Printable 2023 Social Security Benefits Worksheet None of your social security benefits are taxable Enter 0 on Form 1040 or 1040 SR line 6b Yes Subtract line 7 from line 6 9 If you are Married filing jointly enter 32 000 Single head of household qualifying surviving spouse or married filing separately and you 8 lived apart from your spouse for all of 2022 enter 25 000 9

This update provides information about Social Security taxes benefits and costs for 2023 By law some numbers change automatically each year to keep up with changes in price and wage levels Information for people who work Information for people who receive Social Security benefits SSA gov over Update Complete this worksheet to see if any of your Social Security and or SSI supplemental security income benefits may be taxable Current Revision Notice 703 PDF Recent Developments None at this time Other Items You May Find Useful All Notice 703 Revisions About Publication 501 Exemptions Standard Deduction and Filing Information

Printable 2023 Social Security Benefits Worksheet

Printable 2023 Social Security Benefits Worksheet

https://i0.wp.com/socialsecuritygenius.com/wp-content/uploads/2022/07/Printable-Social-Security-Payment-Calendar-2023.png?w=940&ssl=1

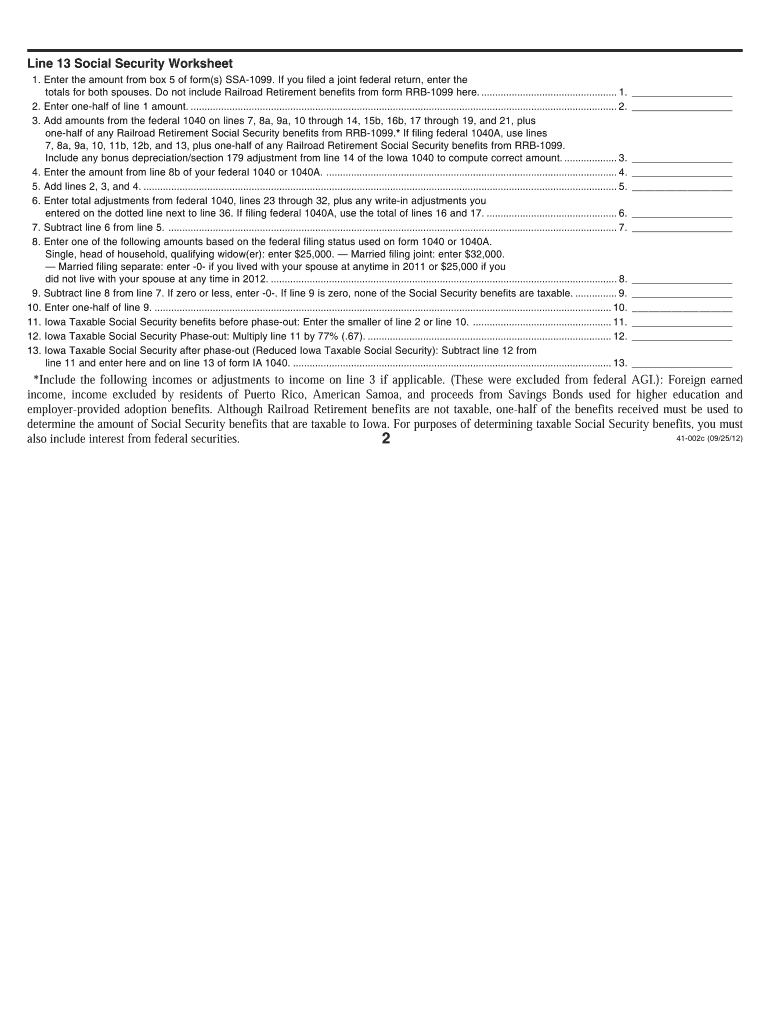

2022 Social Security Benefit Worksheet

https://i.pinimg.com/originals/29/67/4f/29674fb265b15e798e506aa4f85f2305.png

Social Security Benefits 2023 A Comprehensive Worksheet Style Worksheets

https://i2.wp.com/www.fabtemplatez.com/wp-content/uploads/2018/03/main-idea-worksheet-4-54583-social-security-benefit-worksheet-worksheets-for-all-main-idea-worksheet-4-21001275.jpg

If you have a personal my Social Security account you can get an estimate of your future retirement benefits and see the effects of different retirement age scenarios If you don t have a personal my Social Security account create one at ssa gov myaccount We developed this worksheet for you to see if your benefits may be taxable for 2023 Fill in lines A through E Do not use the worksheet below if any of the following apply to you instead go directly to IRS Pub 915 Social Security and Equivalent Railroad Retirement Benefits You received Form RRB 1099 Form SSA 1042S or Form RRB 1042S

The form you are looking for is not available online Many forms must be completed only by a Social Security Representative Please call us at 1 800 772 1213 TTY 1 800 325 0778 Monday through Friday between 8 a m and 5 30 p m or contact your local Social Security office Social security and railroad retirement benefits If you expect to receive social security or tier 1 railroad retirement benefits during 2023 use Worksheet 2 2 to figure the amount of expected taxable benefits you should include on line 1

More picture related to Printable 2023 Social Security Benefits Worksheet

Social Security Benefits Worksheet 2021 Irs

https://i.pinimg.com/originals/d5/67/6d/d5676d9345686ae785bceb1c9a2c0cfe.gif

Navigate Taxable Social Security With This 2023 Worksheet Style

https://i.pinimg.com/originals/81/ed/4b/81ed4b3bd4f8018c79ee99728f33f5b3.jpg

Social security benefits worksheet Lines 5a And 5b Fill Online

https://www.pdffiller.com/preview/581/853/581853092/big.png

Taxable Social Security Benefits You may have to pay federal income taxes on your Social Security benefits This usually happens only if you have other substantial income such as wages self employment interest dividends and other taxable income that must be reported on your tax return in addition to Social Security benefits Taxable Benefits Social Security Benefits Worksheet Lines 6a and 6b Line 6c Line 7 Capital Gain or Loss Exception 1 Exception 2 Don t include any social security benefits unless a you are married filing a separate return and you lived with your spouse at any time in 2022 or b one half of your social security benefits plus your other gross

2023 SOCIAL SECURITY CHEAT SHEET Maximum of YOUR full retirement age benefit an eligible family member can receive if you LENGTH OF MARRIAGE RULES 9 Months Survivor Benefits 1 Year Spousal Benefits 10 Years Divorced Spouse 2023 Family Maximum Benefit Formula 150 percent of the first 1 425 of the worker s PIA plus Social security beneficiaries may quickly and easily obtain information from the Social Security Administration s SSA s website with a my Social Security account to Keep track of your earnings and verify them every year Get an estimate of your future benefits if you are still working

Taxable Social Security Worksheet 2023 Form Fill Out And Sign

https://www.signnow.com/preview/100/98/100098334/large.png

20 Social Security Benefits Worksheet 2019

https://i2.wp.com/www.irs.gov/pub/xml_bc/24811v37.gif

Printable 2023 Social Security Benefits Worksheet - If you have a personal my Social Security account you can get an estimate of your future retirement benefits and see the effects of different retirement age scenarios If you don t have a personal my Social Security account create one at ssa gov myaccount