Printable Form W 4 Ti ng Vi t Krey l ayisyen Complete Form W 4 so that your employer can withhold the correct federal income tax from your pay Consider completing a new Form W 4 each year and when your personal or financial situation changes Current Revision Form W 4 PDF Recent Developments Additional Guidance for Substitute Submissions of Form W 4 29 NOV 2022

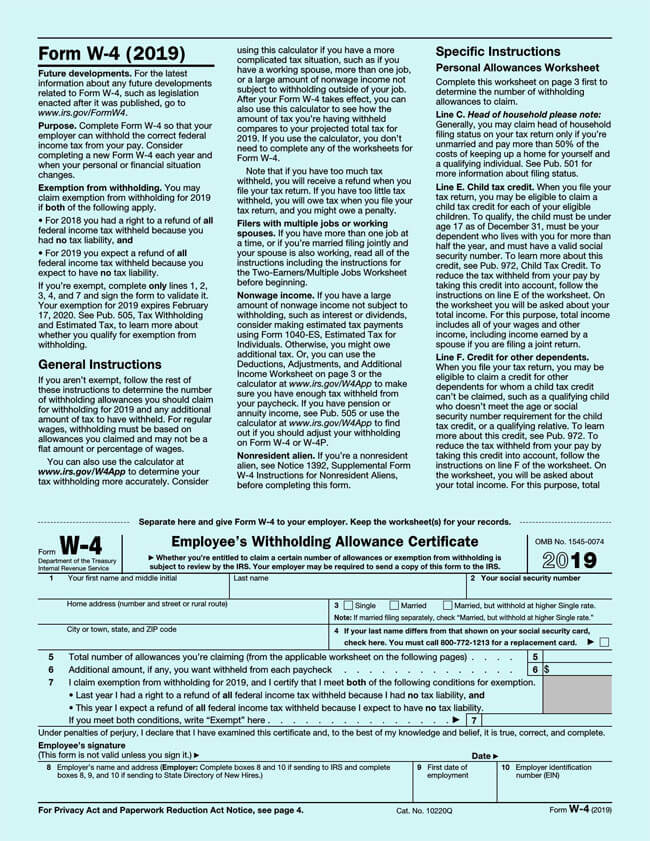

IRS Form W 4 or Employee s Withholding Certificate is a form given to an employer by an employee that calculates the amount of federal income tax that should be withheld from the employee s pay A W 4 is not required to be submitted annually unless the employee is exempt from withholding Download and print a sample Form W 4 from the IRS website so you can run through all the steps together 4 If you both work you should each fill out your own version of the form and compare notes Keep this in mind Only one of you should claim your dependent credits and deductions on the W 4 Otherwise you ll underpay your taxes

Printable Form W 4

Printable Form W 4

http://www.form-w-4.com/wp-content/uploads/2018/03/irs-w-4-2018.png

What You Should Know About The New Form W 4 Atlantic Payroll Partners

https://atlanticpayroll.us/wp-content/uploads/2021/01/Form-W-4-2021-web-imagev2.png

2022 Form W 4 IRS Tax Forms W4 Form 2022 Printable

https://w4formprintable.com/wp-content/uploads/2022/01/irs-w-4-form-w4-form-2021.jpg

Form W 4 Department of the Treasury Internal Revenue Service Employee s Withholding Certificate Complete Form W 4 so that your employer can withhold the correct federal income tax from your pay Give Form W 4 to your employer Your withholding is subject to review by the IRS OMB No 1545 0074 2023 Step 1 Enter Personal Information a A W 4 form formally titled Employee s Withholding Certificate is an IRS tax document that employees fill out and submit to their employers Employers use the information provided on a

Forms W 4 filed for all other jobs For example if you earn 60 000 per year and your spouse earns 20 000 you should complete the worksheets to determine what to enter on lines 5 and 6 of your Form W 4 and your spouse should enter zero 0 on lines 5 and 6 of his or her Form W 4 See Pub 505 for details Another option is to use The form has steps 1 through 5 to guide employees through it Let s look at these important points about the new Form W 4 One difference from prior forms is the expected filing status The new form changes single to single or married filing separately and includes head of household The new form doesn t have married but withhold at higher

More picture related to Printable Form W 4

Federal W 4 Worksheet 2020 Printable Fillable Online Blank

https://www.pdffiller.com/preview/521/567/521567036/big.png

Il W 4 2020 2022 W4 Form

https://w4formsprintable.com/wp-content/uploads/2020/09/how-to-fill-out-a-w-4-form-the-only-guide-you-need.png

IRS Form W 4 Download Fillable PDF Or Fill Online Employee s

https://data.templateroller.com/pdf_docs_html/2554/25541/2554171/irs-form-w-4-employee-s-withholding-certificate_print_big.png

Create Complete your Form W 4 You have 2 options to create your Form s W 4 The Form W4 Creator guides you through to just fill out a PDF Form W 4 without additional calculations etc For more tax planning purposes use the PAYucator and enter your current or future paycheck information and your W 4 PDF Form will be created for you based on Form Complete Form W 4 So that your employer can withhold the correct federal income tax from your pay OMB NO 1545 0074 2021 Rev December 2020 Department of the Treasury Internal Revenue Service a First name and middle initial Step 1 Give Form W 4 to your employer Your withholding is subject to review by the IRS Last name

Form W 4 Step 4 a then he will instead enter 26 000 in Step 2 b i and in Step 2 b iii He will make no entries in Step 4 a on this Form W 4P Example 2 Carol a single filer is completing Form W 4P for a pension that pays 50 000 a year Carol does not have a job but she also receives another pension for 25 000 a year which Form W 4 Department of the Treasury Internal Revenue Service Employee s Withholding Certificate Complete Form W 4 so that your employer can withhold the correct federal income tax from your pay Give Form W 4 to your employer Your withholding is subject to review by the IRS OMB No 1545 0074 2023 Step 1 Enter Personal Information

Treasury And IRS Unveil New Form W 4 For 2020 Accounting Today

https://sourcemedia.brightspotcdn.com/dims4/default/04cd0c6/2147483647/strip/true/crop/814x834+0+0/resize/840x861!/quality/90/?url=https:%2F%2Fsourcemedia.brightspotcdn.com%2Fe8%2F66%2Fe5847a5f48f6b333c9f8dfc06287%2Fform-w-4-2020.JPG

Form W 4 Complete Guide How To Fill with Examples

https://www.wordtemplatesonline.net/wp-content/uploads/2021/05/W4-Form-Template-03.jpg

Printable Form W 4 - A W 4 form formally titled Employee s Withholding Certificate is an IRS tax document that employees fill out and submit to their employers Employers use the information provided on a