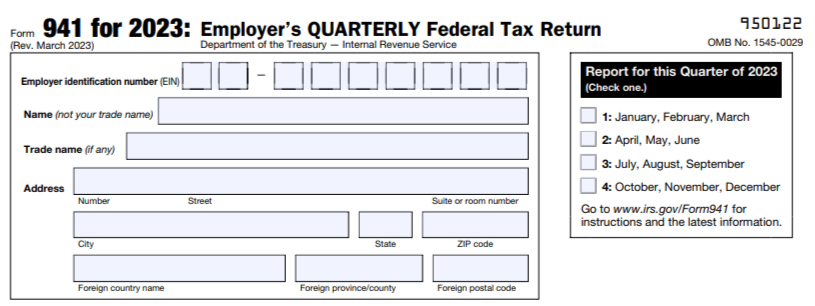

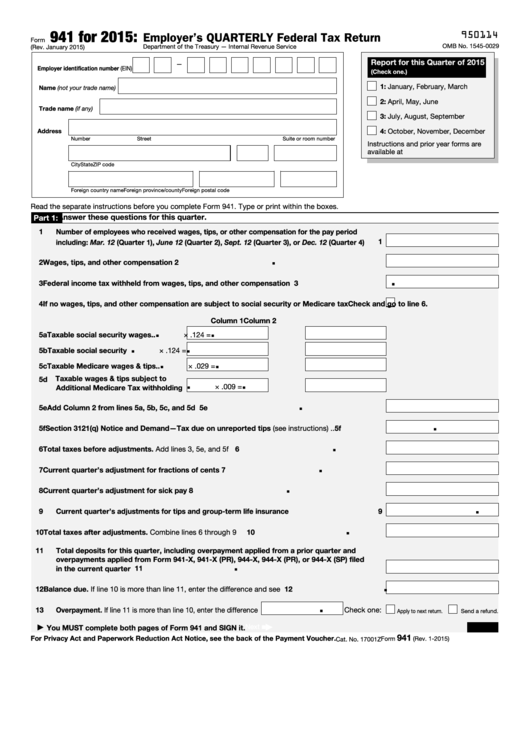

941 Form 2023 Printable Report for this Quarter of 2023 Check one 1 January February March 2 April May June 3 July August September 4 October November December Go to irs gov Form941 for instructions and the latest information Read the separate instructions before you complete Form 941 Type or print within the boxes

Instructions for Form 941 03 2023 Employer s QUARTERLY Federal Tax Return Section references are to the Internal Revenue Code unless otherwise noted Revised 03 2023 Instructions for Form 941 Introductory Material Future Developments Last quarterly payment for 2023 is due on Jan 16 2024 Taxpayers may need to consider estimated or additional tax payments due to non wage income from unemployment self employment annuity income or even digital assets The Tax Withholding Estimator on IRS gov can help wage earners determine if there s a need to consider an additional tax

941 Form 2023 Printable

941 Form 2023 Printable

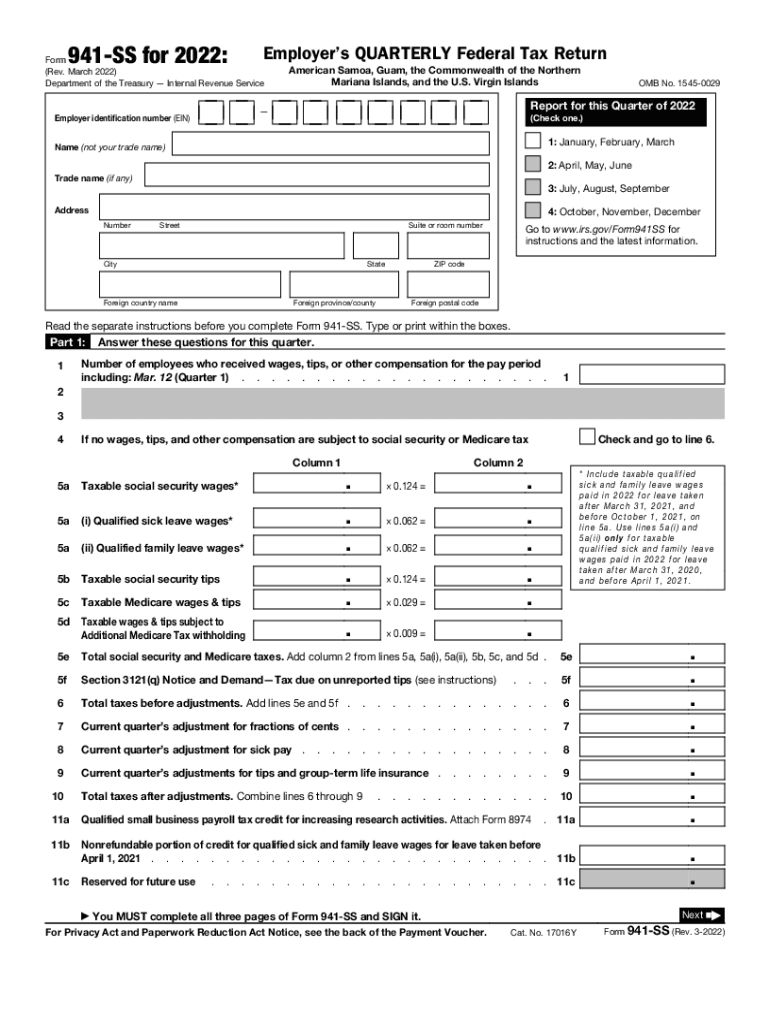

https://www.pdffiller.com/preview/606/520/606520951/large.png

941 Form 2023

https://www.taxuni.com/wp-content/uploads/2022/01/Form-941-Schedule-B-2022-23-1024x576.jpg

IRS Fillable Form 941 2023

https://www.taxuni.com/wp-content/uploads/2022/12/IRS-Fillable-Form-941-TaxUni-Cover-1-768x432.jpg

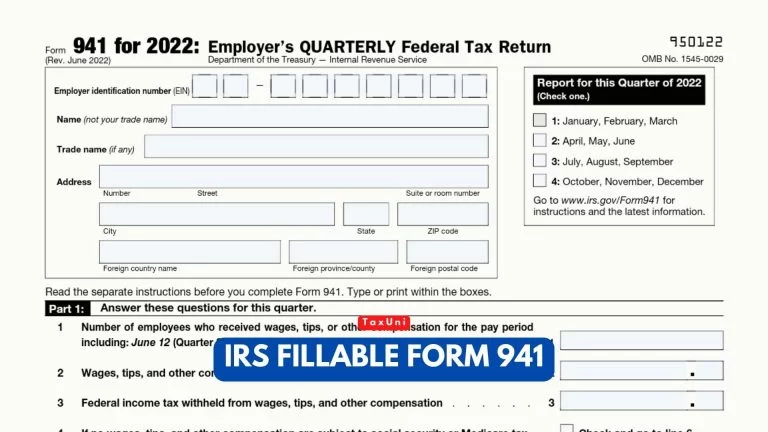

December 14 2023 Sanctions and Russia s War Limiting Putin s Capabilities November 29 2023 The Inflation Reduction Act A Place Based Analysis View all Featured Stories Form 941 employer s quarterly federal tax return Employer Identification Number EIN Small Businesses Small Business Contacts Financial Institutions The IRS released the final instructions for the updated Form 941 in June of 2022 ahead of the second quarter s end There are five parts that need to be completed on Revised Form 941 Part 1 This quarter taxes and wages Part 2 Your deposit schedule and tax liability for this quarter Part 3 Your business

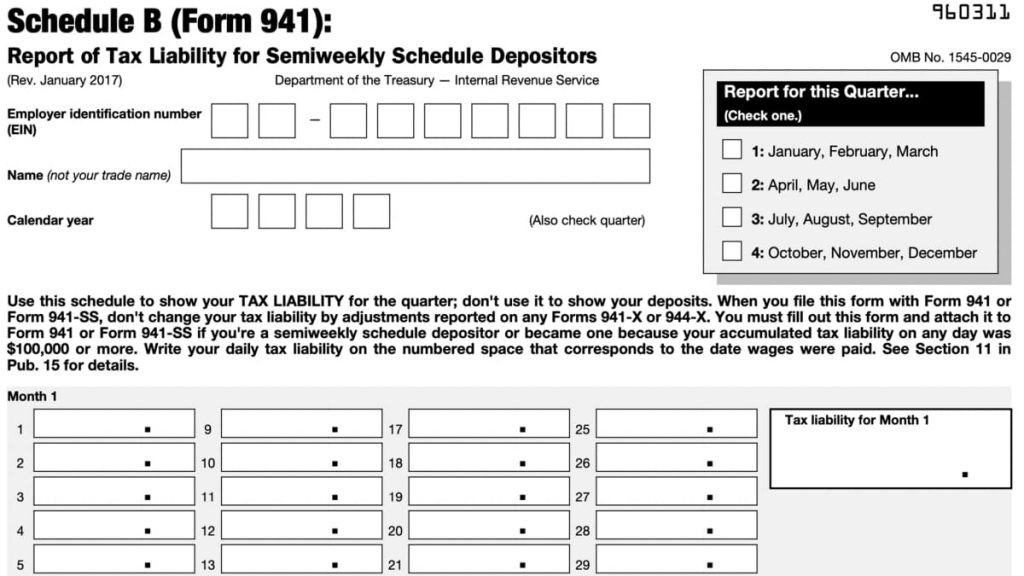

The IRS has released draft versions of the March 2023 Form 941 Employer s Quarterly Federal Tax Return and Schedule R Allocation Schedule for Aggregate Form 941 Filers Form 941 Generally employers use Form 941 Employer s Quarterly Federal Tax Return to report federal income taxes Social Security tax or Medicare tax FICA withheld from employees paychecks and to pay the Tax liability for Month 1 Tax liability for Month 2 Tax liability for Month 3 Fill in your total liability for the quarter Month 1 Month 2 Month 3 Total must equal line 12 on Form 941 or Form 941 SS For Paperwork Reduction Act Notice see separate instructions IRS gov form941 Cat No 11967Q Total liability for the quarter

More picture related to 941 Form 2023 Printable

Fillable Form 941 2023 Printable Forms Free Online

https://www.patriotsoftware.com/wp-content/uploads/2023/01/screenshot-www.irs_.gov-2023.03.01-15_51_33.png

Form 941 For 2023

https://www.zrivo.com/wp-content/uploads/2022/08/Form-941-for-2023-Zrivo-Cover-1.jpg

2023 Form 941 Pdf Printable Forms Free Online

https://d3pbdh1dmixop.cloudfront.net/pdfexpert/content_pages/mac_how-to-fill-941-form/mac_how-to-fill-irs-form-form-irs-20232x.png

Fillable IRS Form 941 for 2023 Create E file Print 941 Home Tax Forms Fillable Form 941 for 2023 Create Efile and Print Forms Instantly The IRS recommends E filing for faster processing and for instant updates Create Form 941 Now Advantages of Filing Electronically Quick Processing Instant IRS Approval Accurate Error Free Filing 2022 Form 941 For the best experience open this PDF portfolio in Acrobat X or Adobe Reader X or later Get Adobe Reader Now

The rate of social security tax on taxable wages paid in 2023 for leave taken between march 31 2020 and April 1 2021 is 6 2 for the employee only They are not subject to the the employer share of social security tax The social security wage base limit is 160 200 The Medicare tax rate is unchanged at 1 45 with no wage base limit Form 941 Update The IRS has made a few changes to Form 941 for 2023 First the form has added a new line item for employers who are claiming the COVID 19 Employee Retention Credit Additionally the form has been updated to reflect the increase in the employer share of Social Security taxes for 2023 As a business owner it is important to

Printable 941 Tax Form Printable Form 2023

https://www.printableform.net/wp-content/uploads/2021/07/fillable-form-941-employer-s-quarterly-federal-tax.png

Form 941 X 2023 Fill Online Printable Fillable Blank

https://www.pdffiller.com/preview/612/105/612105036/big.png

941 Form 2023 Printable - For future references you can check these articles to learn more about form 941 How QuickBooks Populates the 941 E file 940 941 and 944 Tax Forms Thank you for your patience and understanding Visit us again if you need more help with generating payroll forms We re always here to help