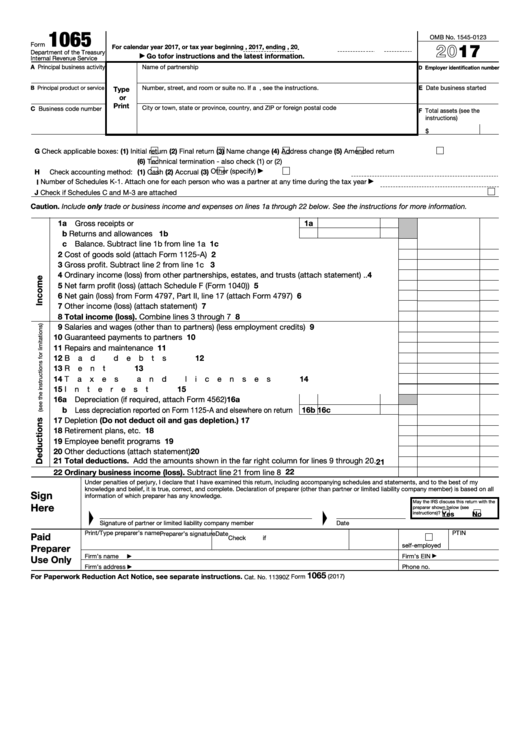

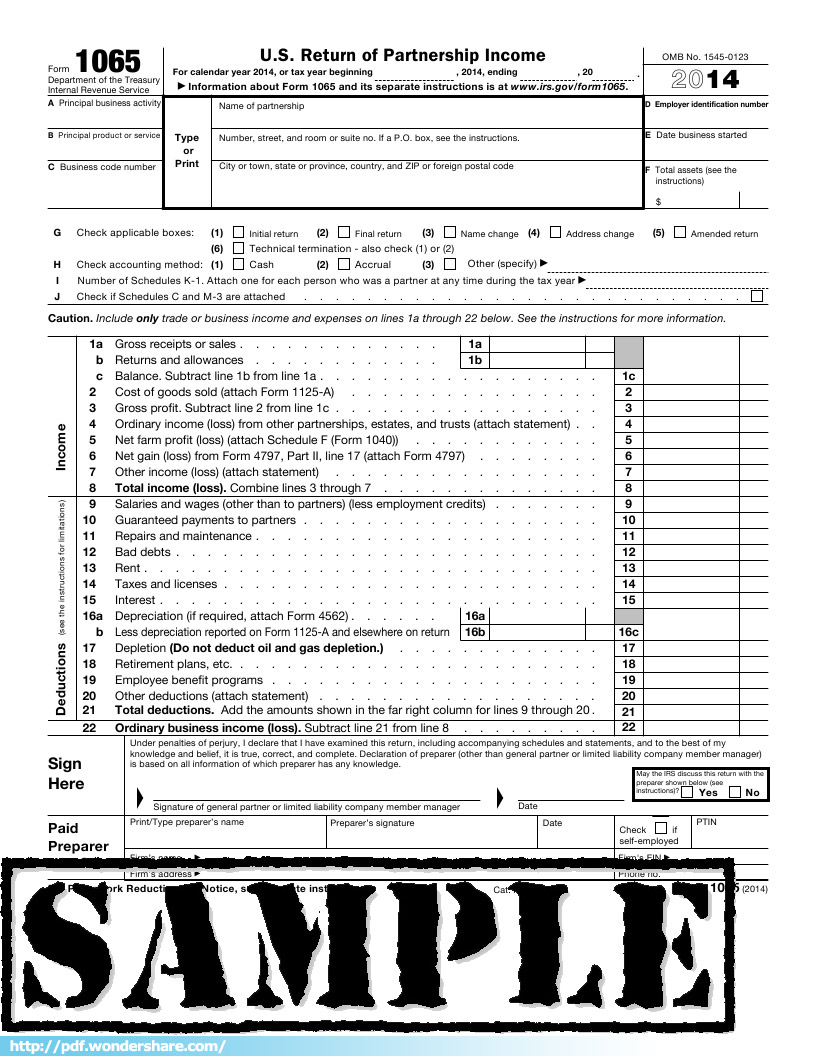

Form 1065 Printable Form 1065 is an informational tax form used to report the income gains losses deductions and credits of a partnership or LLC but no taxes are calculated or paid from this form Good

Form 1065 U S Return of Partnership Income is a tax form used by partnerships to provide a statement of financial performance and position to the IRS each tax year The form includes information related to a partnership s income and deductions gains and losses taxes and payments during the tax year First the partnership reports total net income and all other relevant financial information for the partnership using Form 1065 Second a Schedule K 1 is prepared for each partner which identifies the partner s allocated profits and losses for the total of the reporting period Each partner s Schedule K 1 is sent to the partner and used

Form 1065 Printable

Form 1065 Printable

https://data.formsbank.com/pdf_docs_html/362/3627/362736/page_1_thumb_big.png

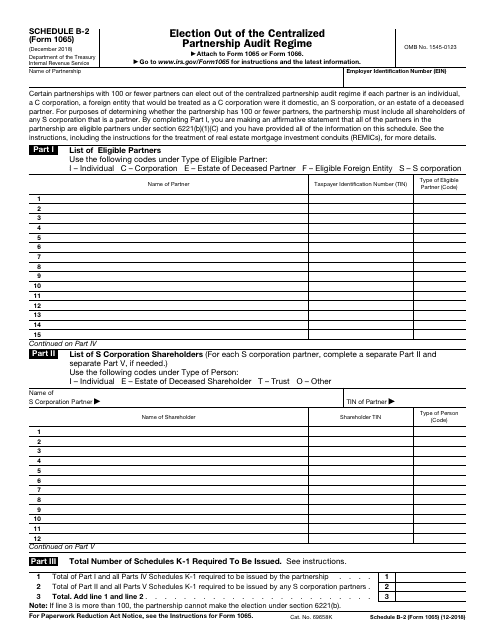

IRS Form 1065 Schedule B 2 Fill Out Sign Online And Download

https://data.templateroller.com/pdf_docs_html/1862/18622/1862207/irs-form-1065-schedule-b-2-election-out-the-centralized-partnership-audit-regime_big.png

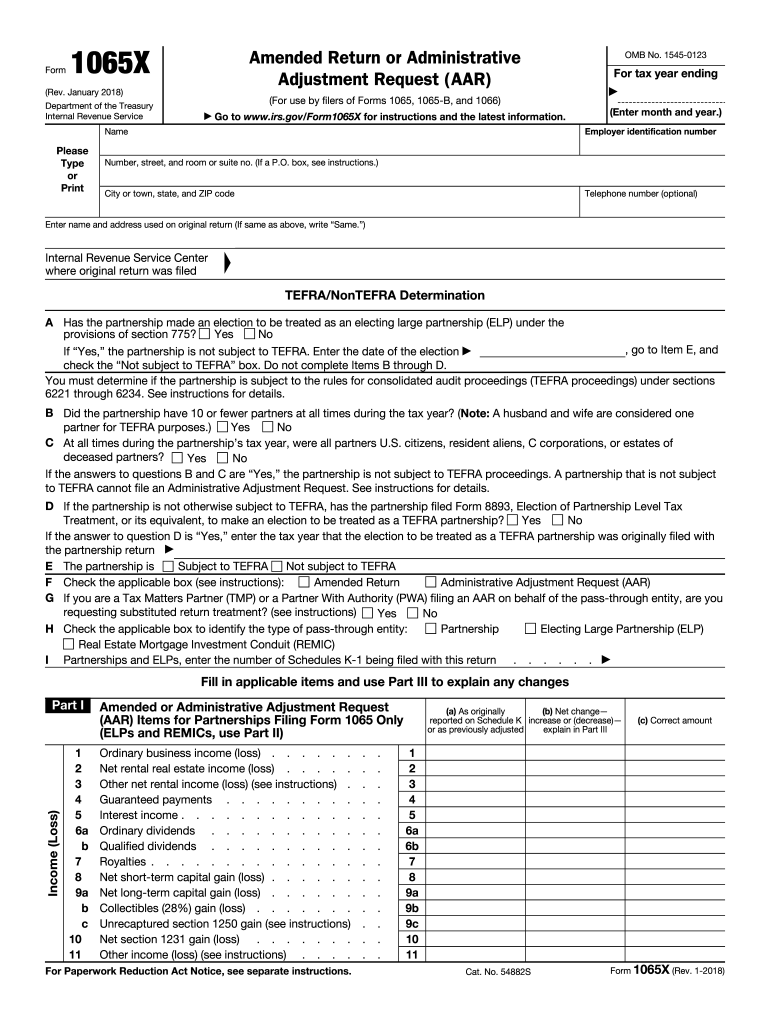

Form 1065 Tax Return Jawermemphis

https://www.pdffiller.com/preview/416/951/416951182/large.png

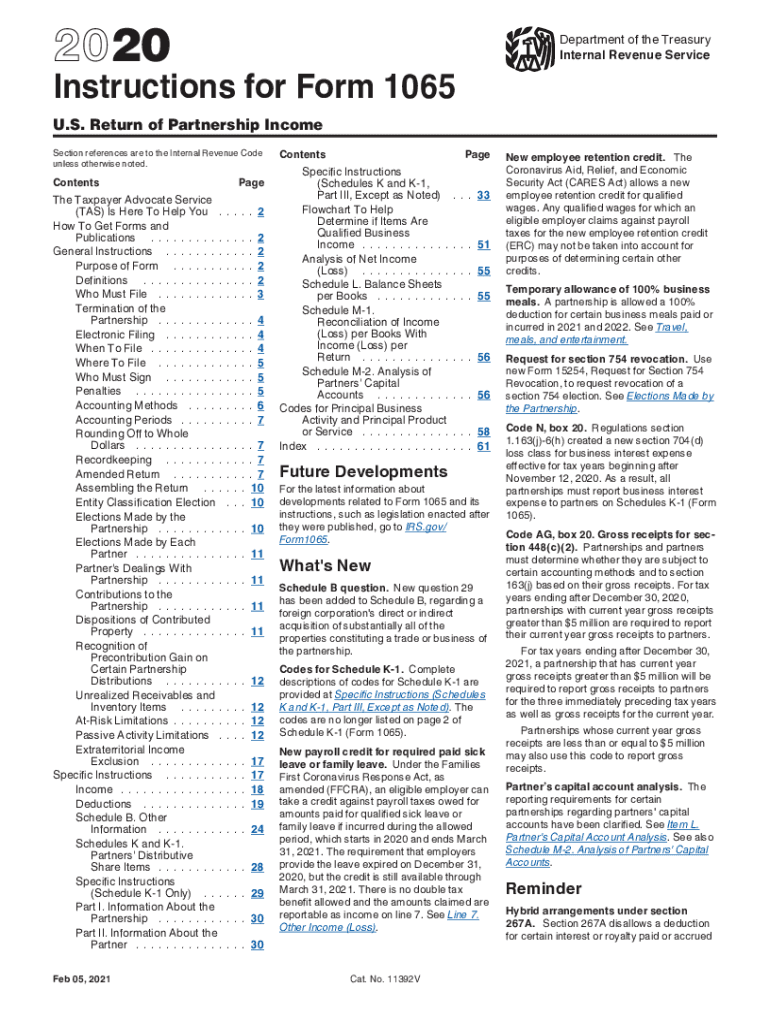

Begin completing Form 1065 by including general information about the partnership including its Employer ID Number EIN and its business code found in the Instructions for Form 1065 Lines 1a 8 Enter different types of partnership income to get total income loss for the year on Line 8 Lines 9 22 Enter all types of deductions next Download or print the 2022 Federal Form 1065 U S Return of Partnership Income for FREE from the Federal Internal Revenue Service

Form 1065 U S Return of Partnership Income is a tax document issued by the Internal Revenue Service IRS used to declare the profits losses deductions and credits of a business Some partnership LLC tax returns are simple and routine with few complexities In those instances use this checklist as a tool to help prepare simple partnership income tax returns Form 1065 U S Return of Partnership Income This checklist is an abbreviated version of the AICPA Tax Section s Annual Tax Compliance Kit s Form 1065 long checklist

More picture related to Form 1065 Printable

Form 1065 K 1 Instructions 2020 Fill Out And Sign Printable PDF

https://www.signnow.com/preview/549/395/549395730/large.png

Form 1065 Schedule K 1 Partner s Share Of Income Deductions And

https://www.formsbirds.com/formimg/tax-payment-forms/8163/form-1065-schedule-k-1-partners-share-of-income-deductions-and-credits-2015-l1.png

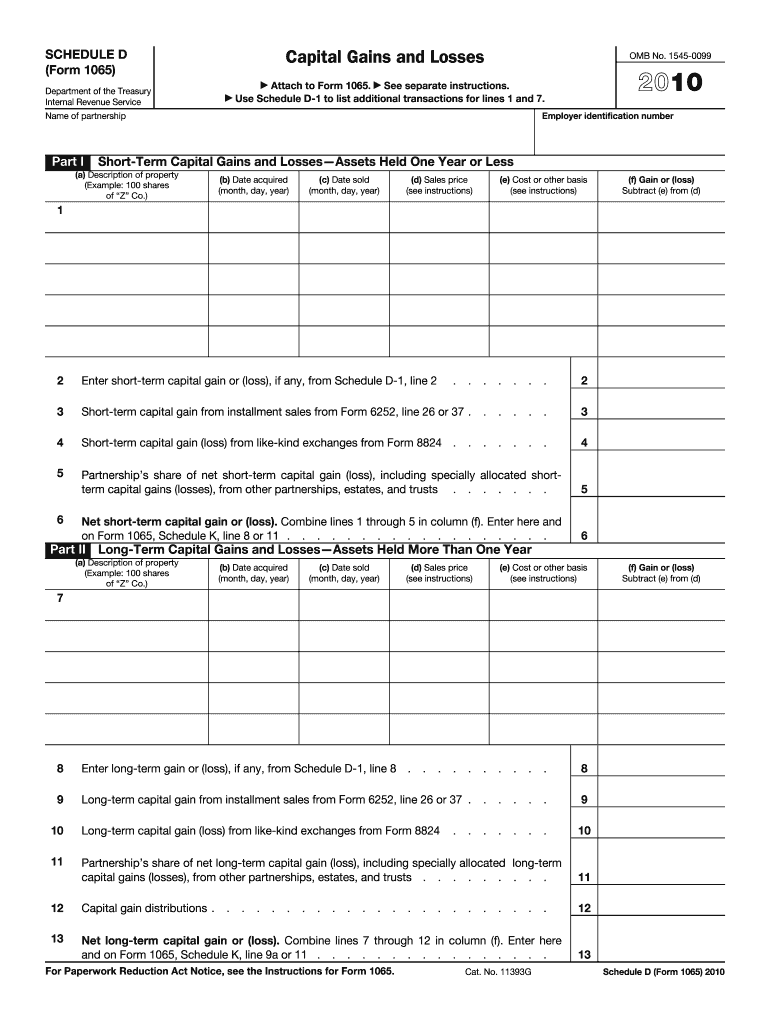

Schedule D Form 1065 Capital Gains And Losses Fill Out And Sign

https://www.signnow.com/preview/10/2/10002619/large.png

IRS Form 1065 is issued for all business partnerships for the purpose of reporting earnings losses deductions and or credits The form type parameter A 1065 2022 for the Upload PDF endpoint is required for this Form Type Learn more about how we process 1065 forms here Optional fields captured Schedules K 1 Form 1065 Partner s Share of Income Credits Deductions Schedules K 1 Form 1120S Final price is determined at the time of print or electronic filing and may vary based on your actual tax situation forms used to prepare your return and forms or schedules included in your individual return

Last quarterly payment for 2023 is due on Jan 16 2024 Taxpayers may need to consider estimated or additional tax payments due to non wage income from unemployment self employment annuity income or even digital assets The Tax Withholding Estimator on IRS gov can help wage earners determine if there s a need to consider an additional tax 1040 As of the 2018 tax year Form 1040 U S Individual Income Tax Return is the only form used for personal individual federal income tax returns filed with the IRS In prior years it had been one of three forms 1040 the Long Form 1040A the Short Form and 1040EZ see below for explanations of each used for such returns

IRS Form 1065 Free Download Create Edit Fill And Print

https://pdfimages.wondershare.com/images/templates/83-form-1065-f1065.jpg

2021 Form IRS 1065 Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/100/12/100012538/large.png

Form 1065 Printable - Type or print the required information in the name address and information boxes on the top of the Arizona Form 165 Schedule K 1 NR Indicate whether the partnership s taxable Form 1065 does not include any net capital gain loss from the exchange of one kind of legal tender for another kind of legal