Printable Payroll Deduction Form Template Editor Published Jan 23 2023 11 00am Editorial Note We earn a commission from partner links on Forbes Advisor Commissions do not affect our editors opinions or evaluations Getty Table of

These Excel templates can be adjusted to reflect hourly rates and overtime salaries taxes and withholdings that apply to your business You don t need to be a designer to create a payroll template that will hold up through thousands of pay cycles but that can be adjusted to reflect changing needs such as costs base pay and raises The Basic Weekly Payroll Template is a ready made template you can edit and customize depending on your company s payroll system This spreadsheet is designed to help you Automate the process of tracking your employees work hours Calculate deductions and Obtain accurate numbers regarding your employees payments

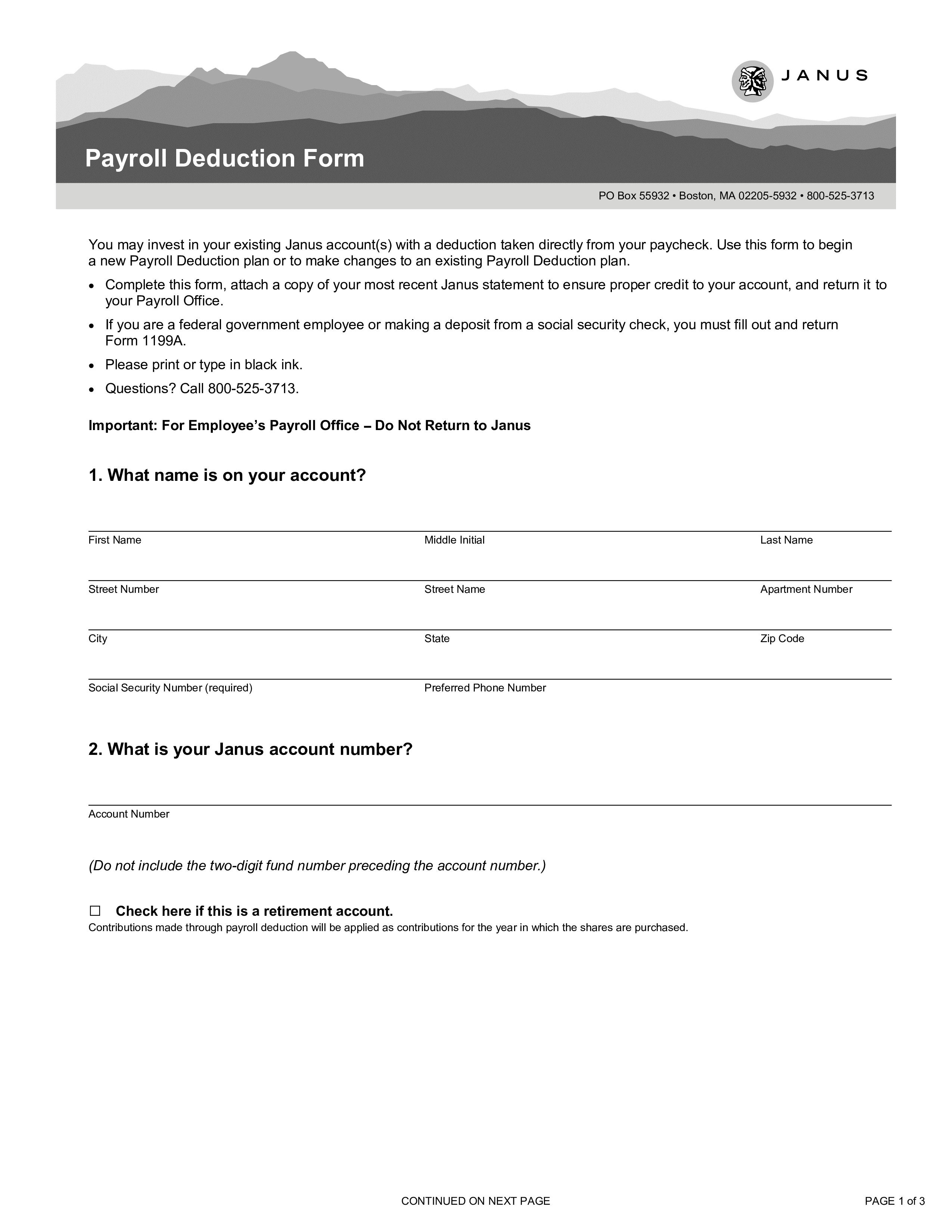

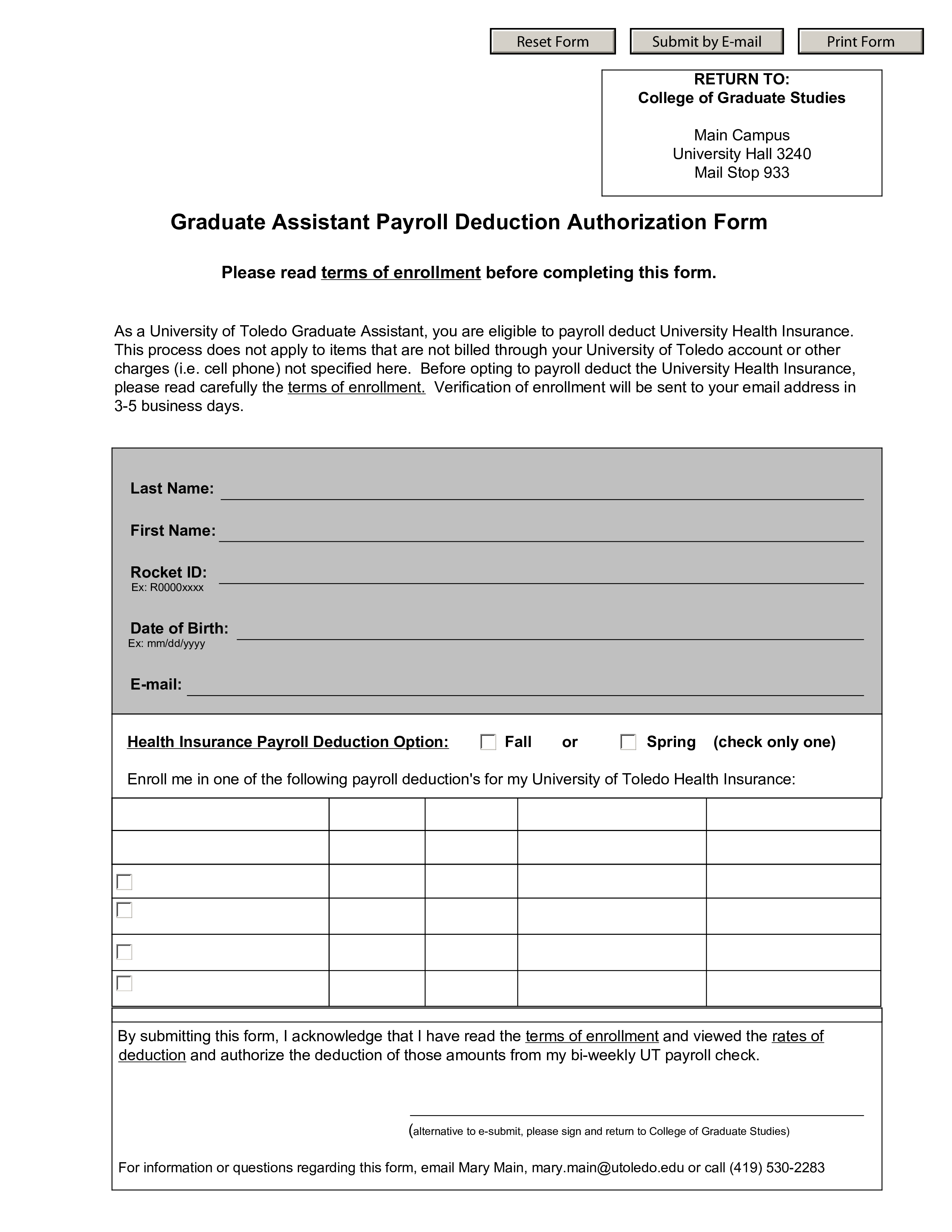

Printable Payroll Deduction Form Template

Printable Payroll Deduction Form Template

https://www.allbusinesstemplates.com/thumbs/4598d5a5-6f90-44c2-8e25-6bbdd24604b0_1.png

Payroll Deduction Form Free Payslip Templates

https://images.template.net/wp-content/uploads/2017/01/17050424/Payroll-Deduction-Authorization-Form-Template.jpg

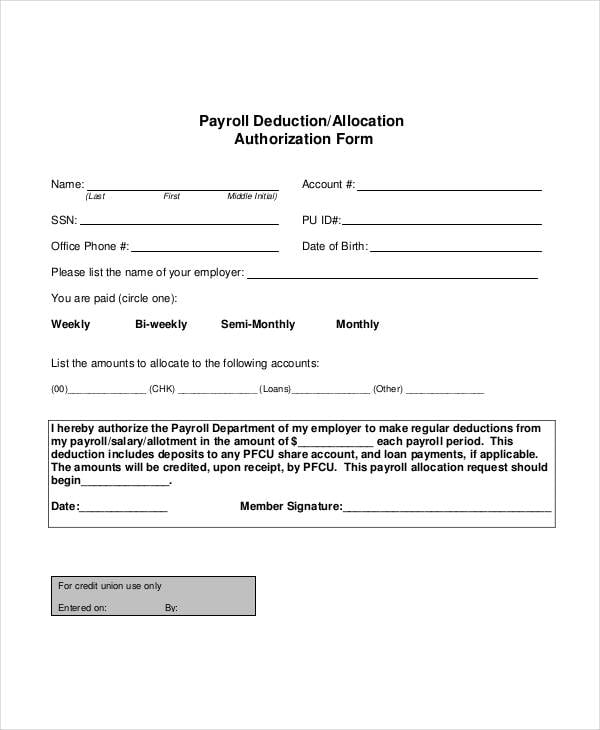

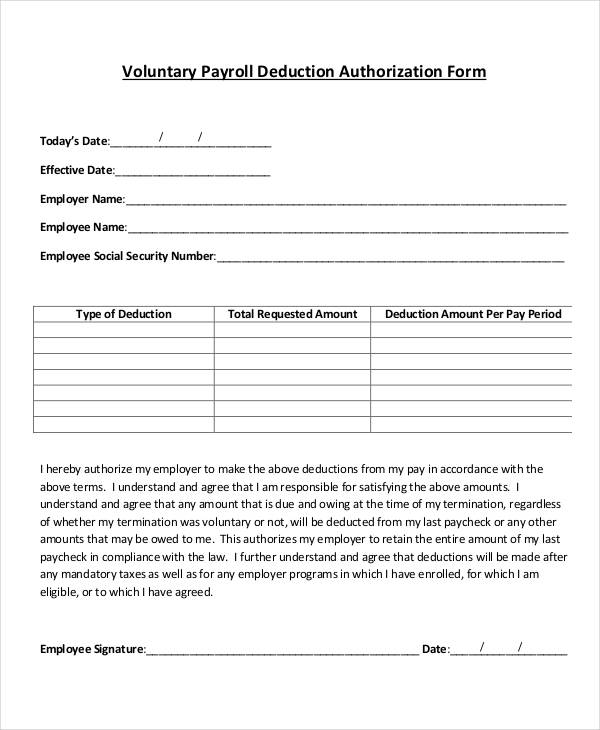

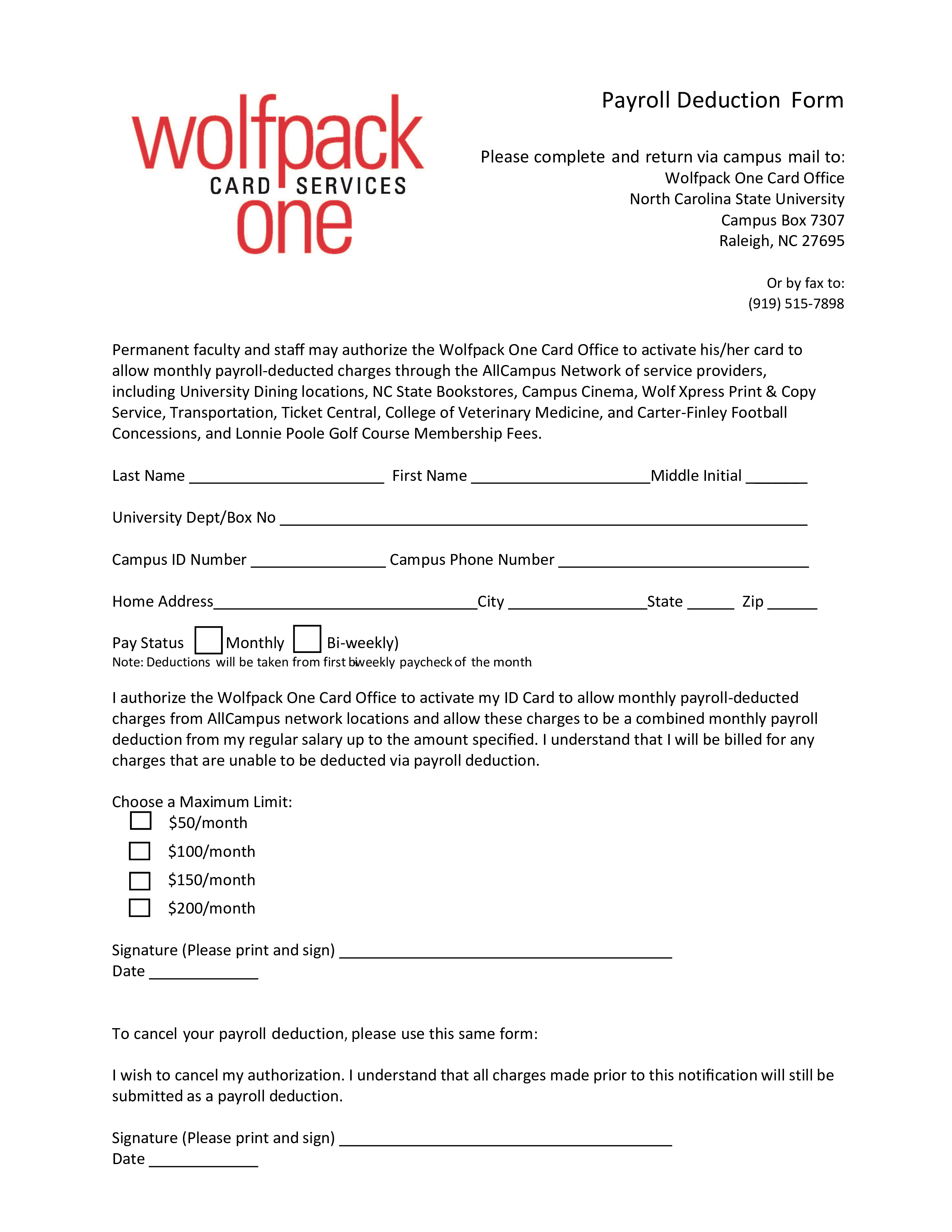

Payroll Deduction Form Template 14 Sample Example Format

https://images.template.net/wp-content/uploads/2017/01/17050449/Voluntary-Payroll-Deduction-Form-Template.jpg

Paycheck see Form 1040 ES Estimated Tax for Individuals Step 4 b Enter in this step the amount from the Deductions Worksheet line 5 if you expect to claim deductions other than the basic standard deduction on your 2024 tax return and want to reduce your withholding to account for these deductions This includes both itemized Free Payroll Templates Want to do payroll yourself A free payroll template can help you start paying employees and calculating taxes correctly Best overall Smartsheet Starting from 0 00 30 day free trial Easy to customize Free templates sync with Excel Word Google Sheets and PDFs See Templates Most affordable Google Sheets Free

401 k LOAN I UNDERSTAND THAT THIS FORM AUTHORIZES THE REDUCTION OF GROSS PAY BY THE AMOUNT OF DEDUCTIONS INDICATED ABOVE MY EMPLOYER IS AUTHORIZED TO DEDUCT A DIFFERENT AMOUNT SHOULD THERE BE A DEDUCTION CHANGE THROUGHOUT THE YEAR Download Payroll Deduction Remittance Form a1accounting Details File Format PDF Size 509 KB Download Payroll Tax Deduction Form irs gov Details File Format PDF Size 102 KB Download Employee Payroll Deduction Form theeducationplan Details File Format PDF Size 244 KB

More picture related to Printable Payroll Deduction Form Template

Standard Payroll Deduction Form Templates At Allbusinesstemplates

https://www.allbusinesstemplates.com/thumbs/42721083-cb86-41c3-b804-2e841b805a76_1.png

FREE 9 Sample Payroll Deduction Forms In PDF MS Word

https://images.sampletemplates.com/wp-content/uploads/2016/02/25072713/Word-Payroll-Deduction-Form-Template.jpg

Payroll Deduction Form Fill Online Printable Fillable Blank

https://www.pdffiller.com/preview/21/982/21982633/large.png

Simplify Payroll Deductions With Our Free Professional Payroll Deduction Templates Effortlessly Calculate Deductions for Taxes Benefits and More Customizable and Downloadable These Templates Ensure Accurate and Efficient Payroll Processing Stay Organized and Compliant With Ease Download Now and Streamline Your Payroll Deductions for Smooth Financial Management Download Now Instant download No email required The Employee Payroll Register Template is useful for both employers and employees The Payroll Register records employee information such as name ID address sex occupation hire date salary or wages basis federal allowances deductions and contribution elections

Form 2159 Rev 5 2020 Taxpayer s Copy INSTRUCTIONS TO TAXPAYER If not already completed by an IRS employee please fill in the information in the spaces provided on the front of this form for the following items Your employer s name and address Your name s plus spouse s name if the amount owed is for a joint return and current address Payroll Deduction Form A payroll deduction form is a document that is used to authorize an employer to deduct money from an employee s paycheck The deduction can be for taxes insurance or other purposes The form must be signed by the employee and approved by the employer

Printable Payroll Deduction Form Template Printable Templates

https://www.allbusinesstemplates.com/thumbs/539d0c3a-e615-4364-b809-5240213df464_1.png

FREE 9 Sample Payroll Deduction Forms In PDF MS Word

https://images.sampletemplates.com/wp-content/uploads/2016/02/25072334/Payroll-Deduction-Form-Example.jpg

Printable Payroll Deduction Form Template - 401 k LOAN I UNDERSTAND THAT THIS FORM AUTHORIZES THE REDUCTION OF GROSS PAY BY THE AMOUNT OF DEDUCTIONS INDICATED ABOVE MY EMPLOYER IS AUTHORIZED TO DEDUCT A DIFFERENT AMOUNT SHOULD THERE BE A DEDUCTION CHANGE THROUGHOUT THE YEAR