Printable Form For Expenses Self Employed Taxpayers Online Learning Tools Who is Self Employed Generally you are self employed if any of the following apply to you You carry on a trade or business as a sole proprietor or an independent contractor You are a member of a partnership that carries on a trade or business

Report farm income and expenses File it with Form 1040 or 1040 SR 1041 1065 or 1065 B 1040 ES Estimated Tax for Individuals Use this form to pay tax on income that is not subject to withholding i e earnings from self employment rents etc 1040 or 1040 SR SE Self Employment Tax See the following section for a list of common expenses most self employed taxpayers will want to review Work related expenses reduce your taxes by lowering the amount of self employment income you get taxed on For example if you made 50 000 in self employment income and had 5 000 out of pocket expenses you d only get taxed on 45 000

Printable Form For Expenses Self Employed Taxpayers

Printable Form For Expenses Self Employed Taxpayers

https://www.pdffiller.com/preview/41/404/41404890/large.png

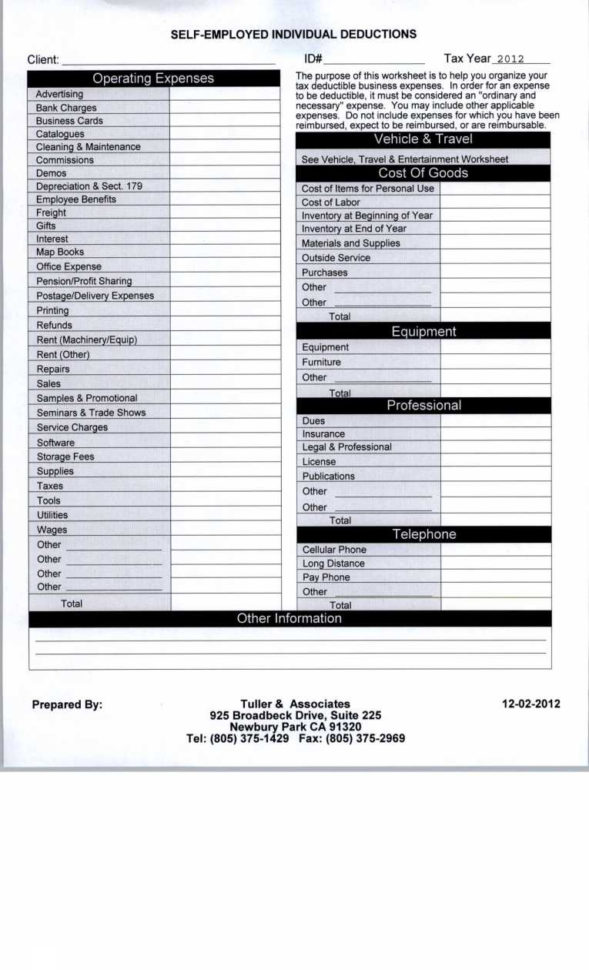

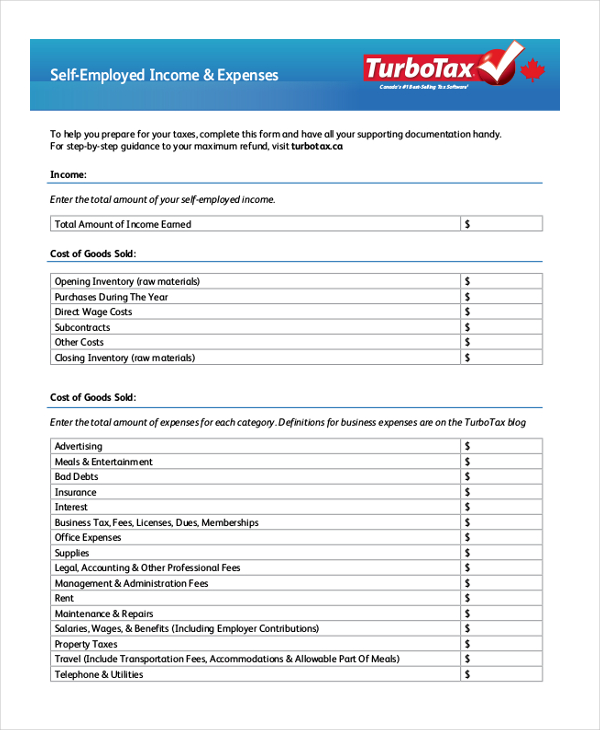

Self Employed Tax Spreadsheet For Self Employed Expense Sheet

https://db-excel.com/wp-content/uploads/2019/01/self-employed-tax-spreadsheet-for-self-employed-expense-sheet-printables-self-employment-tax-and-589x970.jpg

39 self employed expenses Worksheet Worksheet Resource

https://db-excel.com/wp-content/uploads/2019/09/realtor-tax-deduction-worksheet-best-of-tax-deduction.jpg

For details on these fast filing methods see your income tax package Form 1099 MISC File Form 1099 MISC Miscellaneous Income for each person to whom you have paid during the year in the course of your trade or business at least 600 in rents prizes and awards other income payments medical and health care payments and crop insurance proceeds See the Instructions for Forms 1099 MISC Here is a list of common expenses that are ordinary and necessary for many self employed individuals Note that all of the lines specified are for Schedule C only with two exceptions noted below Less Common Expenses for the Self Employed You might encounter some of these expenses in your line of work but they re generally less common

Calculators 2022 Here are some helpful calculators to help you estimate your self employment tax and eliminate any surprises Estimate your refund or what you ll owe with TaxCaster Know how much to set aside for 2022 taxes by answering questions about your life and income Apply business expenses and see how much they save you on taxes Introduction Use Schedule SE Form 1040 to figure the tax due on net earnings from self employment The Social Security Administration uses the information from Schedule SE to figure your benefits under the social security program This tax applies no matter how old you are and even if you are already getting social security or Medicare benefits

More picture related to Printable Form For Expenses Self Employed Taxpayers

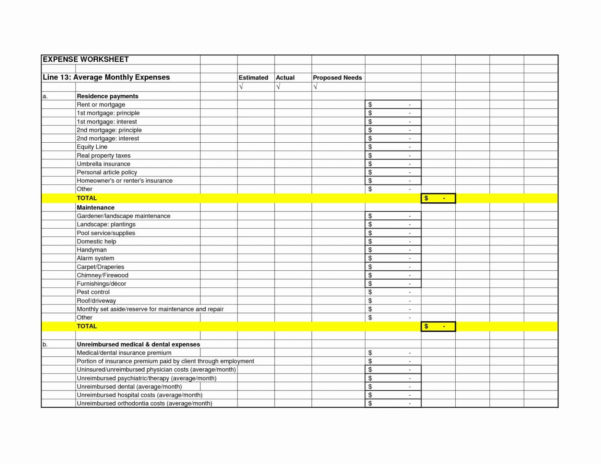

Self Employed Expenses Spreadsheet Free Spreadsheet Downloa Self

http://db-excel.com/wp-content/uploads/2019/01/self-employed-expenses-spreadsheet-free-with-self-employed-expense-sheet-sample-worksheets-tax-employment-601x464.jpg

Self Employed Expenses Spreadsheet With Self Employed Bookkeeping

https://db-excel.com/wp-content/uploads/2019/01/self-employed-expenses-spreadsheet-with-self-employed-bookkeeping-spreadsheet-template-excel-804x970.jpg

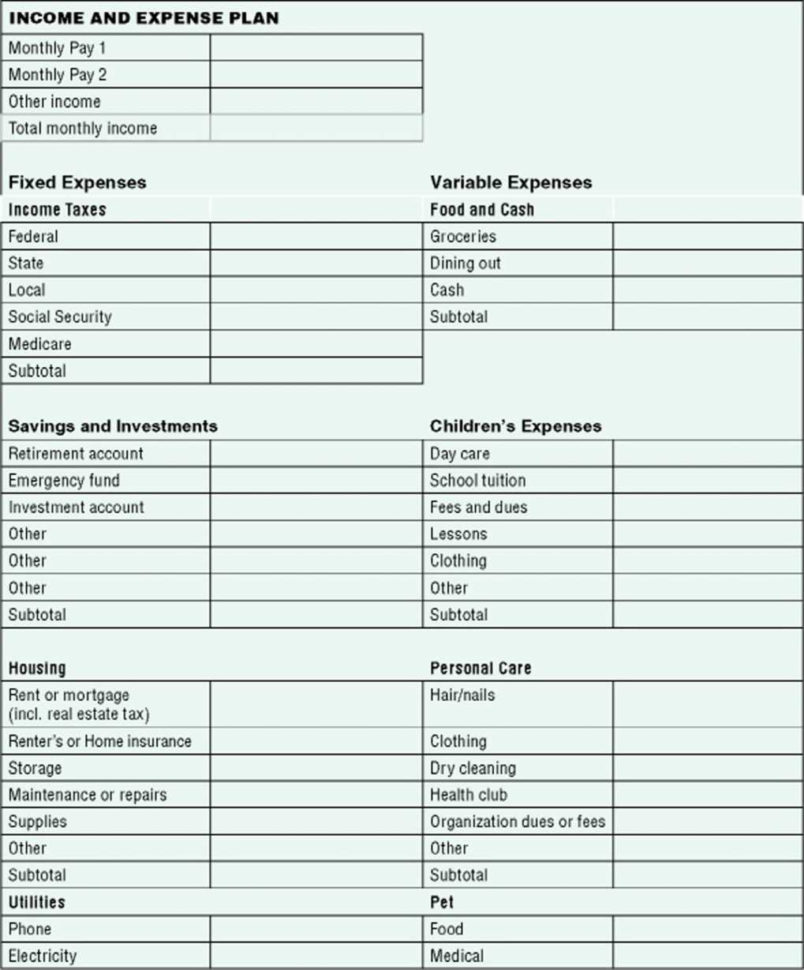

Tax Spreadsheet Uk With Regard To Self Employed Expense Sheet Expenses

https://db-excel.com/wp-content/uploads/2019/01/tax-spreadsheet-uk-with-regard-to-self-employed-expense-sheet-expenses-spreadsheet-uk-tax-sample.jpeg

Forms and Instructions About Schedule SE Form 1040 Self Employment Tax Use Schedule SE Form 1040 to figure the tax due on net earnings from self employment The Social Security Administration uses the information from Schedule SE to figure your benefits under the social security program Employment Tax Forms Form 940 Employer s Annual Federal Unemployment Tax Return Schedule A Form 940 Multi State Employer and Credit Reduction Information Schedule R Form 940 Allocation Schedule for Aggregate Form 940 Filers PDF Form 941 Employer s Quarterly Federal Tax Return

Completing IRS Schedule C Schedule C is used to calculate your business income for the portion of the year that you were self employed all the income your business took in less business expenses The resulting number is what you ll use to calculate your self employment tax on Schedule SE and what you ll report on your Form 1040 as income Who exactly can claim these tax deductions Self employed tax deductions Advertising and marketing Auto expenses Business mileage Bank fees Business insurance Contractors Commissions Computer and tech equipment Dues and memberships Equipment rental Event costs Furniture and decor Gifts Startup costs Self employment tax deduction

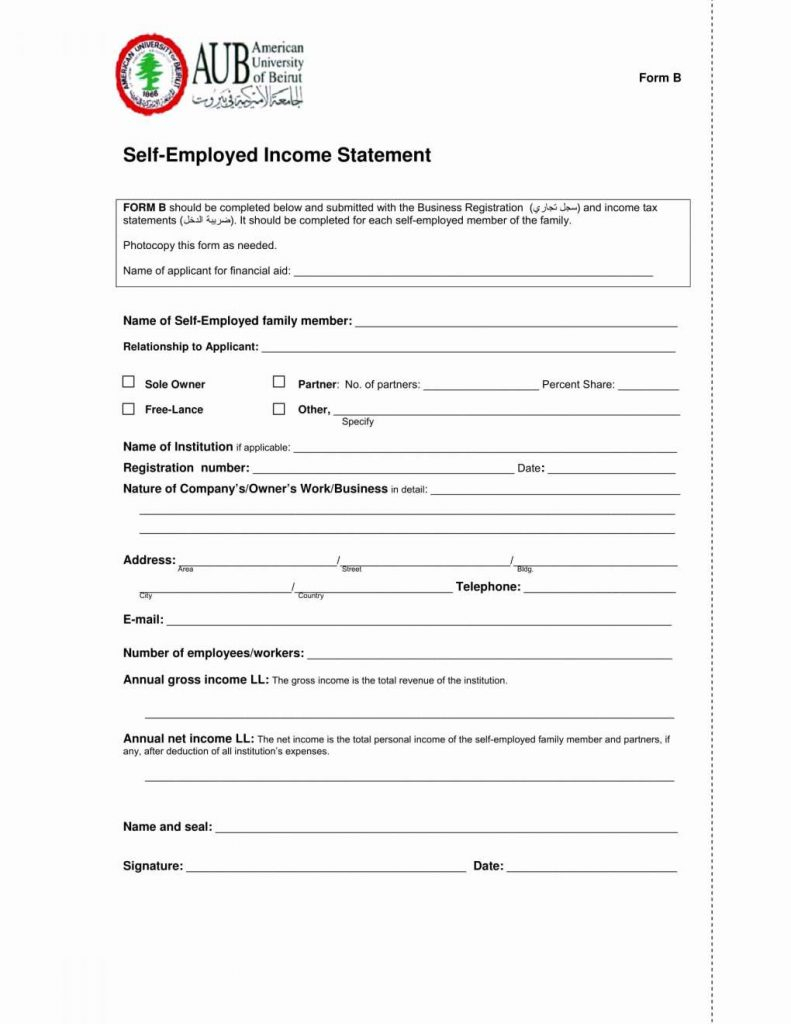

FREE 11 Sample Self Employment Forms In PDF MS Word

https://images.sampleforms.com/wp-content/uploads/2016/09/Self-Employment-Expenses-Form.jpg

7 Self Employment Tax Forms Sample Templates

https://images.sampletemplates.com/wp-content/uploads/2016/01/18163520/Self-Employment-Tax-Organizer-Form.jpg

Printable Form For Expenses Self Employed Taxpayers - IRS Publication 535 has the details How it works It s an adjustment to income rather than an itemized deduction which means you don t necessarily have to itemize to claim it