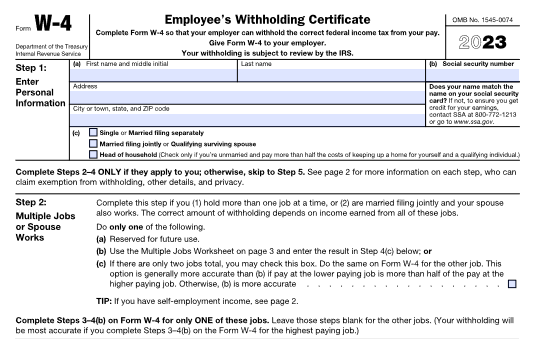

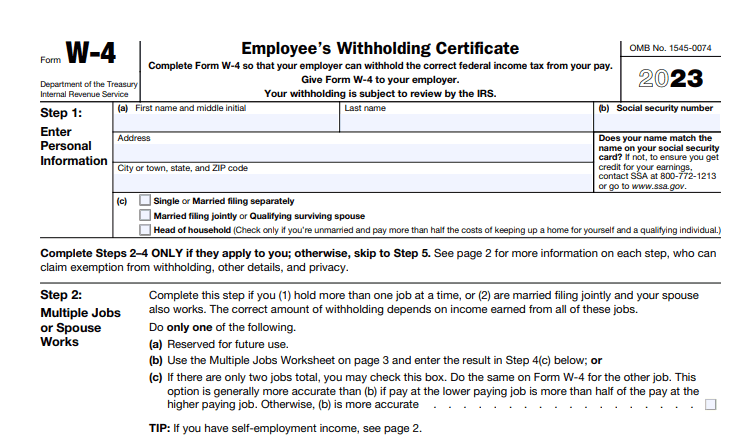

printable w 4 form 2023 2024 Form W 4 Form W 4 Department of the Treasury Internal Revenue Service Employee s Withholding Certificate Complete Form W 4 so that your employer can withhold the correct federal income tax from your pay Give Form W 4 to your employer Your withholding is subject to review by the IRS OMB No 1545 0074

Print Information about Form W 4 Employee s Withholding Certificate including recent updates related forms and instructions on how to file Form W 4 is completed by employees and given to their employer so their employer can withhold the correct federal income tax from the employee s pay Form W 4 Department of the Treasury Internal Revenue Service Employee s Withholding Certificate Complete Form W 4 so that your employer can withhold the correct federal income tax from your pay Give Form W 4 to your employer Your withholding is subject to review by the IRS OMB No 1545 0074 2023 Step 1 Enter Personal Information

printable w 4 form 2023

printable w 4 form 2023

https://free-online-forms.com/wp-content/uploads/2023/01/W-4-Form-2023-768x860.jpg

IRS Makes Minor Changes To 2023 W 4 Form CPA Practice Advisor

https://www.cpapracticeadvisor.com/wp-content/uploads/sites/2/2023/02/2023-W4-Form.png

2022 Form W 4 IRS Tax Forms W4 Form 2022 Printable

https://w4formprintable.com/wp-content/uploads/2022/01/irs-w-4-form-w4-form-2021.jpg

Updated April 29 2024 IRS Form W 4 or Employee s Withholding Certificate is a form given to an employer by an employee that calculates the amount of federal income tax that should be withheld from the employee s pay Languages English Spanish The Form W 4 for 2024 available on the IRS website or through your employer can be used to adjust withholdings on income earned in 2024

Internal Revenue Service IRS Form W 4 Employee s Withholding Certificate is generally completed at the start of any new job This form tells your employer how much federal income tax withholding to keep from each paycheck This form is crucial in determining your balance due or refund each tax season Credits deductions and income reported on other forms or schedules Estimate your paycheck withholding with our free W 4 Withholding Calculator Updated for 2024 and the taxes you do in 2025 simply enter your tax information and adjust your withholding to understand how to maximize your tax refund or take home pay

More picture related to printable w 4 form 2023

W 4 Form 2023 What Employers And Employees Need To Know

https://ejobscircular.com/wp-content/uploads/2023/01/W-4-Form-2023.png

W 4 2023 Printable Form Printable Forms Free Online

https://w4formsprintable.com/wp-content/uploads/2020/09/understand-your-w-4-mrmillennialmoney-11.png

State Withholding Tax Form 2023 Printable Forms Free Online

https://www.patriotsoftware.com/wp-content/uploads/2022/12/2023-Form-W-4.png

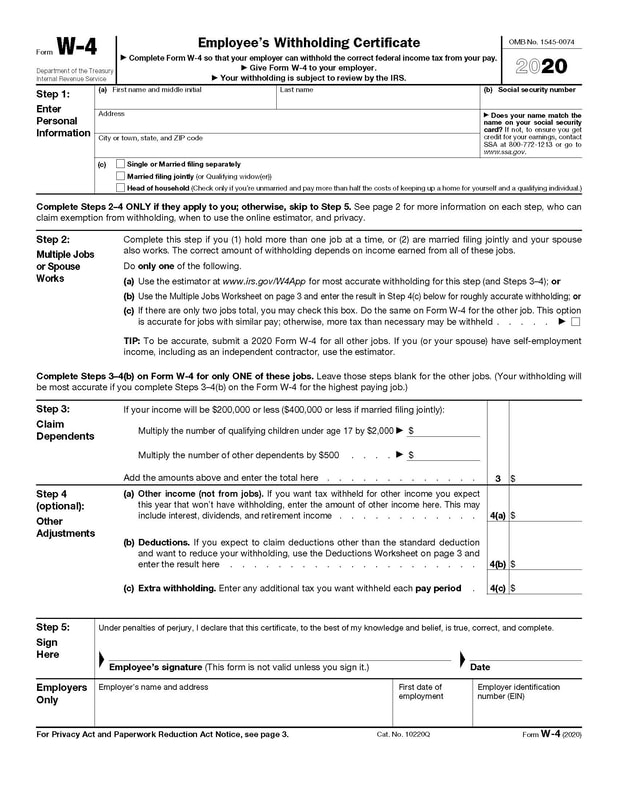

We last updated the Employee s Withholding Allowance Certificate Blank in February 2024 so this is the latest version of Form W 4 fully updated for tax year 2023 You can download or print current or past year PDFs of Form W 4 directly from TaxFormFinder You can print other Federal tax forms here The W4 is an IRS tax form that helps employers know the correct amount of taxes to withhold from employees paychecks Use this template No credit card required W 4 forms by type Get your W 4 forms versions from 2017 to 2023 2017 2018 2019 2020 2021 2022 2023 2024 Open in PandaDoc Why use this free invoice template

Printable IRS W4 Calculator 2023 Form W 4 is a form that employees fill out when they start a new job or make changes to their tax withholding Form W 4 tells the taxpayer s employer how much federal income tax to withhold from their paychecks Here s an explanation of Form W 4 plus a printable W 4 and tax withholding calculator from the IRS A draft of the 2023 Form W 4 was released Dec 7 by the Internal Revenue Service Changes in the draft primarily removed references to the IRS s tax withholding estimator at several points in the form and instructions Amounts used in the Step 2 b and Step 4 b worksheets were also updated

New Form W 4 For 2020

http://www.masonrich.com/uploads/3/8/3/6/38361657/620424791_orig.jpg

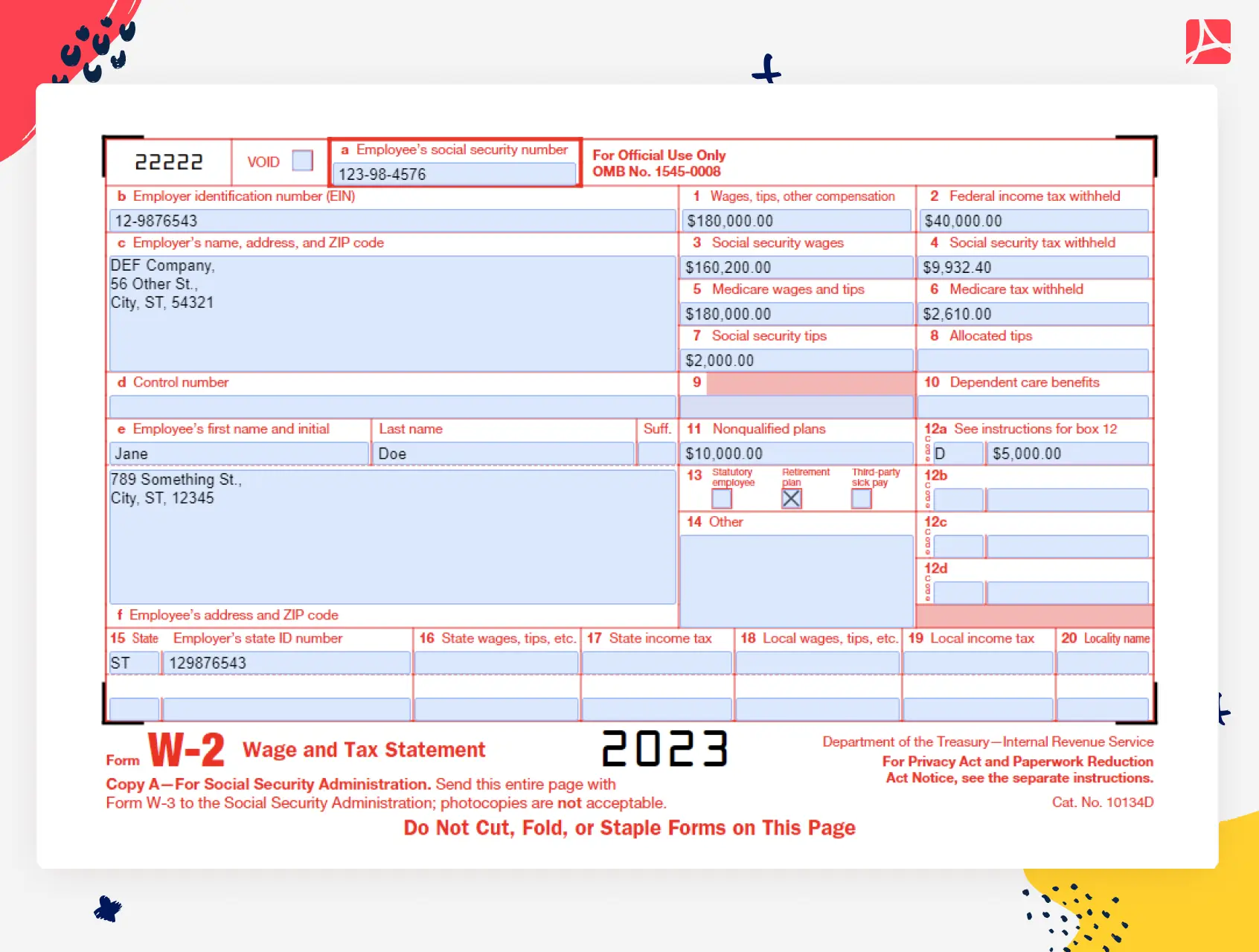

Wisconsin W2 Form 2023 Printable Forms Free Online

https://pdfliner.com/ckeditor/images/gLLSWour7Pm0p8J8SNsvuqkHKVBfOdSbNdbIwXNS.webp

printable w 4 form 2023 - Complete Steps 3 4 b on Form W 4 for only ONE of these jobs Leave those steps blank for the other jobs Your withholding will be most accurate if you complete Steps 3 4 b on the Form W 4 for the highest paying job Step 3 Claim Dependents If your total income will be 200 000 or less 400 000 or less if married filing jointly