Printable 940 Tax Form 2014 Publication 17 2020 PDF Form 941 2021 Employer s Quarterly Federal Tax Return for 2021 For Employers who withhold taxes from employee s paychecks or who must pay the employer s portion of social security or Medicare tax also known as Schedule B Form 941 2021 PDF Related Instructions for Form 941 2021 PDF Form 1099 MISC 2021

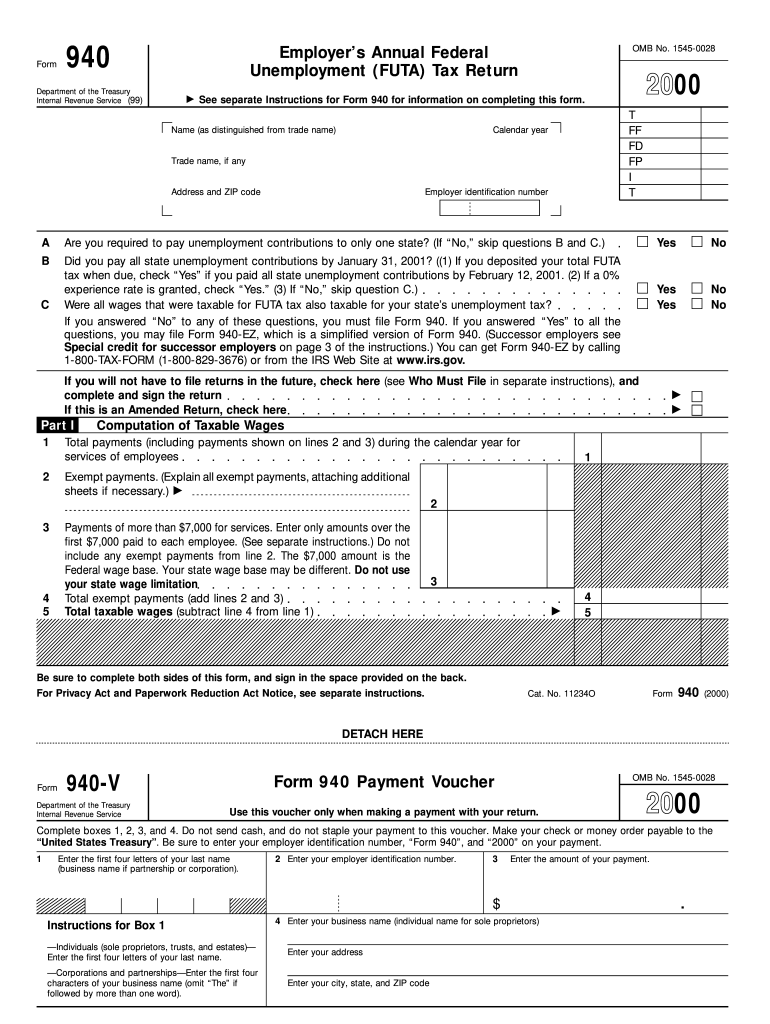

Home About Form 940 Employer s Annual Federal Unemployment FUTA Tax Return Use Form 940 to report your annual Federal Unemployment Tax Act FUTA tax Together with state unemployment tax systems the FUTA tax provides funds for paying unemployment compensation to workers who have lost their jobs IRS 940 2014 Fill and Sign Printable Template Online US Legal Forms IRS 940 2014 Get IRS 940 2014 How It Works Open form follow the instructions Easily sign the form with your finger Send filled signed form or save 16a rating 4 Satisfied 22 votes How to fill out and sign 16b online

Printable 940 Tax Form 2014

Printable 940 Tax Form 2014

http://www.formsbirds.com/formimg/tax-support-document/7936/form-940-schedule-r-allocation-schedule-for-aggregate-form-940-filers-2014-l2.png

How To Fill Out Form 940 Instructions Example More

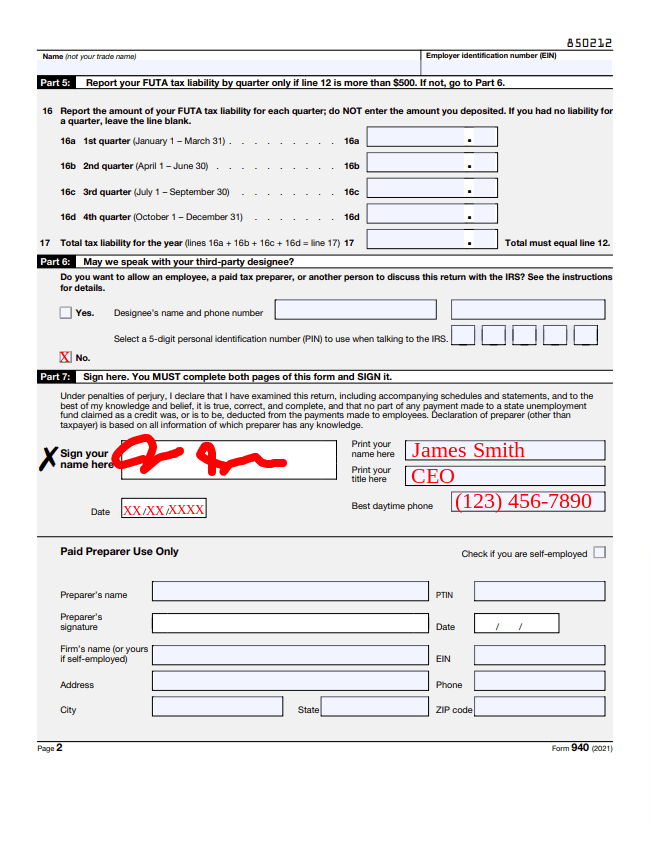

https://www.patriotsoftware.com/wp-content/uploads/2022/02/2021-Form-940-2-1.png

How To Fill Out Form 940 Instructions Example More

https://www.patriotsoftware.com/wp-content/uploads/2022/02/how-to-fill-out-form-940-1.jpg

The due date for filing Form 940 for 2014 is February 2 2015 However if you deposited all your FUTA tax when it was due you may file Form 940 by February 10 2015 clear everything but the Payroll Item and tax tracking type Print the report Place a check mark next to any item that has a tax tracking type of Compensation Reported Tips Part 1 State Unemployment Tax If you paid a state unemployment tax indicate for which state Complete and attach Schedule A Form 940 if you are either a multi state employer who paid unemployment taxes in more than one state or if you paid taxes in a state subject to a credit reduction The credit reduction states for 2023 are California

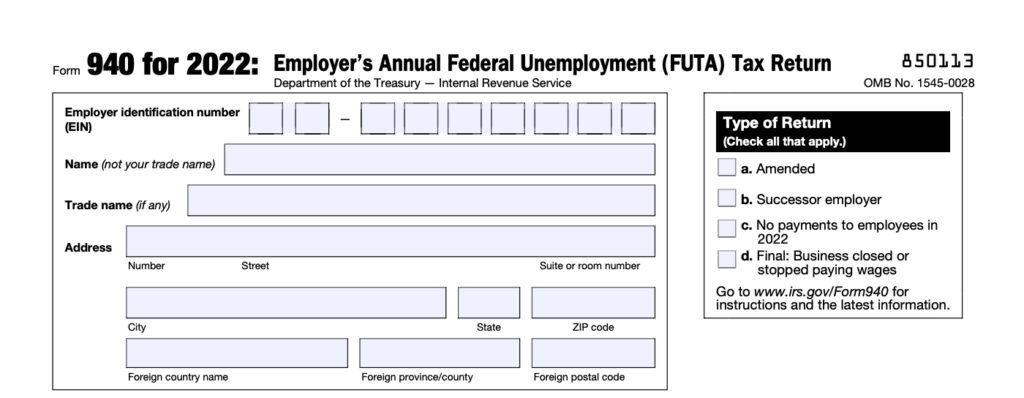

Instructions for Form 940 2022 Employer s Annual Federal Unemployment FUTA Tax Return Section references are to the Internal Revenue Code unless otherwise noted 2022 Instructions for Form 940 Introductory Material Future Developments Special Form 940 Rules Certain types of businesses face special rules for filing Form 940 Individuals with household employees such as nannies or maids must pay FUTA taxes only if they paid 1 000 or more in wages in any one calendar quarter But instead of filing Form 940 you would file Schedule H along with your personal income tax return

More picture related to Printable 940 Tax Form 2014

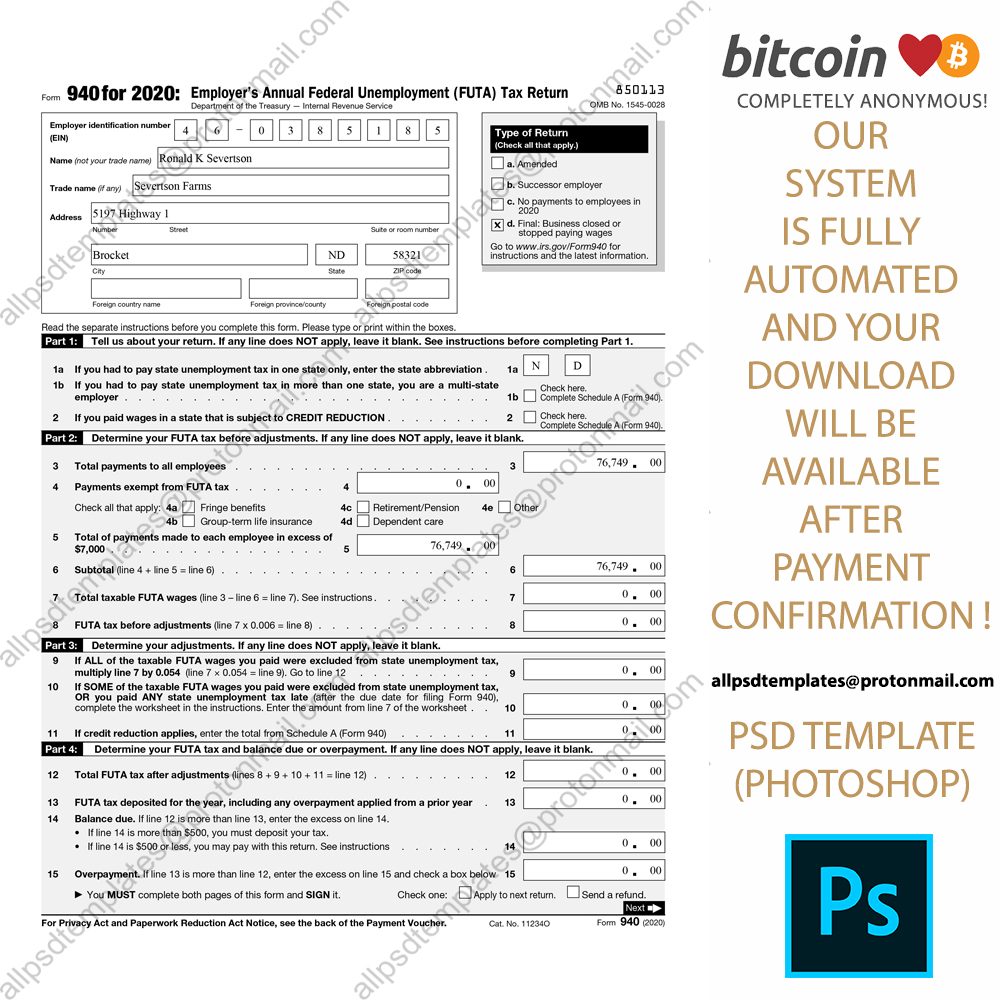

USA 940 Form Template ALL PSD TEMPLATES

https://allpsdtemplates.com/wp-content/uploads/2021/04/5.jpg

IRS Form 940 Filling Instructions To Save Your Time

https://pdfimages.wondershare.com/pdfelement/guide/irs-form-940-part2.png

940 Forms Form 940 Instructions And Requirements Gusto

https://gusto.com/wp-content/uploads/2023/04/Form-940-2022-1-1024x398.png

IRS Form 940 reports your federal unemployment tax liabilities for all employees in one document Employers must submit the form to the IRS by January 31 of each year if they qualify And now here s how to fill out FUTA tax forms Don t want to fill out Form 940 yourself Try Patriot s Full Service Payroll Easy onboarding with our setup wizard The way to submit the IRS 940 Schedule R on the Internet Click on the button Get Form to open it and start modifying Fill all required fields in your document utilizing our professional PDF editor Switch the Wizard Tool on to complete the process even easier Ensure the correctness of filled info Add the date of completing IRS 940

Form 940 Employer s Annual Federal Unemployment FUTA Tax Return is a form employers file with the IRS to report their yearly FUTA tax liability You must file a 940 tax form if either of the following is true You paid wages of at least 1 500 to any employee during the standard calendar year 940 Form 2014 Get 940 Form 2014 How It Works Open form follow the instructions Easily sign the form with your finger Send filled signed form or save Form rating 4 8 Satisfied 26 votes How to fill out and sign a form online Get your online template and fill it in using progressive features

What Is Irs Form 940 Used For IRSYAQU

https://www.irs.gov/pub/xml_bc/33581806.gif

940 Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/100/35/100035707/large.png

Printable 940 Tax Form 2014 - The due date for filing Form 940 for 2014 is February 2 2015 However if you deposited all your FUTA tax when it was due you may file Form 940 by February 10 2015 clear everything but the Payroll Item and tax tracking type Print the report Place a check mark next to any item that has a tax tracking type of Compensation Reported Tips