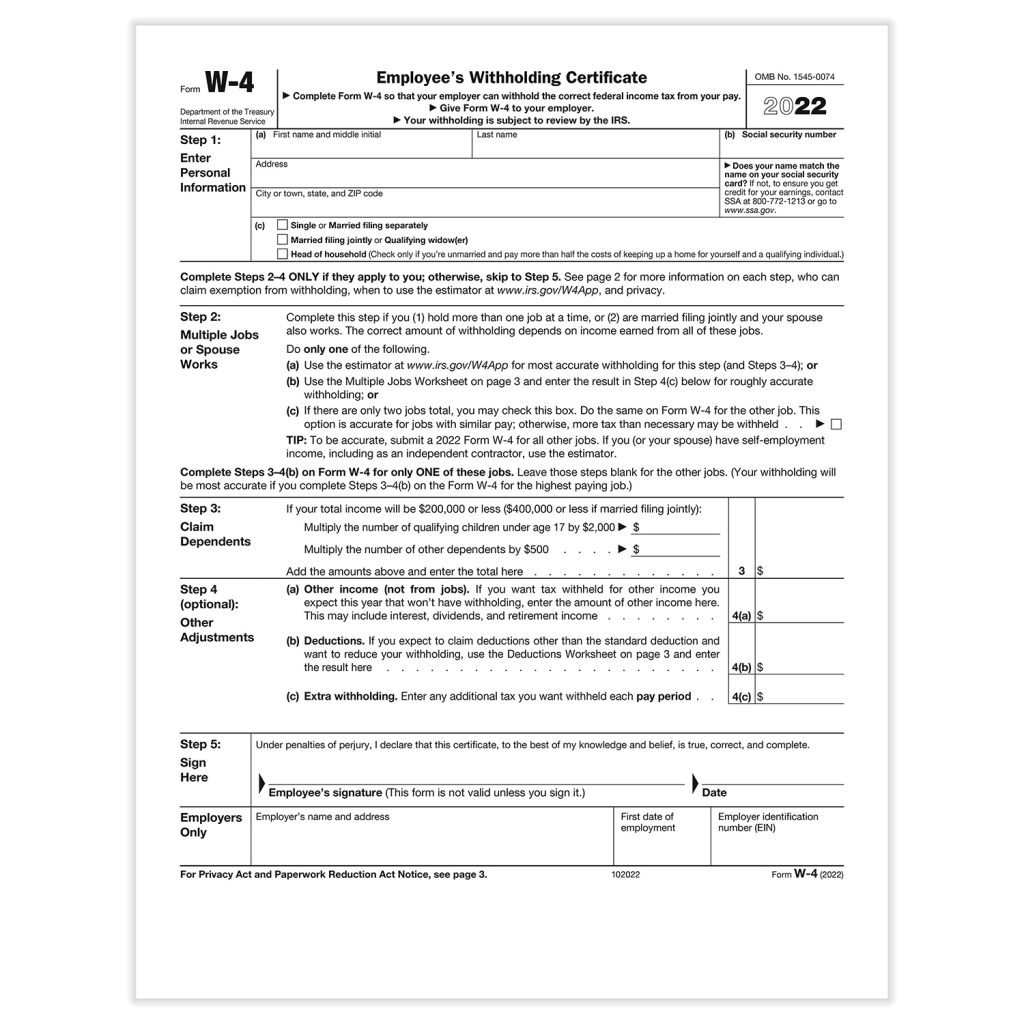

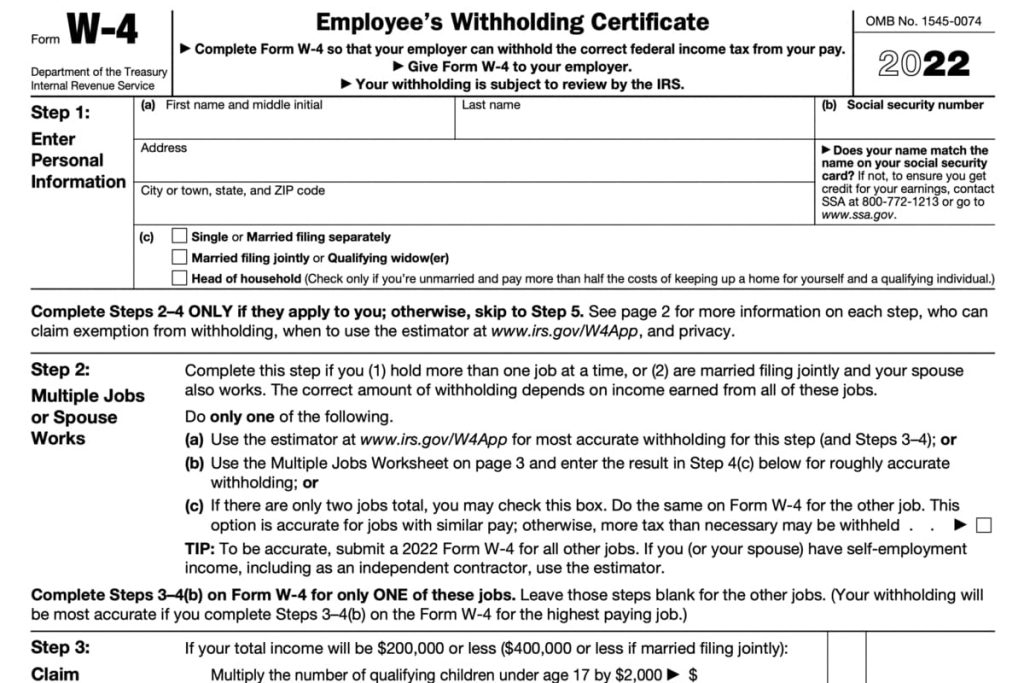

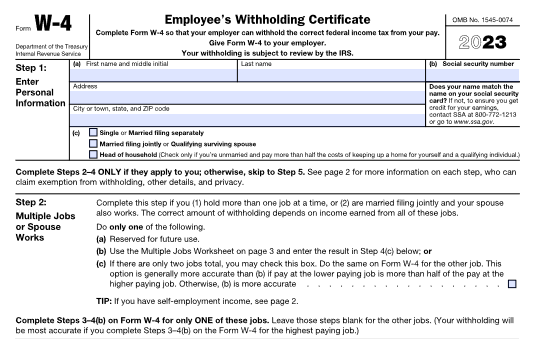

Printable 2023 W 4 Form 2023 Form W 4 Complete Steps 2 4 ONLY if they apply to you otherwise skip to Step 5 See page 2 for more information on each step who can claim exemption from withholding other details and privacy Step 2 Multiple Jobs or Spouse Works

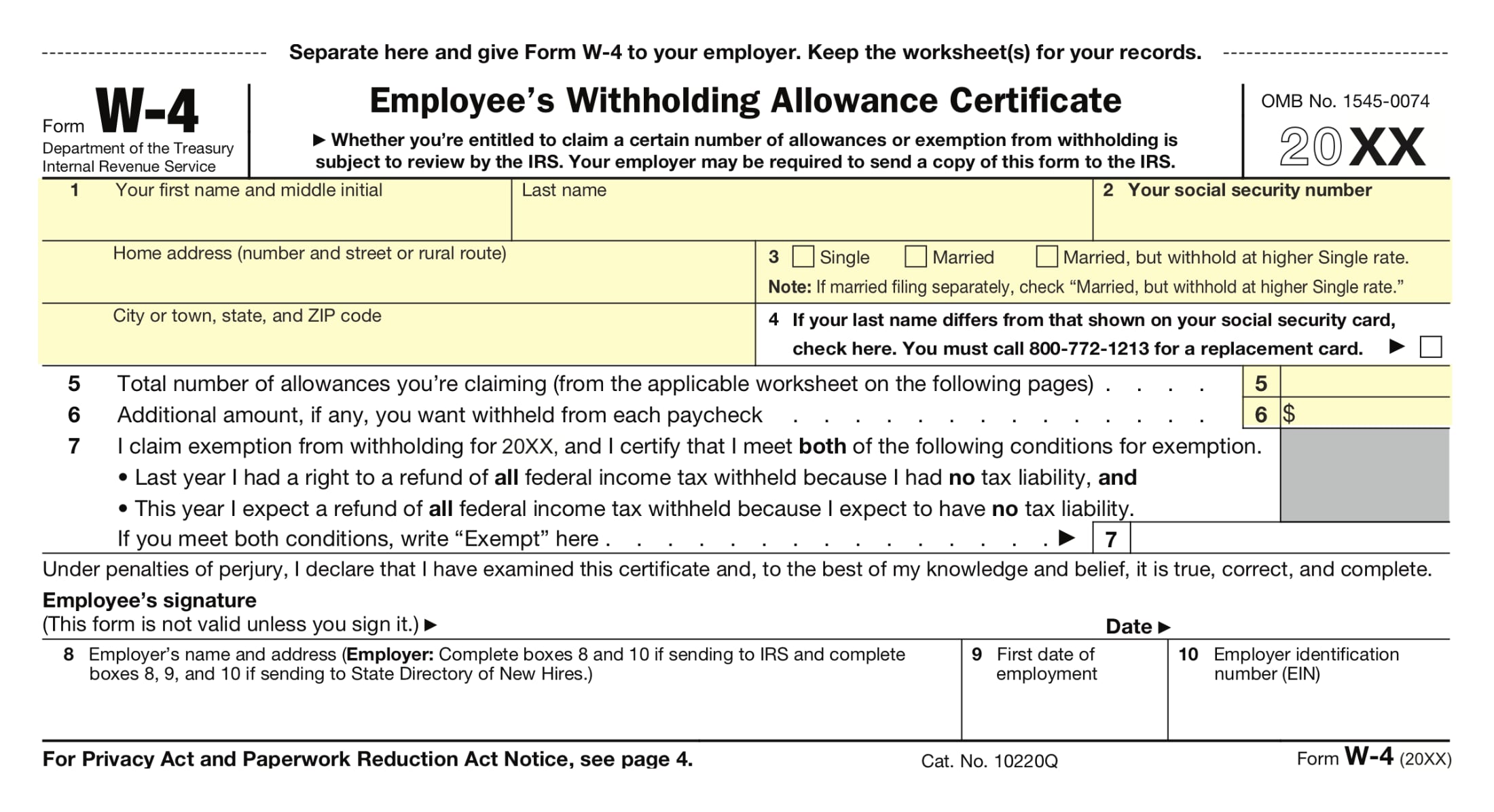

Recent Developments Additional Guidance for Substitute Submissions of Form W 4 29 NOV 2022 Other Items You May Find Useful All Form W 4 Revisions FAQs on the Form W 4 11 Dec 2019 IRS Tax Withholding Estimator About Form W 4P Withholding Certificate for Periodic Pension or Annuity Payments Step 1 Fill Out Your Information The W 4 form is the first step in determining how much tax will be withheld from your paycheck And the first step in filling it out is entering your personal information Accurate information is essential to ensure the correct amount of tax is being withheld from your paycheck

Printable 2023 W 4 Form

Printable 2023 W 4 Form

https://www.patriotsoftware.com/wp-content/uploads/2022/12/2023-Form-W-4.png

IRS Form W 4 Download Fillable PDF Or Fill Online Employee s

https://data.templateroller.com/pdf_docs_html/2554/25541/2554171/irs-form-w-4-employee-s-withholding-certificate_print_big.png

2023 IRS W 4 Form HRdirect Fillable Form 2023

https://fillableforms.net/wp-content/uploads/2022/10/2023-irs-w-4-form-hrdirect-2-1024x1024.jpg

Updated November 13 2023 IRS Form W 4 or Employee s Withholding Certificate is a form given to an employer by an employee that calculates the amount of federal income tax that should be withheld from the employee s pay A W 4 is not required to be submitted annually unless the employee is exempt from withholding Last quarterly payment for 2023 is due on Jan 16 2024 Taxpayers may need to consider estimated or additional tax payments due to non wage income from unemployment self employment annuity income or even digital assets The Tax Withholding Estimator on IRS gov can help wage earners determine if there s a need to consider an additional tax

Click the Search button Showing 1 14 of 14 Show per page Page Last Reviewed or Updated 14 Aug 2023 The latest versions of IRS forms instructions and publications Form W 4 Department of the Treasury Internal Revenue Service Employee s Withholding Certificate Complete Form W 4 so that your employer can withhold the correct federal income tax from your pay Give Form W 4 to your employer Your withholding is subject to review by the IRS OMB No 1545 0074 2023 Step 1 Enter Personal Information

More picture related to Printable 2023 W 4 Form

:max_bytes(150000):strip_icc()/Screenshot2023-03-17at4.01.40PM-e9aa8d8ea87c496b906b8b35c7c8592c.png)

How To Fill Out Your W 4 Form In 2023 2023

https://www.investopedia.com/thmb/gUZXbgsSYvrV3x7Uhtlki1u7cWs=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/Screenshot2023-03-17at4.01.40PM-e9aa8d8ea87c496b906b8b35c7c8592c.png

W4 Form 2023 Withholding Adjustment W 4 Forms TaxUni Fillable Form 2023

https://fillableforms.net/wp-content/uploads/2022/10/w4-form-2023-withholding-adjustment-w-4-forms-taxuni-1024x683.jpg

W 4 2023 Printable Form Printable Forms Free Online

https://www.zrivo.com/wp-content/uploads/2022/09/W4-Form-2023-Zrivo-Cover-1-1-1536x864.jpg

Form W 4 Department of the Treasury Internal Revenue Service Employee s Withholding Certificate Complete Form W 4 so that your employer can withhold the correct federal income tax from your pay Give Form W 4 to your employer Your withholding is subject to review by the IRS OMB No 1545 0074 2023 Step 1 Enter Personal Information A W 4 form formally titled Employee s Withholding Certificate is an IRS tax document that employees fill out and submit to their employers Employers use the information provided on a

2023 Form W 4 Complete Steps 2 4 ONLY if they apply to you otherwise skip to Step 5 See page 2 for more information on each step who can claim exemption from withholding other details and privacy Step 2 Multiple Jobs or Spouse Works The Internal Revenue Service IRS requires every employee to complete Form W 4 before he or she may claim withholding allowances on income tax returns New W 4 forms must also be completed whenever an employee s tax status changes such as with the birth of a child or a change in marital status This item will begin shipping January 2024

IRS Makes Minor Changes To 2023 W 4 Form CPA Practice Advisor

https://www.cpapracticeadvisor.com/wp-content/uploads/sites/2/2023/02/2023-W4-Form.png

W 4 2023 Printable Form Printable Forms Free Online

https://www.econlowdown.org/images/its_your_paycheck_2/w4-blank-highlighted.jpg

Printable 2023 W 4 Form - Click the Search button Showing 1 14 of 14 Show per page Page Last Reviewed or Updated 14 Aug 2023 The latest versions of IRS forms instructions and publications