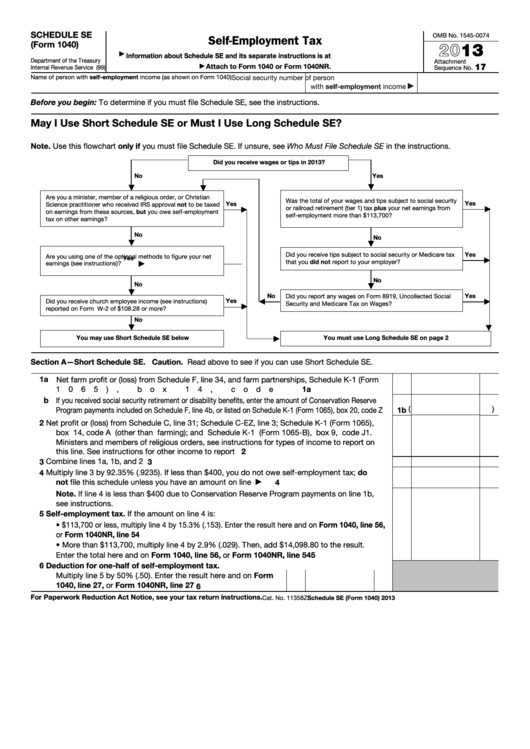

Printable Schedule Se 2013 Schedule SE Form 1040 2013 Schedule SE Form 1040 2013 Attachment Sequence No Page Name of person with self employment income as shown on Form 1040 Social security number of person with self employment income Note If your only income subject to self employment tax is church employee income see instructions Also see instructions for the

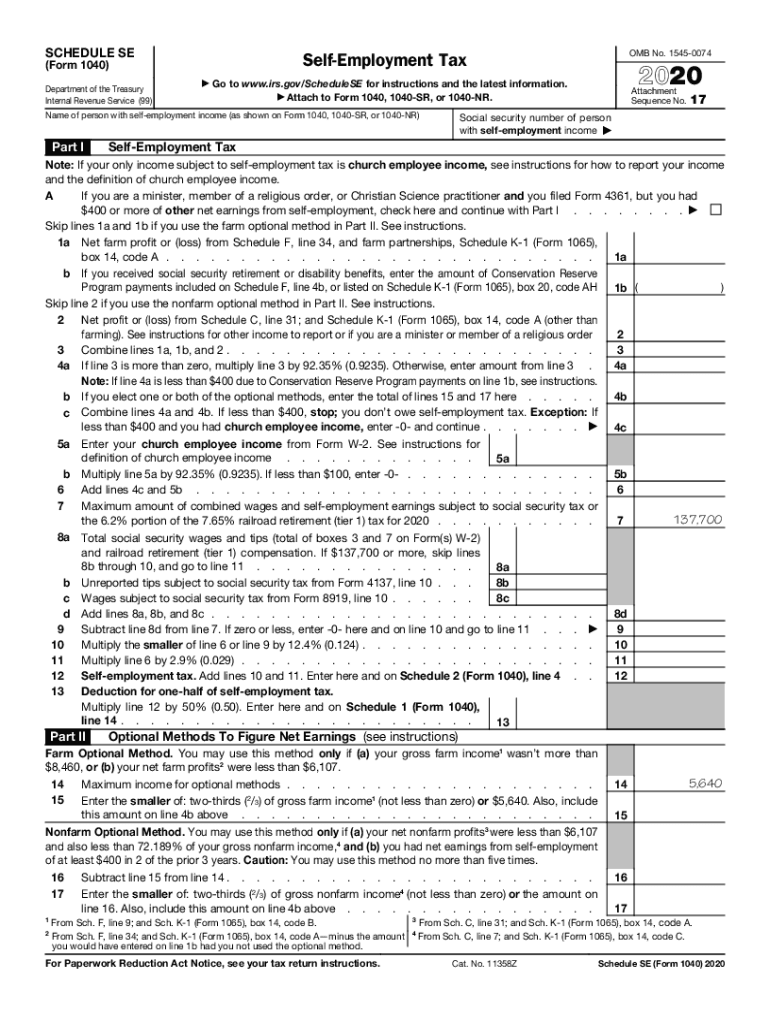

Fill in all the details required in IRS 1040 Schedule SE making use of fillable lines Include photos crosses check and text boxes if you want Repeating details will be added automatically after the first input If you have any difficulties switch on the Wizard Tool You will see some tips for simpler finalization Name of person with self employment income as shown on Form 1040 1040 SR or 1040 NR Social security number of person with self employment income Part I Self Employment Tax Note If your only income subject to self employment tax is church employee income see instructions for how to report your income

Printable Schedule Se 2013

Printable Schedule Se 2013

https://data.formsbank.com/pdf_docs_html/315/3157/315795/page_1_thumb_big.png

Fillable Irs Form Schedule Se Printable Forms Free Online

https://www.pdffiller.com/preview/533/156/533156839/large.png

Schedule Se Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/535/579/535579439/large.png

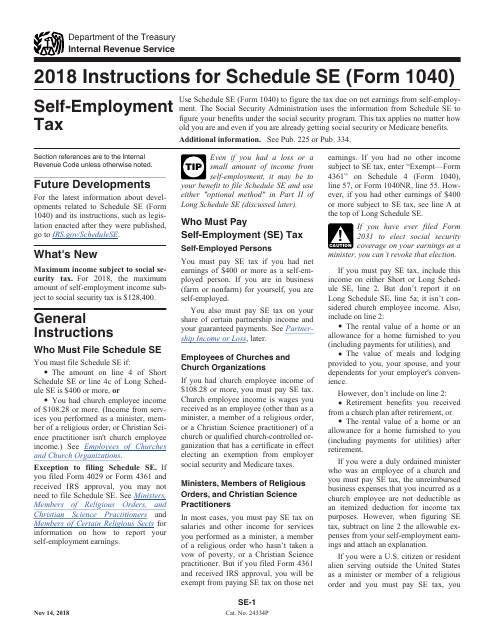

File Now with TurboTax We last updated Federal 1040 Schedule SE in December 2022 from the Federal Internal Revenue Service This form is for income earned in tax year 2022 with tax returns due in April 2023 We will update this page with a new version of the form for 2024 as soon as it is made available by the Federal government 2013 IRS Use Only Do not write or staple in this space For the year Jan 1 Dec 31 2013 or other tax year beginning Deductible part of self employment tax Attach Schedule SE 27 28 Self employed SEP SIMPLE and qualified plans 28 29 Print Type preparer s name Preparer s signature Date

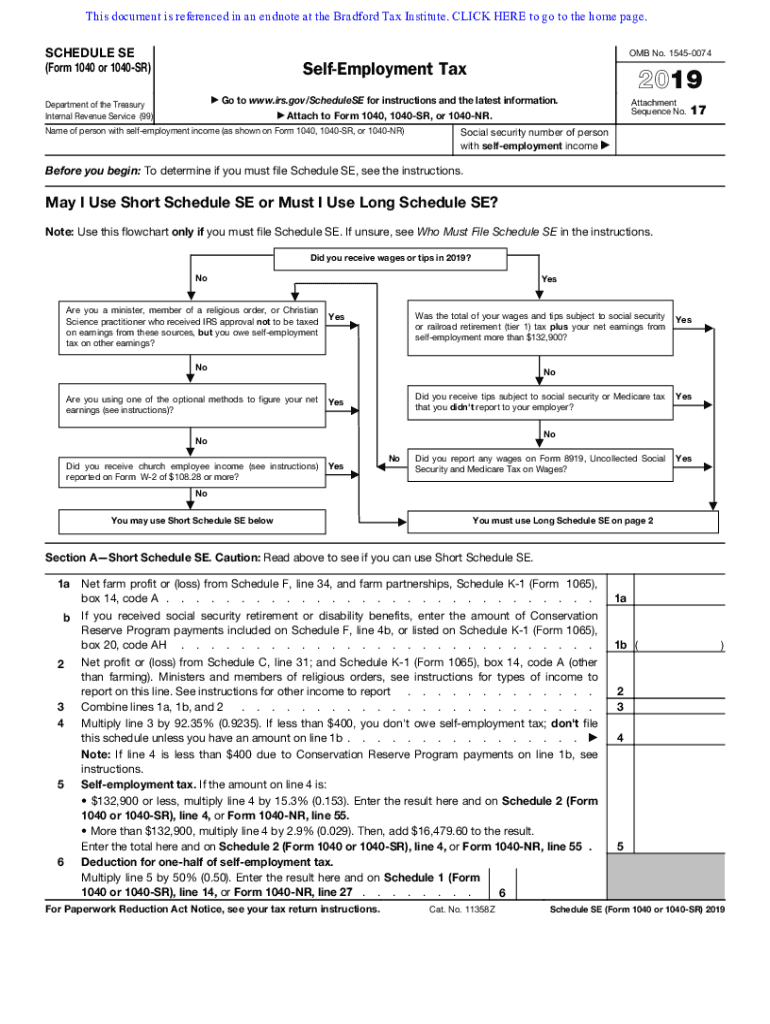

Line 2 Net profit or loss from Schedule C or Schedule K 1 Enter your total self employment income for the year Line 3 Multiply Line 2 by 92 35 If this number is less than 400 you don t owe self employment tax and you don t need to file the form What Is Form 1040 Schedule SE Schedule SE is used to calculate both your self employment tax due and your one half self employment tax deduction on IRS Form 1040 and Form 1040NR Schedule SE is generally required if you file Schedule C EZ Schedule C Schedule F or Schedule K 1 Form 1065

More picture related to Printable Schedule Se 2013

IRS Forms

http://childcaretaxspecialists.com/wp-content/uploads/2014/01/IRS-Schedule-SE-Form-1040.jpg

Schedule SE Easy Guide To Filing Self Employment Tax Ageras Ageras

https://assets-prod.ageras.com/assets/frontend/upload/resources/schedule-se-example.png

Schedule SE 1040 Year End Self Employment Tax

https://assets.website-files.com/563e3912df2a61307458136e/5862deaa5d45728241fecae9_schedule-se-flowchart.png

Oct 12 Vanderbilt at Kentucky Oct 19 Ball State at Vanderbilt Oct 26 Texas at Vanderbilt Nov 2 Vanderbilt at Auburn Nov 9 South Carolina at Vanderbilt Nov 23 Vanderbilt at Name of person with self employment income as shown on Form 1040 or Form 1040NR Self Employment Tax 2016 you do not owe self employment tax don t file this schedule unless you have an amount on line 1b Note If line 4 is less than 400 due to Conservation Reserve Program payments on line 1b see instructions Self employment tax If the

Follow the simple instructions below Have you been searching for a quick and efficient tool to fill out 2013 Instruction 1040 Schedule SE 2013 Instructions For Schedule SE Form 1040 Self Employment at an affordable price Our service offers you an extensive collection of templates available for filling out on the internet December 13 2022 This article is Tax Professional approved If you re self employed you have to pay self employment tax to the IRS And to do that you need to file Schedule SE How exactly does the IRS classify self employment income Who needs to file Schedule SE Here s what you need to know What is Schedule SE

1040 Schedule SE Form Printable

https://data.templateroller.com/pdf_docs_html/1862/18625/1862571/instructions-irs-form-1040-schedule-se-self-employment-tax-2018_big.png

USA 1040 Schedule SE Form Template ALL PSD TEMPLATES

https://i0.wp.com/allpsdtemplates.com/wp-content/uploads/2020/09/2.jpg?resize=768%2C768&ssl=1

Printable Schedule Se 2013 - 2013 IRS Use Only Do not write or staple in this space For the year Jan 1 Dec 31 2013 or other tax year beginning Deductible part of self employment tax Attach Schedule SE 27 28 Self employed SEP SIMPLE and qualified plans 28 29 Print Type preparer s name Preparer s signature Date