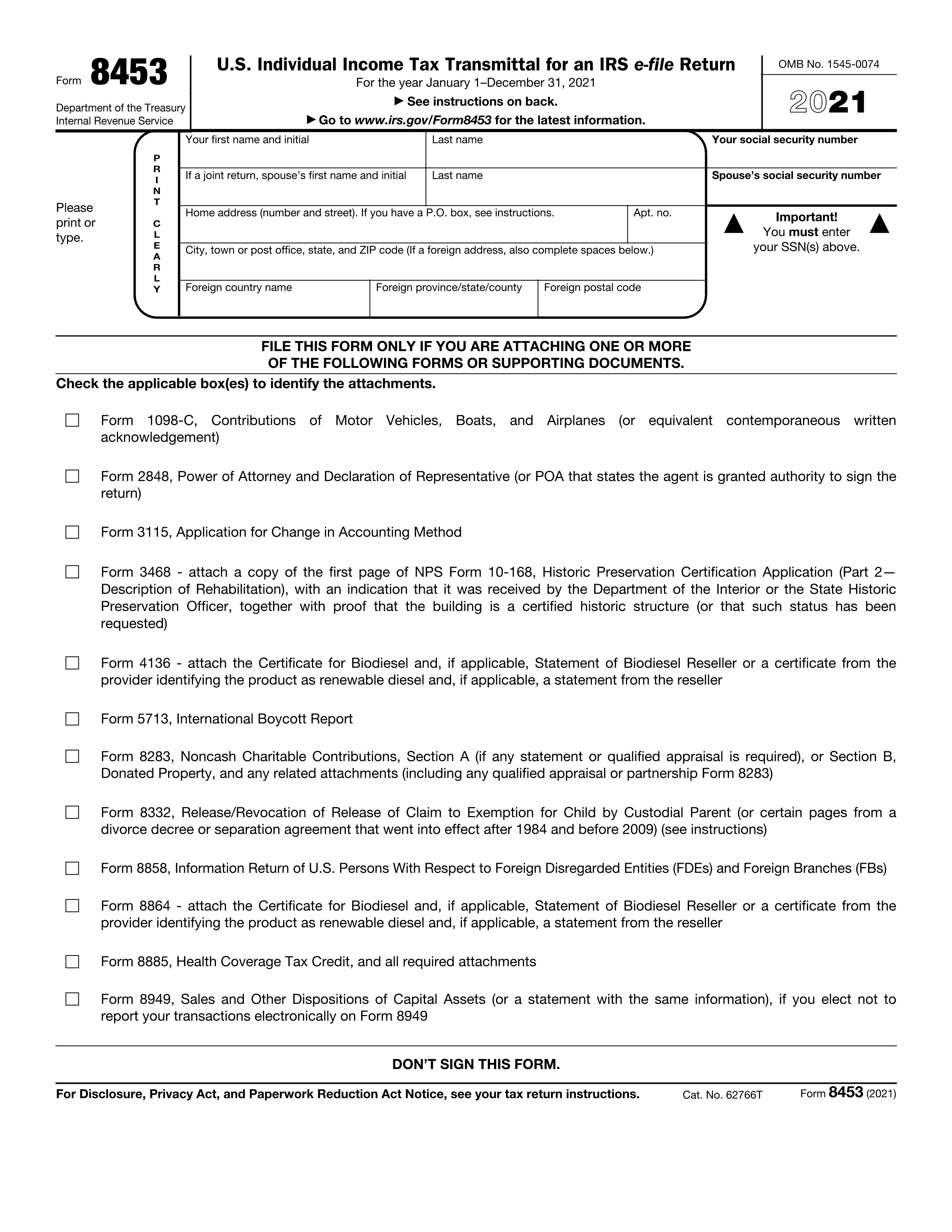

Form 8949 Exception 2 When Electronically Filing Form 1040

https://www.form8949.com/images/2021/png-split/2021_f8453.1.png

Form 8949 Archives EquityStat Blog

https://www.equitystat.com/wordpress/wp-content/uploads/2017/04/Form89492019.png

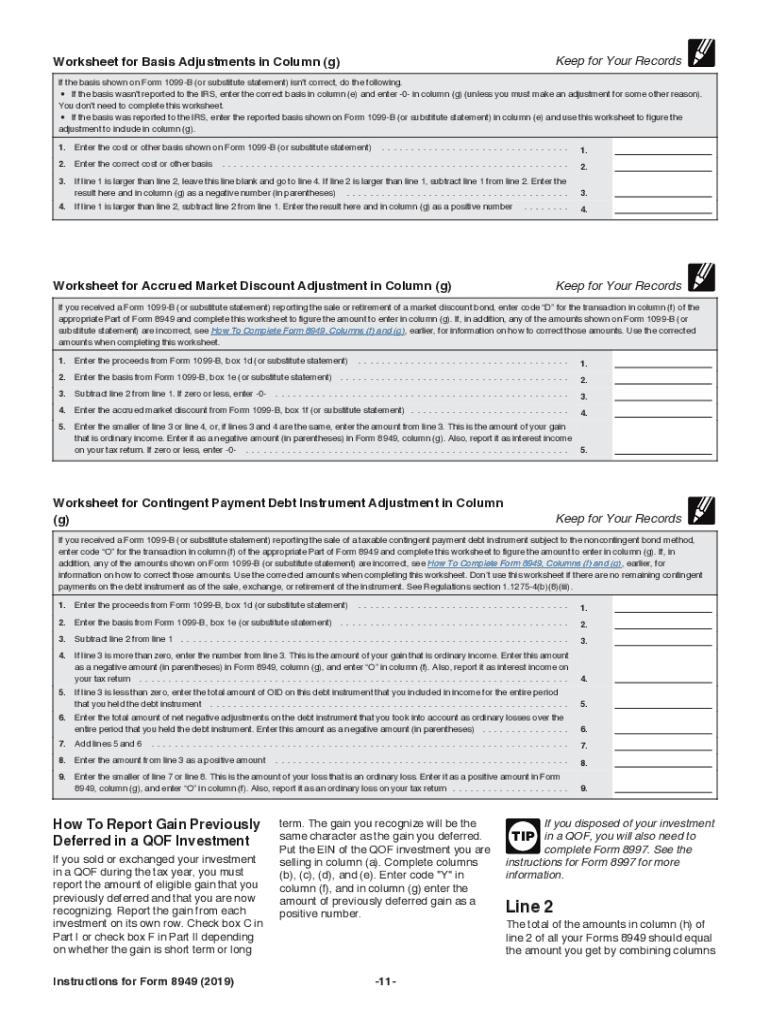

Instructions for Form 8949 Other Forms You May Have To File Form 8949 Use Form 8949 to report the sale or exchange of a capital asset defined later not reported on another form or schedule See Lines 1a and 8a later for more information about when Form 8949 is and isn t needed Form 4797 Use Form 4797 to report the following 1 Cryptocurrency Whenever you sell a capital asset held for personal use at a gain you need to calculate how much money you gained and report it on a Schedule D Depending on your situation you may also need to use Form 8949

Form 8949 Sales and Other Dispositions of Capital Assets records the details of your capital asset investment sales or exchanges Part I of the 8949 shows the short term transactions held less than a year and Part II has the long term transactions When you enter investment sales or exchanges from Form 1099 B or 1099 S in TurboTax we ll From within your TaxAct Online return click Print Center down the left to expand then click Custom Print Click Federal Form 8949 Attachment You may need to scroll down in the section to locate the item Click Print then click the PDF link Click the printer icon or the save icon available when you hover your mouse over the PDF form to print or save the PDF copy

More picture related to Printable 2023 Form 8949

Fillable Form 8949 2017 Irs forms Internal Revenue Service

https://i.pinimg.com/originals/07/7b/a1/077ba1c6739ab43228e237595482e992.jpg

W 9 form 2023 printable W9 Form 2023

https://w9form2023.com/wp-content/uploads/2022/11/W-9-form-2023-printable.png

IRS Crypto Tax Form 8949 How To Fill Out Correctly In 2023

https://coinpanda.io/wp-content/uploads/2023/08/scheduled-preview-1024x790.png

IRS Form 8949 is a tax document you typically use to account for the difference in figures reported on Forms 1099 B and 1099 S and your tax return Form 8949 is filed along with Schedule D Key Takeaways The primary purpose of IRS Form 8949 is to report sales and exchanges of capital assets Updated November 24 2023 Reviewed by Ebony Howard Fact checked by Vikki Velasquez Any time you sell or exchange capital assets such as stocks land or artwork you must report the transaction

Here s what the IRS says should be reported on Form 8949 The sale or exchange of a capital asset not reported on another form or schedule i e if you ve offloaded a capital asset you ll report it here Gains from involuntary conversions other than from casualty or theft of capital assets not used in your trade or Form 8949 An Internal Revenue Service form implemented in tax year 2011 for individual taxpayers to report capital gains and losses from investment activity Taxpayers must use form 8949 Sales

8949 Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/47/798/47798141/large.png

Form 8949 Instructions Information On Capital Gains Losses Form

https://www.communitytax.com/wp-content/uploads/2018/07/Form-8949.jpg

Printable 2023 Form 8949 - From within your TaxAct Online return click Print Center down the left to expand then click Custom Print Click Federal Form 8949 Attachment You may need to scroll down in the section to locate the item Click Print then click the PDF link Click the printer icon or the save icon available when you hover your mouse over the PDF form to print or save the PDF copy